Oracle’s AI cloud bet hits a margin reality check. Shares of Oracle slid over 3% Tuesday after a report revealed razor-thin profits on its Nvidia-powered cloud business — raising new questions about whether the software giant’s aggressive AI expansion can remain sustainable.

Oracle’s Margins Fall Flat on AI Cloud

A new report from The Information indicated Oracle earned just 14% gross margins on roughly $900 million in Nvidia-based cloud revenue for the quarter ending in August — a fraction of its typical 70% corporate average.

The disclosure, citing internal documents, shows Oracle made only about $125 million in profit from its AI cloud rentals, reflecting the steep costs of acquiring Nvidia GPUs and maintaining massive infrastructure for clients like OpenAI.

The stock fell nearly 4% to $280.05 in afternoon trading, slipping below its 21-day moving average for the first time since early September.

A Big Bet on Nvidia—and a Bigger Bill

Oracle has positioned itself as one of the fastest-growing cloud providers in the AI arms race, betting that renting Nvidia supercomputing clusters to AI firms will drive future growth.

Its cloud backlog surged 359% year-over-year to $455 billion, fueled by its $300 billion, five-year contract with OpenAI to power the Stargate AI data center project — one of the largest cloud deals in history.

But the economics are catching up. Nvidia GPUs, the backbone of Oracle’s AI offering, are expensive to acquire and maintain, and the company’s aggressive pricing to attract AI clients is crimping profitability.

“The internal documents highlight the financial challenge of renting servers with Nvidia chips,” The Information noted.

Analysts Push Back: “Margins Will Improve With Scale”

Despite the sell-off, several analysts defended Oracle’s long-term strategy.

“While new GPU workloads may run below 25% gross margins, we expect meaningful improvement as Oracle scales,” said Stifel’s Brad Reback, maintaining a Buy rating.

Guggenheim’s John DiFucci echoed that view, saying margins tend to rise as utilization ramps up:

“It’s normal for early AI contracts to start low. Over time, we expect Oracle’s GPU operations to reach 25% margins or higher — otherwise they wouldn’t sign these deals.”

Both analysts expect Oracle to outline profitability targets next week at its “AI World” analyst day in Las Vegas, where investors will seek clarity on scaling costs, capex, and future pricing strategy.

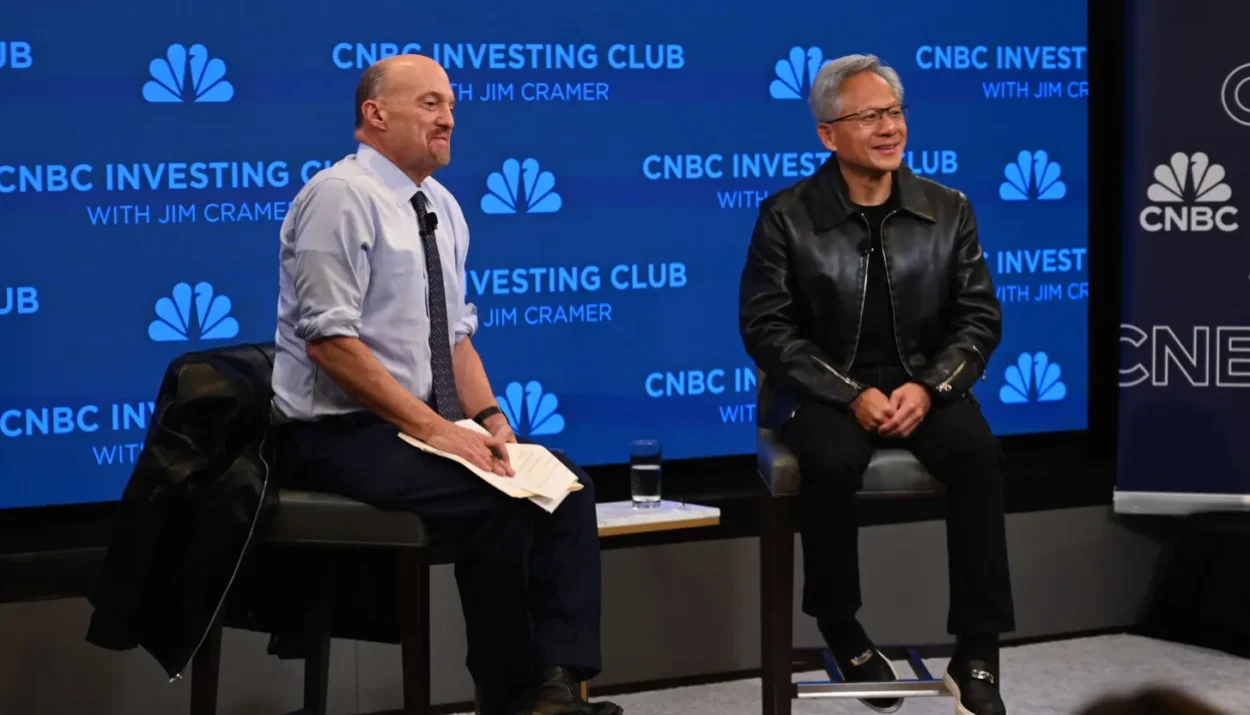

Nvidia CEO Defends Oracle: “They’ll Be Wonderfully Profitable”

Speaking with CNBC’s Jim Cramer on Tuesday, Nvidia CEO Jensen Huang defended Oracle’s model:

“When you first ramp up a new technology, there’s every possibility you might not make money in the beginning. But over the life of the system, they’ll be wonderfully profitable.”

Huang praised Oracle’s scale, calling its AI data centers “giant supercomputers” requiring land, power, cooling, and complex coordination — a challenge even seasoned hyperscalers face.

The Bigger Picture: Growing Pains in the AI Gold Rush

Oracle’s slip underscores the growing pains of the AI cloud boom. While demand is soaring, margins are tightening across the sector as providers compete to attract generative AI clients.

Other AI infrastructure names — including CoreWeave and Nebius Group — also dipped Tuesday, while Nvidia’s early gains faded to a near-flat close.

Despite the stumble, Oracle remains up nearly 70% year-to-date, riding investor optimism that AI infrastructure spending will expand exponentially by the decade’s end.

Still, Tuesday’s sell-off was a reminder that even the winners of the AI boom must eventually prove they can profit from it.

Oracle’s AI cloud story is still compelling — but for now, the company’s profits are getting lost in the cloud.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.