It was another volatile day for the “Quantum Four” — IonQ (IONQ), Rigetti Computing (RGTI), Quantum Computing Inc. (QUBT), and D-Wave Quantum (QBTS) — as the sector rallied on speculation that the Trump administration might invest directly in US quantum startups.

According to a Wall Street Journal report Wednesday night, the Commerce Department was exploring equity stakes in exchange for federal funding from its CHIPS Research and Development Office. The rumoured funding floor was $10 million per firm, though the amount of equity sought was unclear.

Following the news, all four stocks jumped in premarket trading Thursday:

- D-Wave Quantum (QBTS) +13%

- IonQ (IONQ) +12%

- Quantum Computing Inc. (QUBT) +11%

- Rigetti Computing (RGTI) +9%

The rally helped erase much of Wednesday’s losses from a broader market selloff tied to US-China trade tensions and weak tech earnings.

Commerce Department Denies Report

By Thursday afternoon, however, momentum faded after Commerce Department officials denied that such equity discussions were underway.

“The Trump administration isn’t negotiating with quantum-computing companies for equity stakes,” a department representative said.

The clarification sent shares off intraday highs, though they remained up sharply on the day.

- D-Wave Quantum: +13.8%, but below session peak

- IonQ: +7% to +10%, after spiking over 12%

- Rigetti: +9%

- Quantum Computing Inc.: +8%

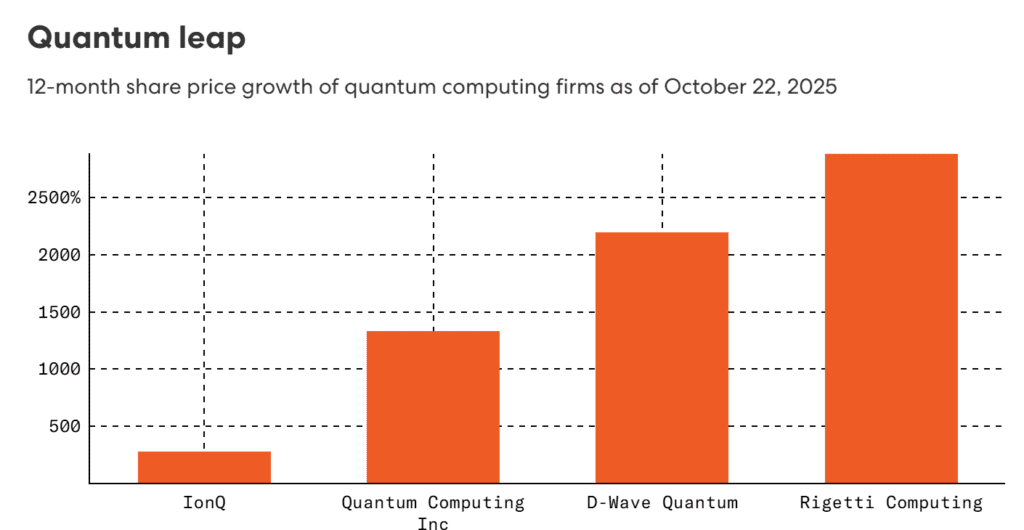

A 12-Month “Quantum Leap”

Even with today’s swings, the sector has seen staggering 12-month gains. As of October 22, 2025, according to market data:

- Rigetti Computing: +2,831%

- D-Wave Quantum: +2,174%

- Quantum Computing Inc.: +1,215%

- IonQ: +269%

Analysts say the gains reflect “AI spillover hype” and government-backed optimism that quantum computing could soon underpin national security, logistics, and advanced research.

Rigetti’s Response and Industry Context

Rigetti Computing responded to Fast Company, saying it was “continuously engaging with the U.S. government on funding opportunities that advance quantum computing.”

“Government investment has long been vital to maintaining America’s technological leadership—early public funding helped ignite the internet, GPS, and semiconductor industries. The same holds true for quantum computing today,” the company said.

IonQ and Quantum Computing Inc. declined to comment.

Analysts note that while quantum computing remains years away from commercial viability, it has become a strategic priority alongside chips, AI, and rare earth materials — areas where Washington has already taken direct financial stakes.

Market Snapshot & Latest Data

As of Friday morning (October 24, 2025):

- IonQ (IONQ): $27.10 (+8.4% YTD, -34% from Oct. 13 peak)

- Rigetti (RGTI): $4.85 (+136% YTD, -38% from Oct. 14 high)

- D-Wave (QBTS): $3.61 (+225% YTD, -42% from last week’s high)

- Quantum Computing (QUBT): $1.82 (-10% YTD, -45% from Oct. 3 high)

The broader Nasdaq 100 was down 0.4% Thursday, while Bitcoin hovered near $108,000, showing continued rotation among speculative tech assets.

The Big Picture

Even amid the pullback, the quantum rally underscores investor hunger for next-frontier technologies. Traders are betting that government funding and corporate partnerships could turn today’s lab experiments into tomorrow’s industrial backbone.

For now, though, the quantum trade looks as volatile as its physics — fueled by rumour, reaction, and the promise of a revolution that’s still years away.

Quantum computing stocks are riding a wave of speculative optimism, amplified by whispers of government support and the sector’s alignment with the AI revolution. But as Thursday’s reversal shows, even quantum dreams can collapse faster than they materialise.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.