The Federal Reserve’s September 17, 2025 meeting is one of the most closely watched in years. Markets are convinced a cut is coming, but the real story is more complicated: a weakening labor market, sticky inflation, and a White House that has pushed Fed independence to the limit. To understand what’s at stake, we need to look at both history and today’s unique pressures.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy

Historical Lessons: Why the Fed Cut in the Past

Throughout history, cuts have come when the risks of inaction outweighed fears of inflation. Some key examples:

- 1987 Crash: When stocks plunged 20% in a day, Alan Greenspan slashed rates and injected liquidity. Confidence was restored, recession avoided.

- 1998 LTCM Crisis: A hedge fund collapse threatened global credit markets. The Fed cut rates by 0.75% in quick succession, including an emergency move. Panic subsided.

- 2001–03 Recession and 9/11: Rates fell from 6.5% to 1%. The cuts prevented a deeper downturn but set the stage for the housing boom.

- 2008 Financial Crisis: Facing bank failures, the Fed cut to zero and rolled out new tools like QE. This stopped the bleeding but left scars.

- 2019 Trade War: Growth was still fine, but trade tensions risked tipping the U.S. into recession. The Fed delivered three “insurance” cuts.

- 2020 COVID Shock: The fastest cuts in history, straight to zero. Markets stabilized, but only alongside fiscal stimulus.

The pattern: The Fed cuts when it fears a recession, systemic stress, or both. It resists cutting when inflation is too high — but even then, if markets or jobs collapse, cuts win out.

How the Fed Decides: Balancing Two Mandates

The Fed’s job is simple in theory, difficult in practice: keep prices stable and achieve maximum employment. Every rate decision weighs these goals.

- When jobs are strong but inflation is rising, the Fed tends to hike.

- When unemployment climbs and growth slows, cuts become more likely.

- If markets are stressed — think 1987 crash or 2008 meltdown — the Fed acts as a backstop to prevent panic.

But Fed decisions are not made in a vacuum. Global trade wars, oil shocks, and yes, even political pressure have tilted the balance before. Historically, presidents have leaned on the Fed to juice growth, but the institution has fought to preserve its independence. That battle is playing out again today.

How the Fed Makes Decisions: Balancing Data and Mandates

The Federal Reserve is guided by its dual mandate: keep inflation near 2% and maintain maximum employment. Every meeting is essentially a balancing act, weighing whether the bigger risk comes from prices rising too fast or jobs weakening too much. Policymakers ground their choices in a wide set of indicators: CPI and PCE inflation reports, monthly jobs data, GDP growth, and signals from credit and financial markets. At times of stress, like market crashes or banking turmoil, financial stability itself becomes the decisive factor.

