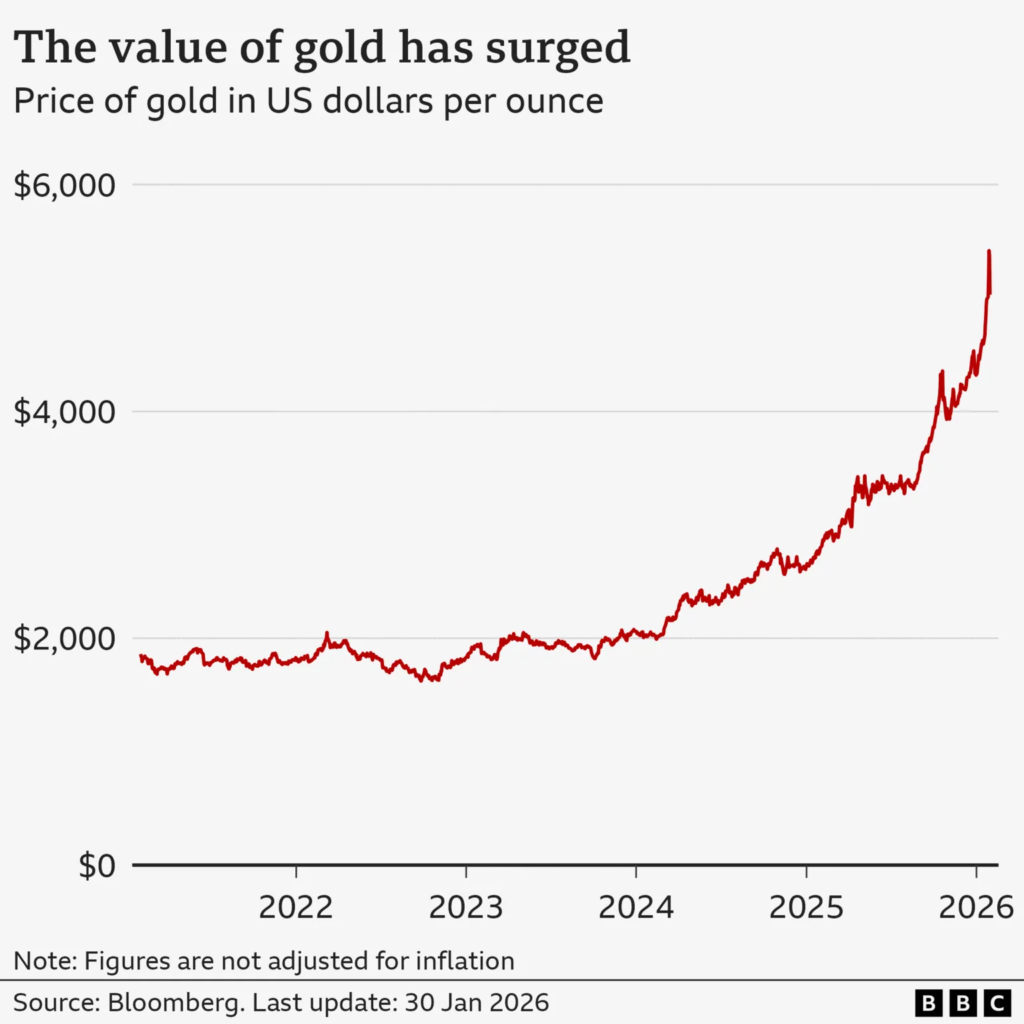

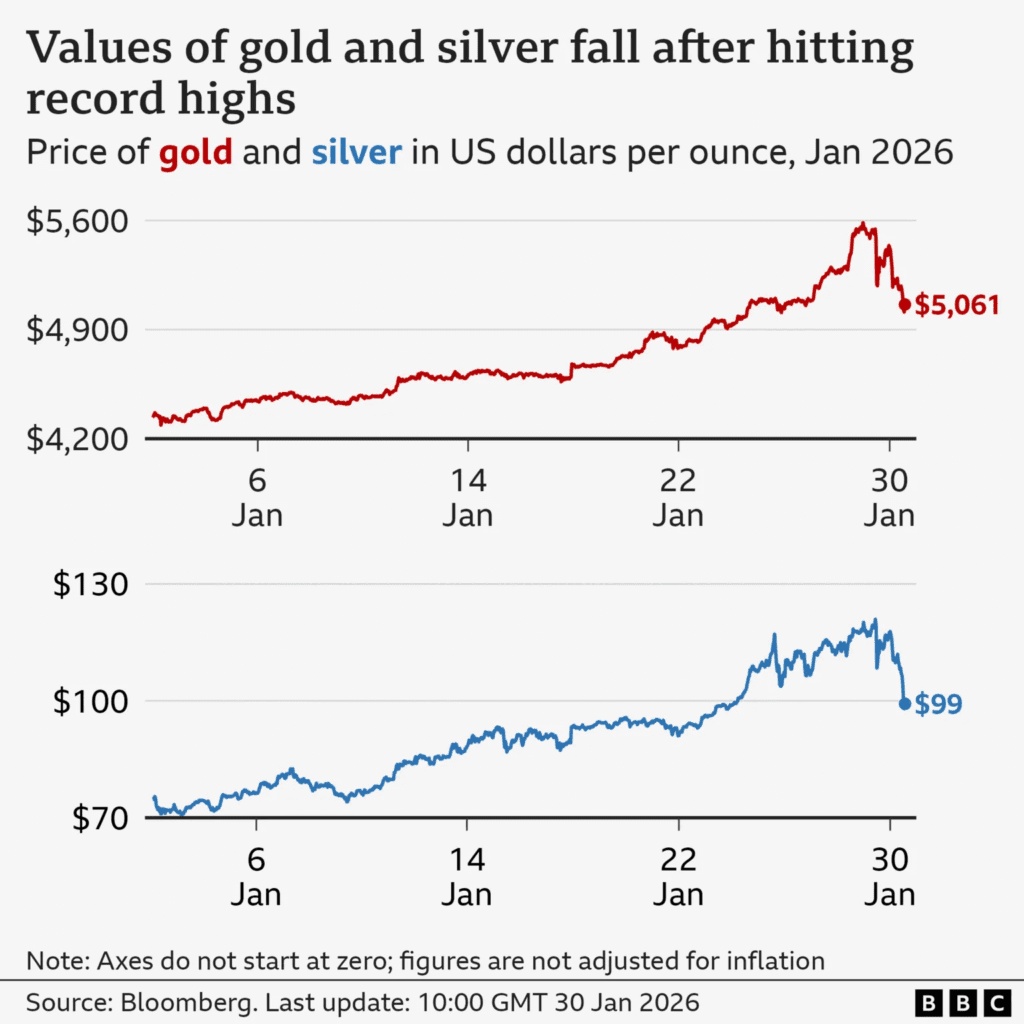

Gold prices surged to historic highs this week, briefly topping $5,500 per ounce, as investors rushed into safe-haven assets amid global political and economic uncertainty. Silver and platinum followed the same path. But after the rally, prices pulled back sharply. Here is what pushed gold to records, and what triggered the sudden drop.

1. Trump-Driven Political and Trade Uncertainty

Uncertainty linked to Donald Trump has been a major catalyst behind gold’s rally.

Trump’s aggressive tariff strategy, threats against multiple trade partners, and renewed tensions over Greenland unsettled markets and weakened confidence in US policy stability.

