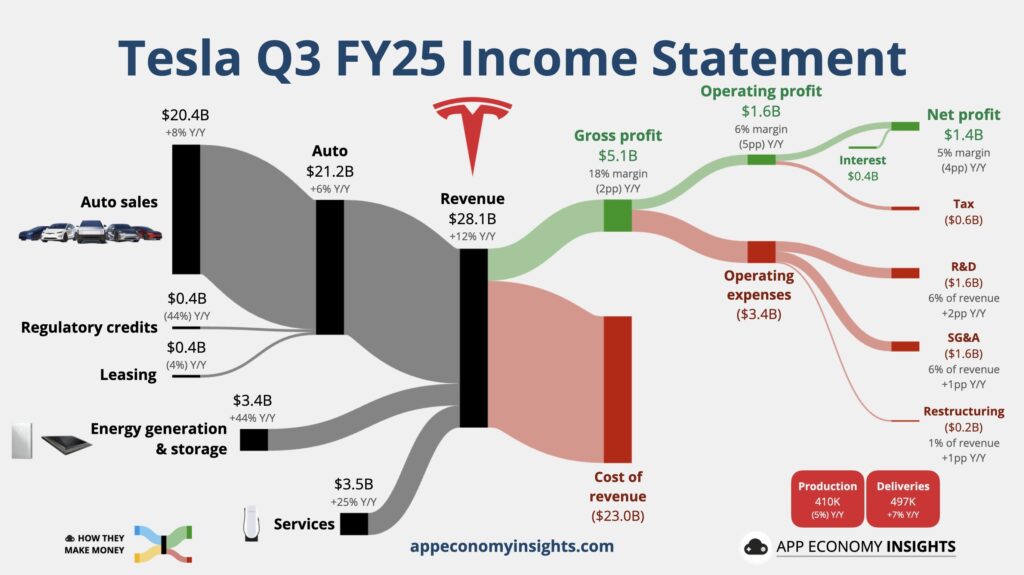

Tesla (NASDAQ: TSLA) posted record quarterly revenue of $28.1 billion, up 12% year-over-year, but saw net income plunge 37% to $1.4 billion as heavy AI and robotics R&D costs, tariffs, and price cuts took a toll on margins. Shares dropped over 4% in pre-market trading following the results.

Margins Squeezed Despite Record Deliveries

Tesla delivered 497,099 vehicles globally, outpacing production of 447,450 units, reflecting healthy demand before US EV tax credits expired. However, deep price cuts — with Model 3 and Model Y now starting at $36,990 and $39,990 — reduced profitability.

Operating income fell 40% to $1.6 billion, with margins contracting to 5.8%, down from 10.2% a year earlier. Adjusted EPS came in at $0.50, missing Wall Street’s $0.54 forecast.

AI and Robot Investments Drive Spending Surge

Tesla’s R&D costs surged nearly 50%, driven by investments in AI, the Optimus humanoid robot, and Full Self-Driving (FSD) software. CFO Vaibhav Taneja warned of “substantial capital expenditure increases in 2026” as these programs scale.

Analysts at Morgan Stanley said Tesla’s strategy to transform into an “intelligence company” offers long-term promise but “weighs heavily on near-term margins.”

Energy Business Surges, Offsetting Automotive Weakness

The energy division was a bright spot, with sales of Megapack and Powerwall products up 44% to $3.4 billion and margins above 30%. Energy storage deployments hit 12.5 GWh, almost doubling from last year.

Meanwhile, “Services & Other” revenue rose 25% to $3.5 billion, driven by software and charging operations — evidence of Tesla’s growing recurring-revenue ecosystem.

FSD and Software: The Road to Recurring Income

About 50–60% of Model S/X buyers and 20–30% of Model 3/Y owners opted for FSD, supporting Tesla’s software-as-a-service strategy. Subscription-based revenue from FSD and connectivity services is helping diversify income beyond car sales.

The Road Ahead

CEO Elon Musk described Tesla as an “intelligence and robotics company” in transition. The company plans to ramp up production of the Optimus robot and Cybercab robotaxi platform in 2026 — both key to future growth.

Still, with a forward P/E above 250 and analysts pegging fair value near $370 per share, Tesla faces high expectations. Any delays in its AI or robot rollout could test investor patience.

Tesla’s Q3 results show a company balancing innovation and profitability. The record revenue underscores resilience, but the margin squeeze highlights the cost of reinventing itself from EV leader to AI powerhouse.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.