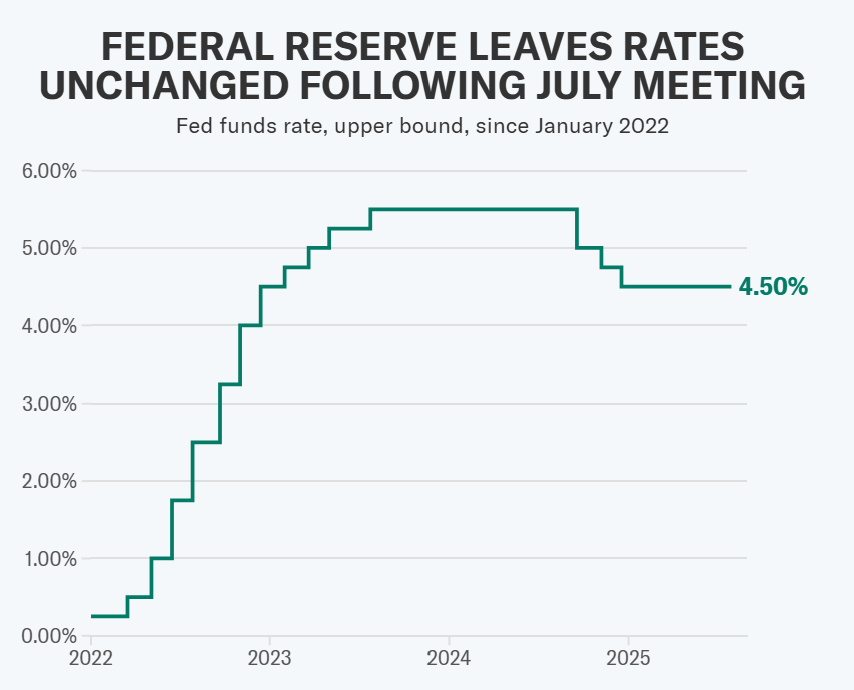

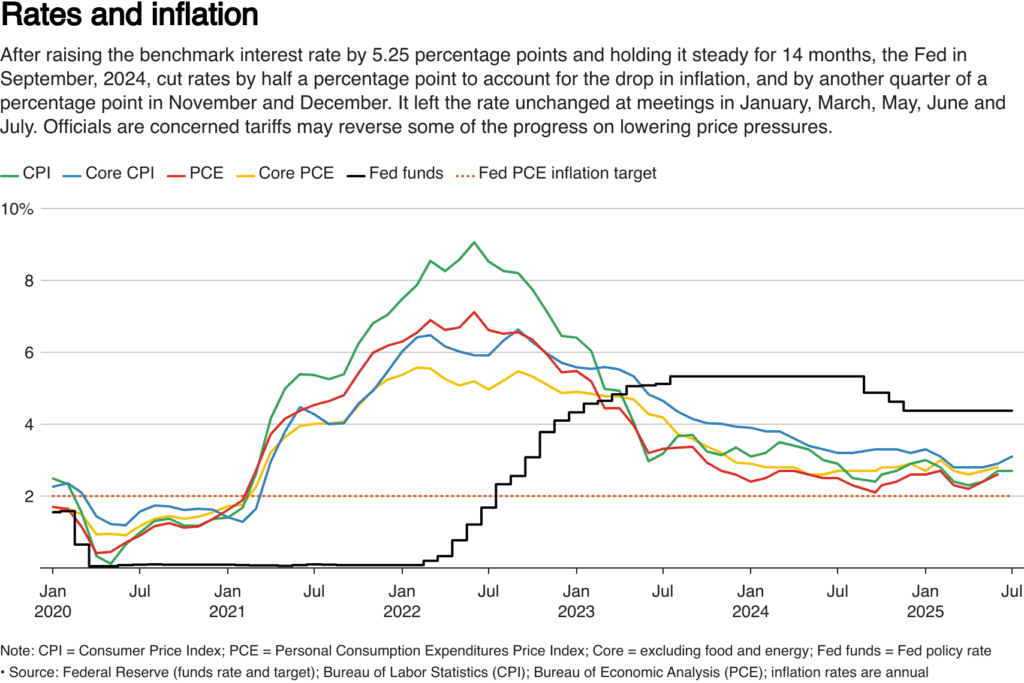

In practice, the Fed’s priorities evolve with the data. After the inflation surge of 2022, the focus in 2023 and much of 2024 was squarely on bringing prices down. Rates were held at their highest in decades as CPI and PCE lingered above 4%, while the job market remained surprisingly resilient, unemployment stuck below 4% and wages were still growing. This gave the Fed space to keep policy tight, even at the cost of slower growth.

But by mid-2024, the balance began to shift. Inflation cooled more convincingly, dropping toward 3%, while the labour market lost some of its strength. Job creation slowed, prior gains were revised down, and unemployment crept upward. Powell acknowledged the change, saying the “balance of risks” between the two mandates was moving back toward jobs. That’s why the Fed began cautious rate cuts late in 2024, not a wholesale pivot, but enough to prevent weakness from deepening.

