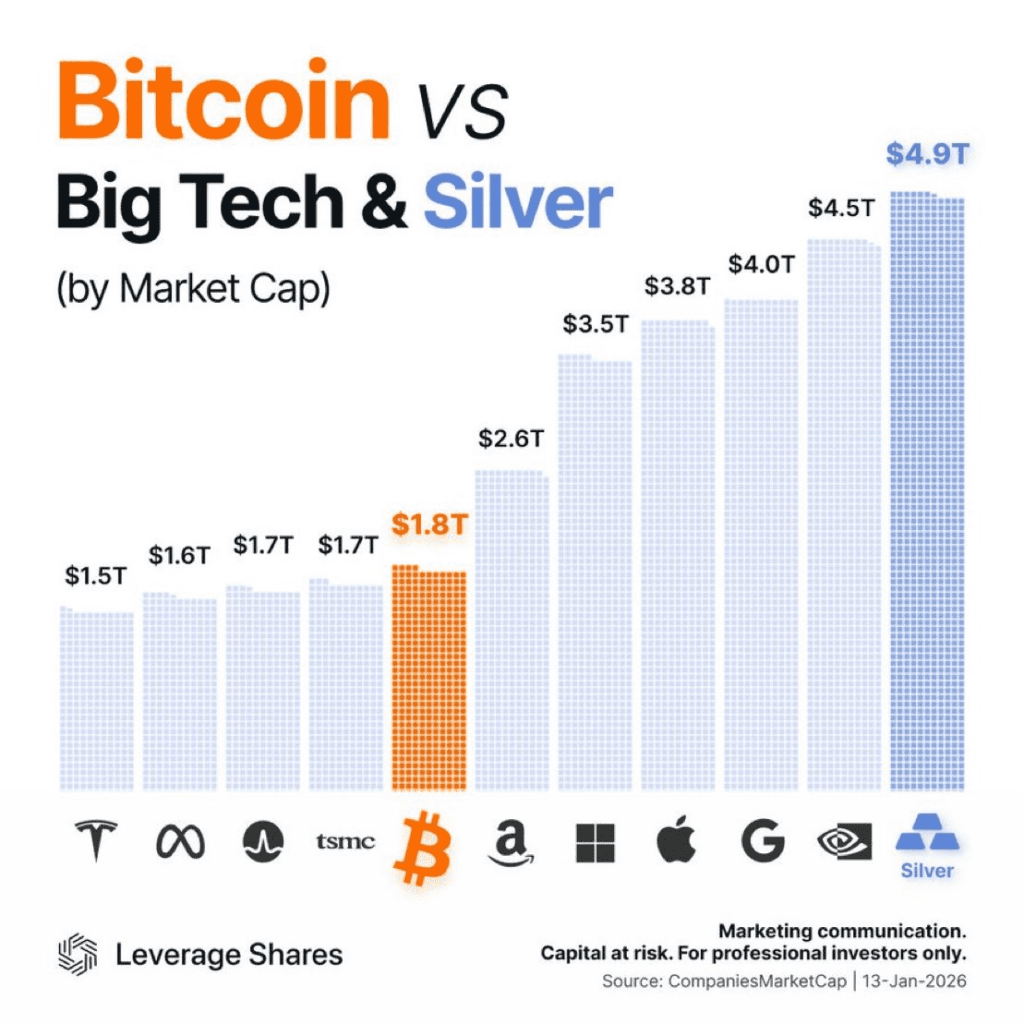

Silver has delivered one of the strongest asset rallies of the past year, adding more than $3.9 trillion in market capitalization over the last 12 months and outperforming stocks, cryptocurrencies, and even gold.

Prices have climbed nearly 200% over the period, lifting silver’s total market value above $5 trillion. The metal now ranks as the second-largest asset globally by market cap, behind gold at roughly $32 trillion.

Silver recently hit a new all-time high near $93, before easing slightly to around $89, still close to record levels and showing strong momentum.

The rally has far exceeded gains across major markets:

- Gold is up about 70% over the same period

- The S&P 500 has gained roughly 17%

- The Nasdaq Composite is up around 21%

- Bitcoin is down about 4% year over year

Silver has also overtaken the market capitalizations of major technology companies such as Nvidia, Apple, Microsoft, Alphabet, and Amazon.

At current levels, silver’s market cap is estimated to be about 2.5 times larger than bitcoin’s, underscoring how dramatically capital has rotated into the precious metal.

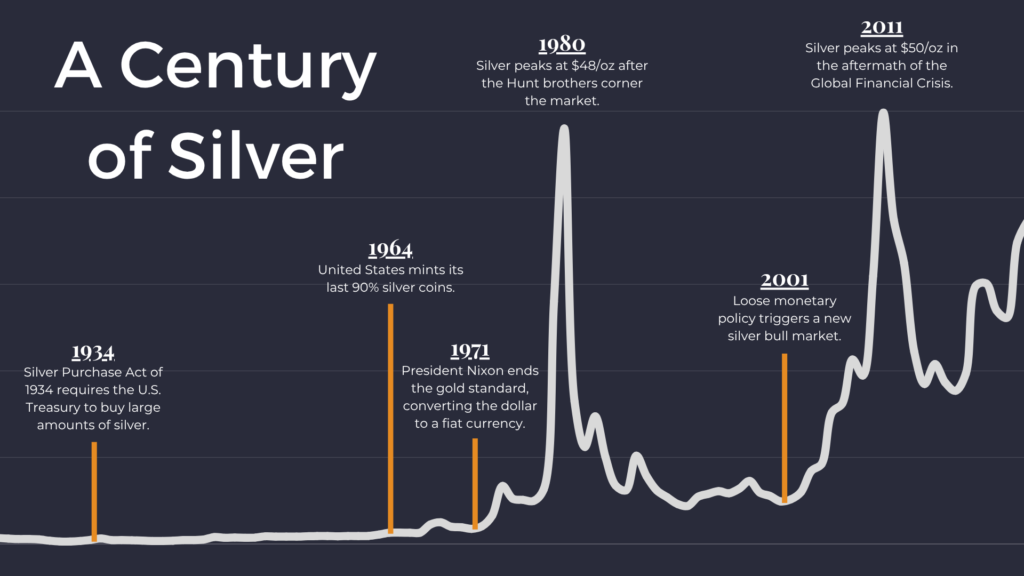

Market analysts say silver’s surge reflects a mix of tight supply, strong industrial demand, and growing investor interest in hard assets as protection against inflation, policy uncertainty, and currency risk. While prices have pulled back slightly from their peak, traders say the broader trend remains firmly bullish.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Gold and Silver Soar as Bitcoin Falls Behind in 2025