Setting clear financial goals is the first step toward building long-term financial stability. Whether saving for the latest gadget, enjoying a vacation, or working on retirement, having specific money goals to act as a compass guiding you through financial decision-making is key to success.

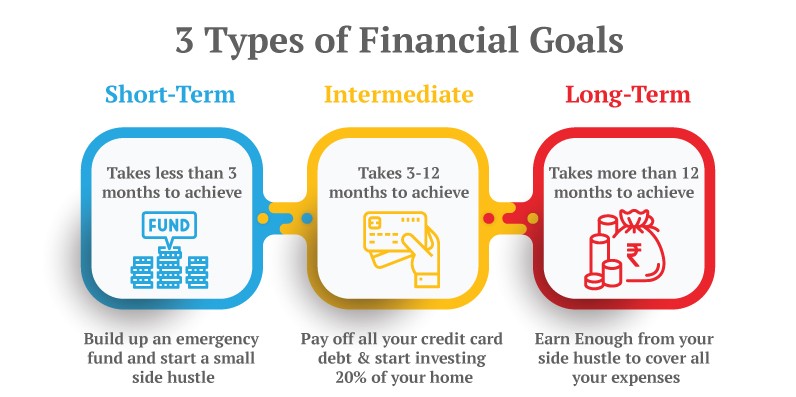

We can classify financial goals into three groups, short-term, mid-term, and long-term financial objectives. But, what sets them apart? Why should you have them? And how do you follow your plans? Let’s explore each of these types more closely and design your path to financial success!

Understanding the Importance of Setting Financial Goals

Without a defined plan and direction, your finances can easily be scattered everywhere, leaving you wondering where it all went. But when proper goals are set, each dollar has a mission to carry out. 69% of Americans are reported to have set financial goals for themselves.

Setting financial goals helps you create a roadmap for your future. It determines the way you should allocate your expenses, savings, and investments. As an example, having a specific goal of repaying a debt will encourage you to reduce spending unnecessarily and direct the remaining money towards a more important cause. Similarly, putting aside funds for an emergency will give you the security of being able to deal with an unexpected financial crisis.

Financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART). This method will allow you to measure the advancement and be inspired to move on. Besides, if you connect your financial goals with your personal beliefs and life objectives, the process can become more interesting and gratifying.

Building a Strong Foundation with Short-term Financial Goals

Setting short-term financial goals lays the groundwork for long-term success. These are small milestones achievable within a year that provide the foundational structure for bigger financial dreams.

The most important step in setting short-term financial goals involves setting a budget. A budget helps you to track where your money goes each month, along with finding unnecessary expenditures and ways through which money could be saved. One can make small adjustments to free up cash by cutting down on subscriptions or dining out.

Next, build up an emergency fund. Consider it as your life jacket that keeps you floating when life may flood you with surprises, e.g., sudden job loss or being billed wrong for your medical treatment which came out to be more than you expected. Save up to three to six months’ worth of living expenses to keep yourself on a straight path with your finances.

Lastly, pay off high-interest debt. Paying down credit card balances saves money, increases your credit rating, and frees up money to be saved or invested.

You may also want to save for shorter-term goals, for instance, small gadget expenses, improvement over the house, or enhancement courses that may add more value to your career prospects. It can also be used to make life worthwhile by spending it on a weekend getaway or a cherished hobby.

Mid-term and Long-term Financial Goals: Planning for the Future

Mid-term financial goals form the bridge between short-term achievements and long-term dreams and can be achieved in the time span of 1 to 5 years. Some examples are saving for a down payment on a house, planning a major renovation, or funding a child’s education. They are the goals that need careful planning and steady saving but are manageable with focus and effort. According to the Bankrate Financial Security survey, 74 percent of Americans believe that the American dream is homeownership, further emphasizing the importance of saving for a mid-term goal.

Long-term goals usually reflect your big dreams that take more than 5 years to achieve. They might include saving for retirement, building a large investment portfolio, or buying a vacation home. Since these goals are huge, they call for more strategic planning and consistent effort.

Mid-term and long-term goals together make for a dynamic duo in your financial planning. Mid-term goals provide immediate tangible targets to keep the motivation going, while long-term goals are the big picture that guides your journey. A balanced approach to both will ensure a steady course toward a secure and rewarding financial future.