This evolution set the stage for today:

September 2025: A Rare Dilemma

So why now? The economic signals point in different directions:

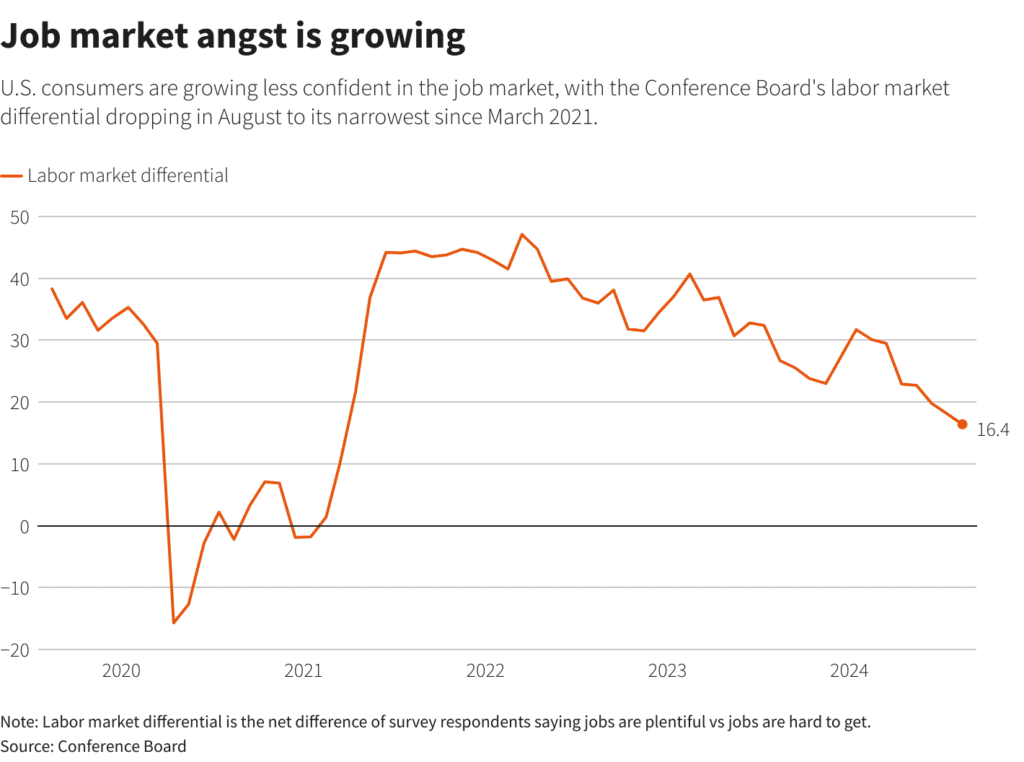

- Jobs weakening: The economy added almost no jobs this summer. June even showed net losses. Revised data knocked 900,000 jobs off prior months, revealing a weaker labor market than believed. Unemployment is ticking higher.

- Inflation sticky: August inflation came in at 2.9%, with core at 3.1%. That’s far below the 8–9% peaks of 2022, but still above the 2% goal. New Trump tariffs on consumer goods risk pushing prices higher in the months ahead.

- Markets calm, for now: Treasury yields have drifted down into the meeting, and stocks have climbed in anticipation of a cut. But businesses are nervous, credit is tightening at the margins.