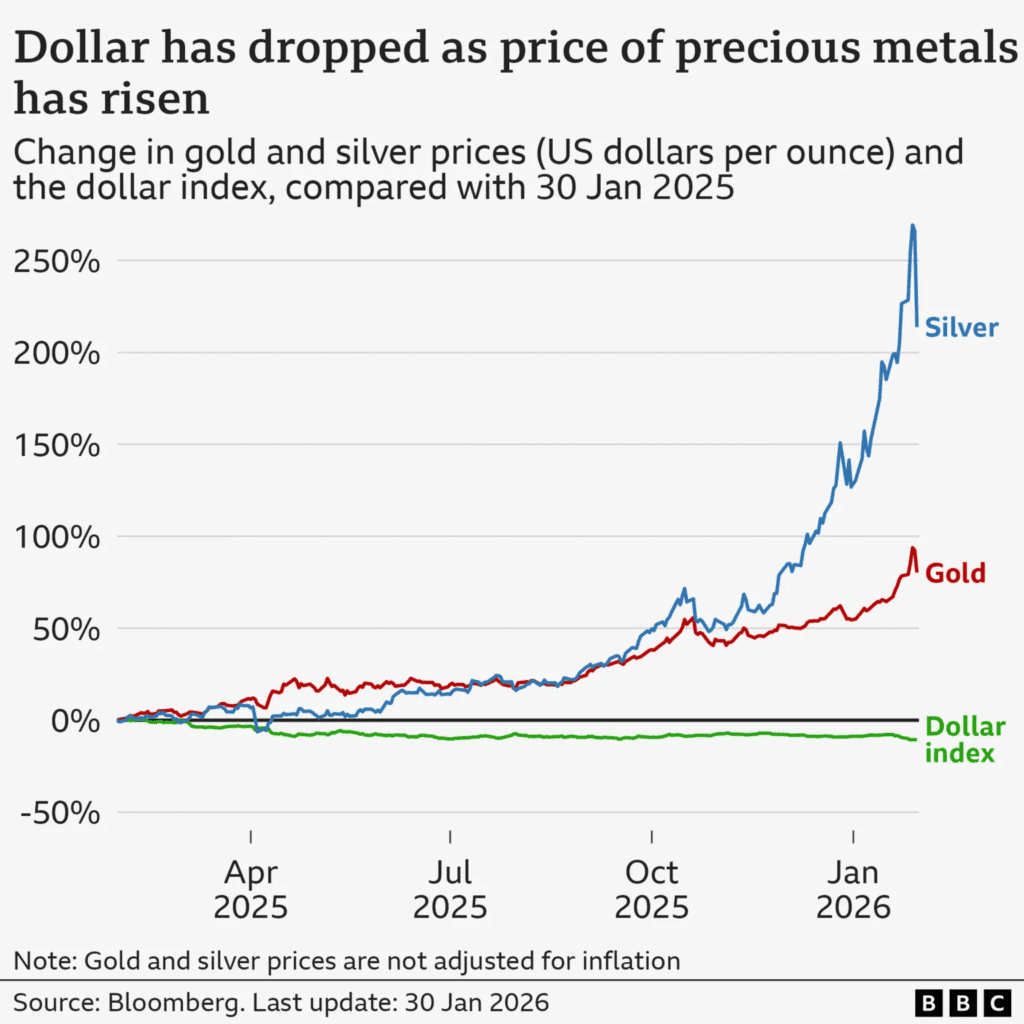

Investors responded by shifting money away from risk assets and into gold, which is traditionally seen as protection against political shocks, trade wars, and dollar weakness.

2. Global Conflicts and Geopolitical Stress

Ongoing wars in Ukraine and Gaza, combined with fresh international tensions involving the US, Canada, China, and Venezuela, added to the sense of global instability.

Gold tends to perform best when the world feels unpredictable. As fears around diplomacy, military conflict, and global alliances intensified, demand for precious metals accelerated.

3. Central Banks and Large Buyers Stockpiling Gold

Central banks continue to play a crucial role in gold demand. Many governments have been increasing gold reserves to reduce dependence on the US dollar, especially after seeing how dollar assets can be frozen or restricted during geopolitical disputes.

China remains the world’s largest buyer, while institutional investors and even crypto-linked firms such as Tether have accumulated significant gold holdings, amplifying the price surge.

Why Gold Prices Suddenly Fell

The pullback came after reports that Trump may nominate Kevin Warsh as the next chair of the Federal Reserve.

Warsh is viewed by markets as a more predictable and orthodox choice compared with other potential nominees. That reduced fears of extreme interest-rate cuts, runaway inflation, and further dollar collapse. As those risks eased, investors took profits in gold, silver, and platinum.

Gold’s explosive rally was driven by politics, war, and central-bank demand. Its recent drop reflects easing fears around US monetary leadership, not a return to global stability.

Prices remain far above last year’s levels, and with ongoing conflicts, tariffs, and geopolitical risks still in play, gold’s role as a safe haven is far from over.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Gold Crash! Down $3.4 Trillion as Silver Sinks 12% from New Record Highs

Gold’s Rally Isn’t Over: Why Analysts Say the Metal Could Reach $6,000 This Year