Creating and Tracking Your Financial Roadmap

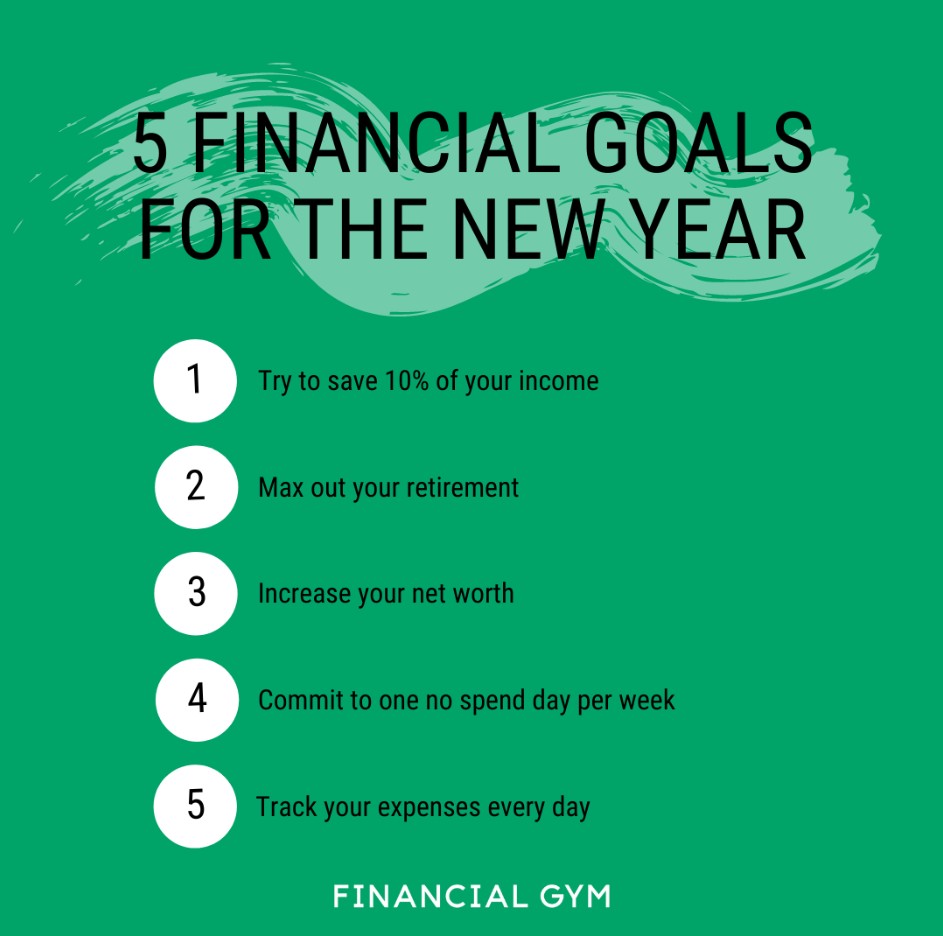

Building a financial plan requires clear steps that can help you stay organized and on track. Here’s how to build and follow your roadmap:

- Clearly Set Goals: Clearly define your goals in both the short run (like saving $1,000 in 6 months), medium run (such as a down payment on the house), and long run (like retirement savings).

- Budget Setup: Categorize your expenses and apply the 50/30/20 rule or zero-based budgeting methodology to determine the rate of savings and reduce financial stress.

- Plan Savings: Create a high-yield savings account for your emergency fund and automate monthly contributions towards your goal in an efficient manner.

- Throttle as Needed: You have to do a reevaluation every few months with the change in income versus expenses.

- Leverage Financial Tools: Utilize budgeting tools like Mint or YNAB, spreadsheet programs like Google Sheets, or an online tracker to map and stay organized about your progress.

- Be Consistent: Continue practicing good financial habits and, when needed, refine your plan to keep it updated with your goals.

To Conclude

A healthy financial plan allows one to take care of the present smoothly while preparing for the future.

Remember, flexibility is essential. Adjust your plan whenever your life circumstances change, along with continued commitment. Over time, discipline and careful planning will reward you with a safe and secure financial future.

Sources:

- https://www.nerdwallet.com/article/finance/financial-goals-definition-examples

- https://www.financestrategists.com/financial-advisor/financial-planning/financial-goals/

- Seven in 10 Americans Likely to Set Goals for 2023 (gallup.com)

- https://www.lendingclub.com/resource-center/personal-finance/how-to-build-a-strong-financial-foundation

- https://www.bankrate.com/mortgages/homeownership-remains-centerpiece-of-american-dream

- The 50/30/20 Budget Rule Explained With Examples (investopedia.com)

- How To Leverage Your Bank’s Tools for Better Expense Tracking in 4 Steps | GOBankingRates