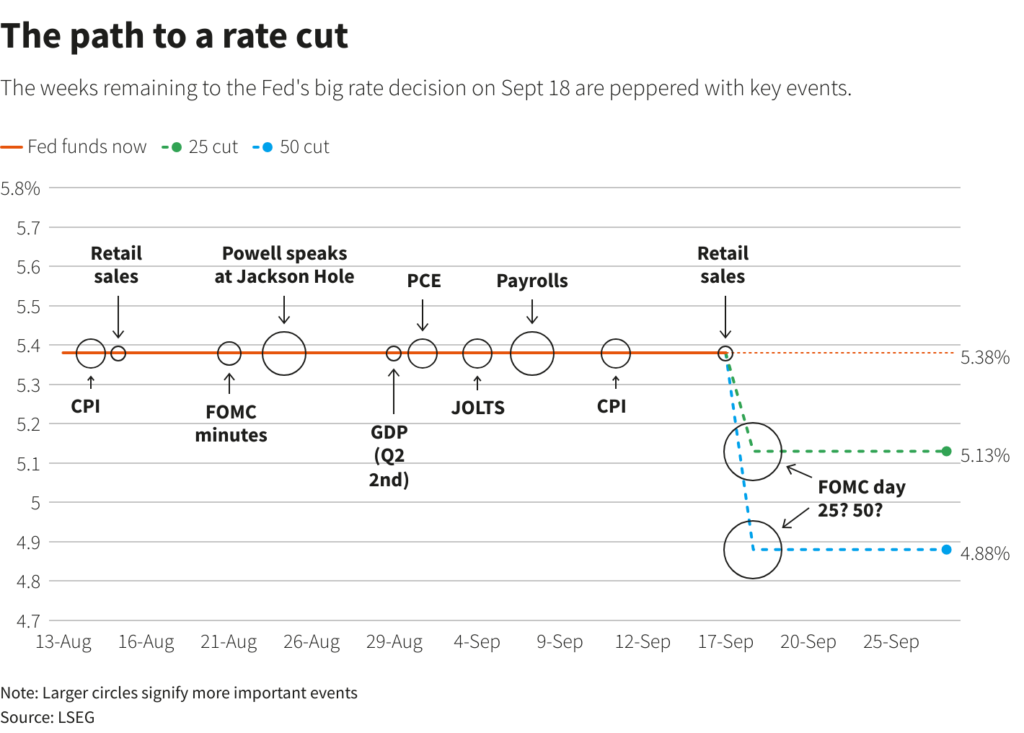

Normally, the Fed would wait for inflation to fall closer to 2% before cutting. But with jobs flashing red, waiting risks a sharper slowdown. That’s why a 25 basis point cut is expected.

The Trump Factor: Politics Meets Policy

Here’s where things get messy. Normally, the Fed’s biggest headache is inflation data or unemployment numbers. But this time? The central bank is staring at something different: political interference at full volume.

Trump isn’t whispering from the sidelines, he’s shouting. He’s demanded rate cuts as steep as three full percentage points. Think about that: not just a small tweak, but a huge shift that could redraw the financial map.

And then came the bombshell: in late August, Trump tried to fire Fed Governor Lisa Cook. No president has ever done that before. The courts stepped in, blocking it immediately. Why? Because Fed governors are protected by law, they can only be removed “for cause” (serious misconduct, not just for disagreeing with the president). But the message from Trump was crystal clear: cross me, and you could be next.

Could Powell Really Be Fired?

This is the question everyone’s asking. Trump has mocked Powell as “a numbskull,” even threatened to demote him. But here’s the kicker: under US law, the president cannot fire the Fed Chair at will. Powell himself has said it, just like Trump couldn’t fire Cook, he can’t just show Powell the door. That “for cause” protection is a shield.

So, is Powell safe? Legally, yes. Politically, not so much. The pressure is real, and it’s mounting.

A New Ally Inside the Fed

As if that wasn’t enough, Trump’s ally Stephen Miran was just confirmed to the Fed Board. That means when the FOMC sits down to vote, Trump’s voice may be right there in the room. The optics? Brutal.

The Credibility Test

Here’s Powell’s dilemma:

- If the Fed cuts rates, skeptics say it caved to Trump.

- If it holds steady, the White House attack machine revs up louder.

So yes, Trump’s pressure influences the Fed, not because Powell fears losing his job tomorrow, but because the Fed must prove it’s acting on data, not politics. This is why Powell’s language will be extra careful: expect him to hammer “independence” and “data-driven decisions.”

Still, no matter what Powell says, the shadow of politics hangs heavy. Independence has never looked so fragile.

Related: Trump would be challenged to remove Powell

What It Means for Markets

A rate cut doesn’t just sit on paper — it moves trillions. Here’s how:

- Stocks: Lower rates support earnings and valuations. Tech and growth names usually benefit most. But if the cut signals panic, gains can fade. Markets already rallied into this meeting — limiting upside.

- Bonds: Yields fall when the Fed eases. Two-year Treasuries move first; the curve can steepen if investors price in more cuts. Bondholders gain.

- Dollar & Gold: A softer Fed means a softer dollar. That lifts gold — already at record highs above $3,680 — and supports commodities priced in dollars.

