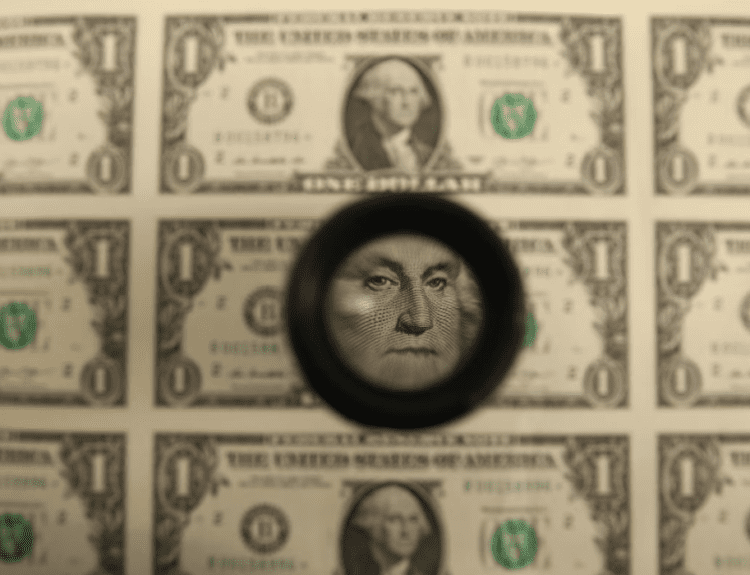

Elon Musk’s Tesla has transferred approximately $765 million worth of Bitcoin to undisclosed wallets, causing a stir in the cryptocurrency and financial markets. This action raises questions about the company’s future plans for its digital asset holdings.

- Massive Transfer: Tesla shifted about $765 million worth of Bitcoin, as reported by Arkham Intelligence, though the destination of these funds remains unknown.

- Market Impact: This transfer has led to widespread speculation among investors and analysts about potential sales or strategic moves by Tesla.

- Bitcoin Holdings: According to BitcoinTreasuries, Tesla is one of the top holders of Bitcoin among public companies in the U.S., though its holdings represent less than 1% of its total market cap.

- Historical Context: Tesla initially purchased $1.5 billion in Bitcoin in early 2021, influencing a significant price increase in the cryptocurrency.

- Sustainability Concerns: Musk reversed his decision on Bitcoin transactions for Tesla products in mid-2021 due to environmental concerns, impacting Bitcoin’s price.

- Previous Sales: Tesla sold a large portion of its Bitcoin in 2022 at a lower price than the purchase, incurring potential lost profits compared to current valuations.

- Accounting Changes: Upcoming changes from the Financial Accounting Standards Board (FASB) will affect how companies like Tesla report their digital asset holdings, allowing for the marking of assets at fair value on financial statements.

Tesla’s recent Bitcoin transaction has ignited discussions on its investment strategy and the implications for its financial reporting. With new accounting rules coming into effect, the financial community is keenly watching how this will influence Tesla’s handling of Bitcoin and other digital assets. The strategic decisions Tesla makes now could have long-term effects on its investment portfolio and its position in the cryptocurrency market.