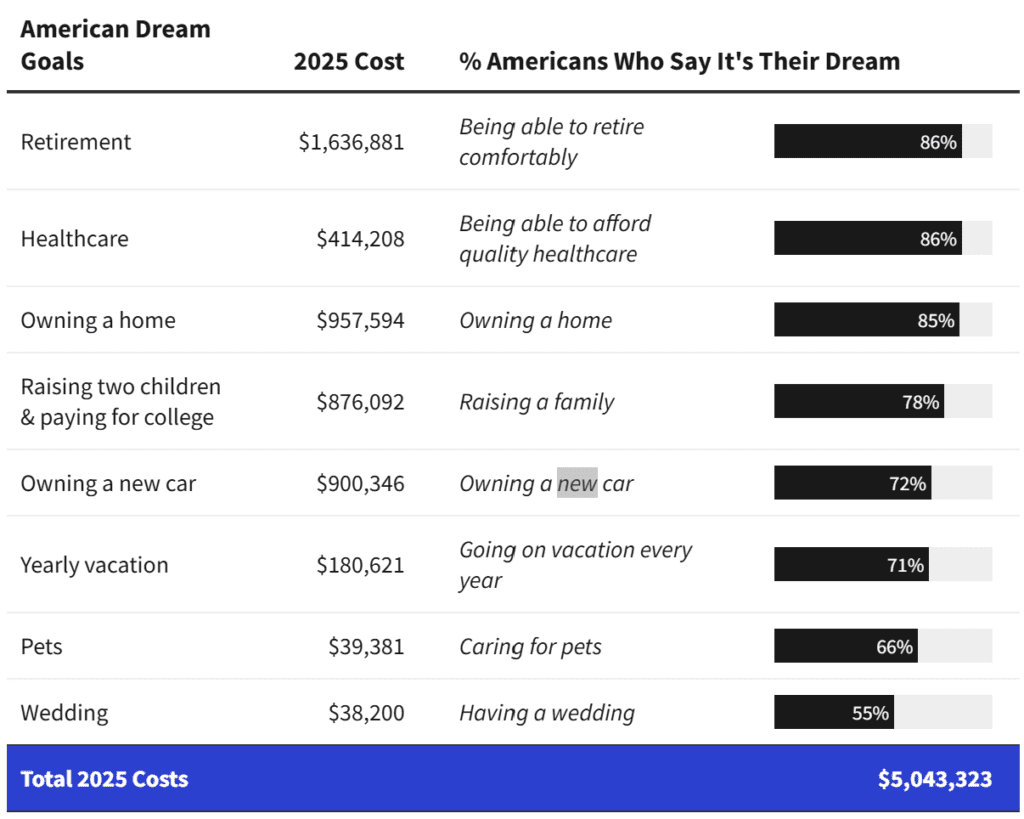

Living the American Dream has never been more expensive. A new Investopedia analysis reveals that achieving traditional middle-class milestones—such as homeownership, retirement, raising children, and owning a car—now totals more than $5 million over a lifetime, highlighting how financial realities have outpaced wages for most Americans.

According to the report, the eight pillars of the American Dream—homeownership, retirement, healthcare, children, college, weddings, cars, vacations, and pets—require a combined $5.04 million for a dual-income household to afford. A college-educated American earning the national average would still fall about $2.2 million short of that total.

The largest expense remains retirement, estimated at $1.64 million, followed by homeownership ($957,594) and car ownership ($900,346). Raising two children and sending them to college costs roughly $876,000, while healthcare adds another $414,000 over a lifetime.

Even smaller luxuries add up: the average annual vacation costs $180,000 over decades, pets nearly $40,000, and weddings about $38,000.

The findings underscore how inflation, high mortgage rates, and surging education and healthcare costs have reshaped what it takes to “make it” in America. While 85% of respondents still view homeownership as part of their dream, the study concludes that fully achieving it is now realistic only for “college-educated, dual-income households.”

The American Dream remains alive—but for many, it’s drifting further out of reach.