- Oil: Lower rates help demand but tariff-driven inflation fears cap upside. Expect choppy moves.

- Crypto: Bitcoin thrives on easy money and dollar weakness. At $116k, it’s near record highs, with bulls eyeing $120k. But like stocks, it risks a “sell-the-news” dip if the cut is already priced.

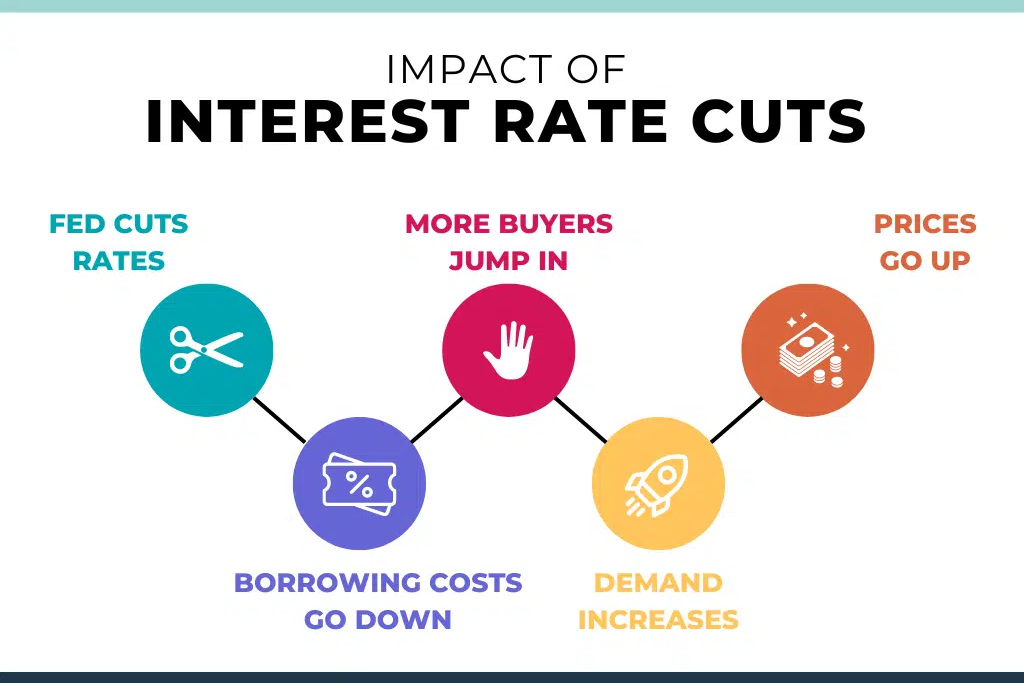

- The Economy: Cuts trickle down to mortgages, car loans, and business credit. They boost confidence and can prevent slowdown from turning recession. But if cuts come too fast, inflation can rebound later.

“Sell the News?” — The Risk of Disappointment

Markets often rally into Fed cuts — then stall. Why? Because traders buy the rumor, then take profits when the news hits.

This time, futures markets had priced a 0.25% cut with 100% certainty. Stocks, gold, and Bitcoin rallied ahead of the meeting. That means the cut itself won’t surprise anyone.

The real catalyst will be Powell’s press conference:

- If he signals more cuts ahead, markets could keep climbing.

- If he stresses inflation risks and independence, traders may see fewer cuts coming — prompting a pullback.

- If no cut happens at all, expect a sharp sell‑off across risk assets.

History shows the first cut after a hiking cycle often brings volatility. July 2019 is the model: stocks dipped on the day because investors wanted more. Today could echo that — a modest cut, cautious tone, and a market pause.

The Fed is walking a tightrope: ease enough to support jobs, but not so much that inflation flares or independence is questioned. The most likely outcome is a quarter‑point cut with Powell stressing data over politics. For markets, the headline move is expected; the guidance is what matters.

Investors should be ready for choppiness, but the bigger picture is clear: the Fed has started to pivot, and that changes the game for stocks, bonds, gold, and crypto heading into 2026.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

LIVE: Fed Chair Jerome Powell press conference following September interest rate decision