Jensen Huang’s viral dinner in Seoul turned into a mini stock mania — proof that the AI hype cycle may be peaking.

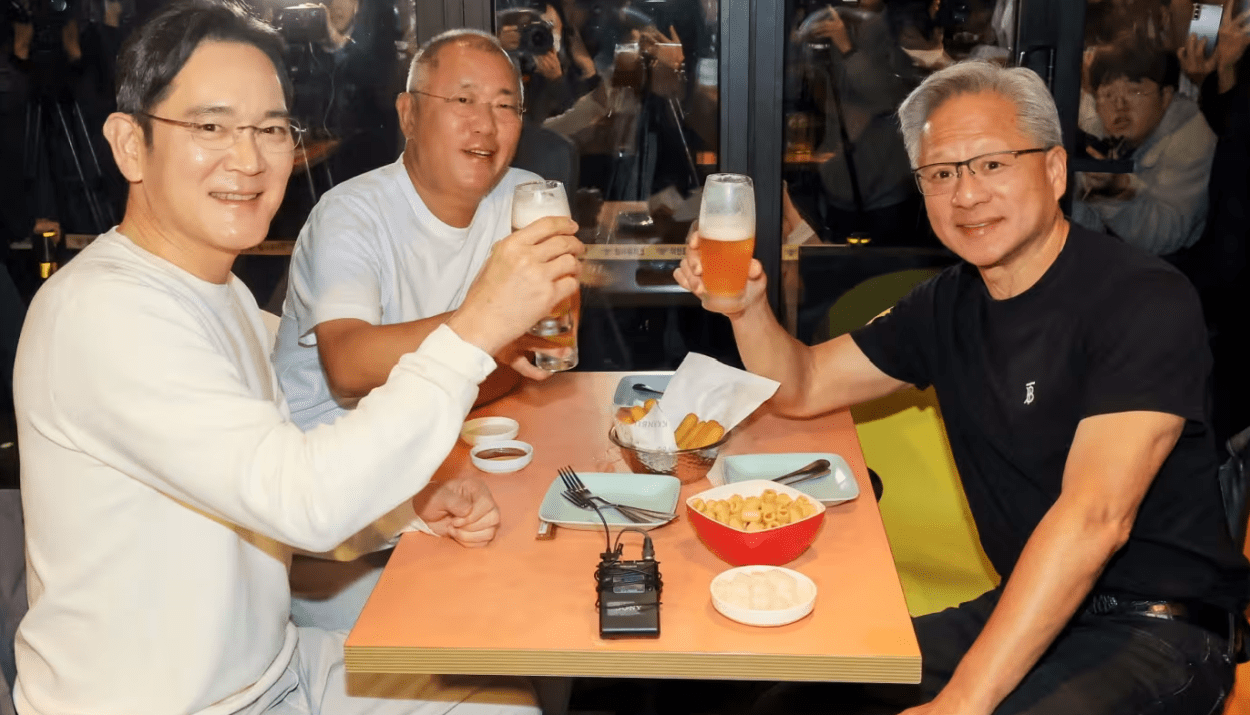

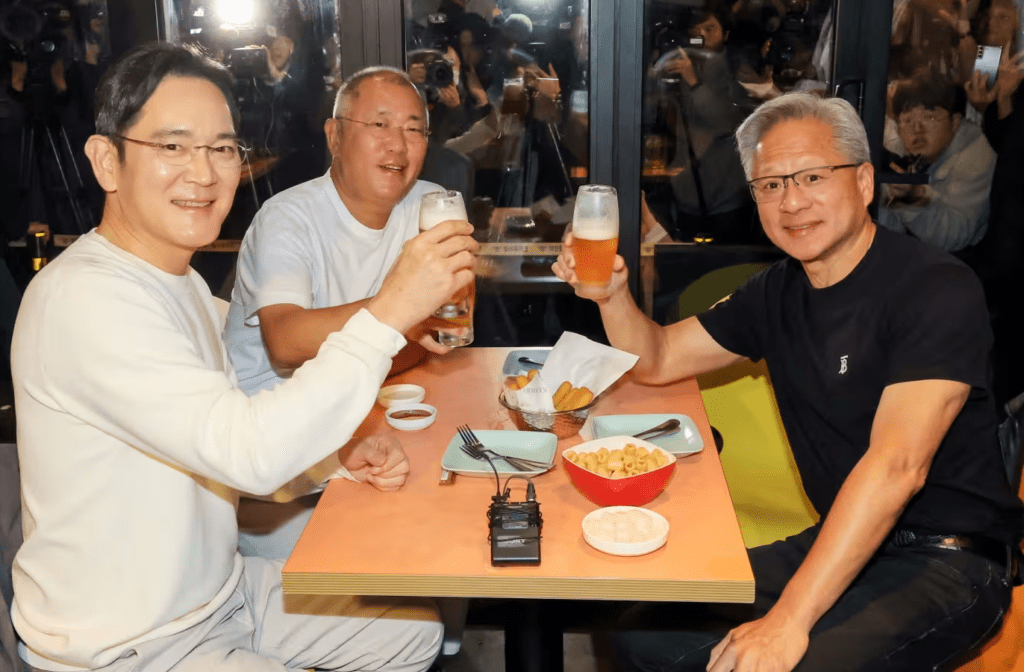

Photos of Nvidia CEO Jensen Huang casually eating fried chicken and beer in Seoul with Samsung’s Jay Y. Lee and Hyundai’s Chung Euisun went viral last week. Within hours, South Korean investors started piling into anything even remotely connected to chicken or AI.

While Kkanbu Chicken — the restaurant itself — isn’t publicly listed, rival Kyochon F&B jumped nearly 20%, poultry processor Cherrybro Co. hit Korea’s daily limit of +30%, and even Neuromeka, a robotics firm that makes chicken-frying robots, surged sharply.

The frenzy, as FT noted, highlights how speculative the AI boom has become — and how quickly social media hype now moves markets.

From Chips to Chicken: The Absurd Side of the AI Boom

This isn’t the first time a market bubble produced bizarre side effects. Think Pets.com in 2000, NINJA loans in 2007, or $100,000 tulip bulbs in the 1600s. Each symbolized a moment when rational valuation gave way to mass euphoria.

Now, the “fried chicken rally” may become the meme moment of the AI cycle — a time when investors buy anything that looks AI-adjacent.

Even legitimate names are feeling the effect. Bloom Energy, a fuel cell maker only loosely tied to the AI data-center theme, has soared 1,166% in 12 months, now valued above companies like United Airlines, Kraft Heinz, and Vodafone, despite modest $83M projected profits.

A Circular, Self-Funding Ecosystem

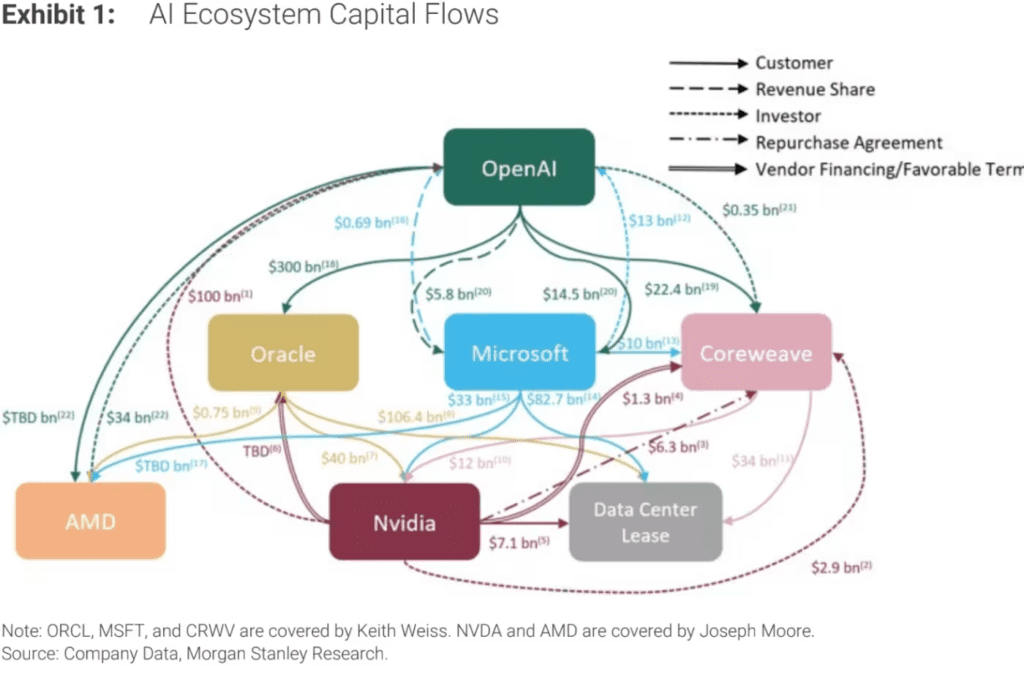

Beyond the humor, the real concern lies in what Morgan Stanley calls the “circular funding loop” inside the AI industry.

Suppliers are investing in customers, customers are reinvesting in suppliers, and many have revenue-sharing deals that blur the lines of real economic activity.

This creates what the bank calls “cascading liquidity” — where vendors keep their clients afloat by funding them, enabling even more spending and artificial growth.

Analysts warn this can obscure true profitability, inflate demand, and raise counterparty risk if one domino falls.

Signs of a Top

Even as Nvidia, Microsoft, and OpenAI continue to post massive sales and partnerships, the valuation disconnect is widening. The AI trade now seems driven more by fear of missing out than by fundamentals.

From fried-chicken stocks to AI-linked fuel-cell rallies, investors are chasing narratives rather than numbers—the classic hallmark of a late-stage bubble.

When retail investors start linking fried chicken dinners to AI profits, it’s a sign euphoria has gone too far.

The AI revolution is real — but history shows every boom breeds its own absurd moments before reality sets in.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.