A pivotal week unfolds as investors weigh Fed policy shifts, Trump’s Russia strategy, and retail earnings. Global markets opened cautiously, with energy, defense, and consumer spending in focus.

Last Week in Review

Markets swung through a volatile week dominated by inflation data, corporate earnings surprises, and geopolitics.

- CPI held steady at 2.7% YoY, reinforcing expectations for a September Fed rate cut.

- PPI surged 0.9% MoM, the hottest in three years, dampening hopes of a 50bps move.

- Earnings: BigBear.ai, Cava, and Deere slumped, while SoundHound, Ford ($5B EV pledge), and UnitedHealth (up ~10% on Buffett’s $1.6B stake) stood out positively.

- Tech in focus: Nvidia’s China export deal reassured markets, while Intel jumped on talk of government backing.

- Geopolitics: Trump confirmed no tariffs on gold, floated 200–300% semiconductor tariffs, and met Putin in Alaska — no ceasefire, but talk of a broader peace deal.

By Friday, the Dow closed just shy of a record, supported by defensive flows, while the broader market wrestled with tariff fears and shifting Fed expectations.

Global Markets This Morning

Global markets opened the week on a cautious but steady footing, with investors balancing Fed cut hopes against geopolitical risks.

Equities:

- Asia: MSCI Asia Pacific +0.4%, led by China and Japan. Shanghai shares approached a 10-year high. India’s Nifty 50 surged 1.6% after Modi announced a landmark tax cut on everyday goods, aimed at offsetting US tariffs.

- Europe: Stock futures +0.2%.

- US: S&P futures +0.1%, with traders watching Trump–Zelensky talks.

Commodities:

- Brent crude held just below $66 after Friday’s 1.5% drop. WTI hovered near $63. Oil’s drift reflects reduced sanction fears as Trump signaled no new penalties on Russian exports, while markets brace for potential Arctic drilling agreements. (More about: Oil Markets Turn Bearish as Trump–Putin Alaska Summit Shakes Global Energy Outlook)

- Gold steadied after last week’s tariff confusion; no new restrictions are expected.

Bonds & FX:

- US yields steepened as short-end anchored by Fed cut bets, while long-end fretted over deficits and inflation.

- European yields rose as governments confront ballooning defense budgets.

- The euro rallied 13% YTD, now near $1.17.

Sentiment: The CNN Fear & Greed Index sits in “Greed”, showing investors are leaning risk-on despite headline risks.

Trump–Zelensky Meeting: A Defining Moment

After the Alaska summit with Putin ended without a ceasefire, attention shifts to Washington today. (More about: Trump–Putin Alaska Summit: What Really Happened)

Who’s at the table:

- Trump, Zelenskyy

- Germany’s Chancellor Merz, France’s Macron, Finland’s Stubb, Italy’s Meloni

- EU President Von der Leyen

- NATO chief Rutte

Agenda:

- Security guarantees for Ukraine.

- Conditions for a durable peace agreement.

- Russia’s demand for phased SWIFT re-entry and sanctions relief.

Trump’s calculus is clear: leverage Russia’s dependence on China by offering transactional deals in Arctic energy, shipping, and critical minerals. Analysts warn this could fracture Europe’s Ukraine strategy, forcing EU states to ramp up defence spending while Trump reorients Washington toward the Indo-Pacific.

Markets see less risk of fresh US sanctions and more room for energy supply. Brent crude remains priced for a peace scenario, though BofA warns Arctic projects could push oil into a “deep bear market.” Defense stocks, meanwhile, continue their extraordinary rally — Rheinmetall up 1,500% since 2022.

A breakthrough could reprice energy markets lower and reinforce the rally in European defence stocks, while failure risks prolonging uncertainty.

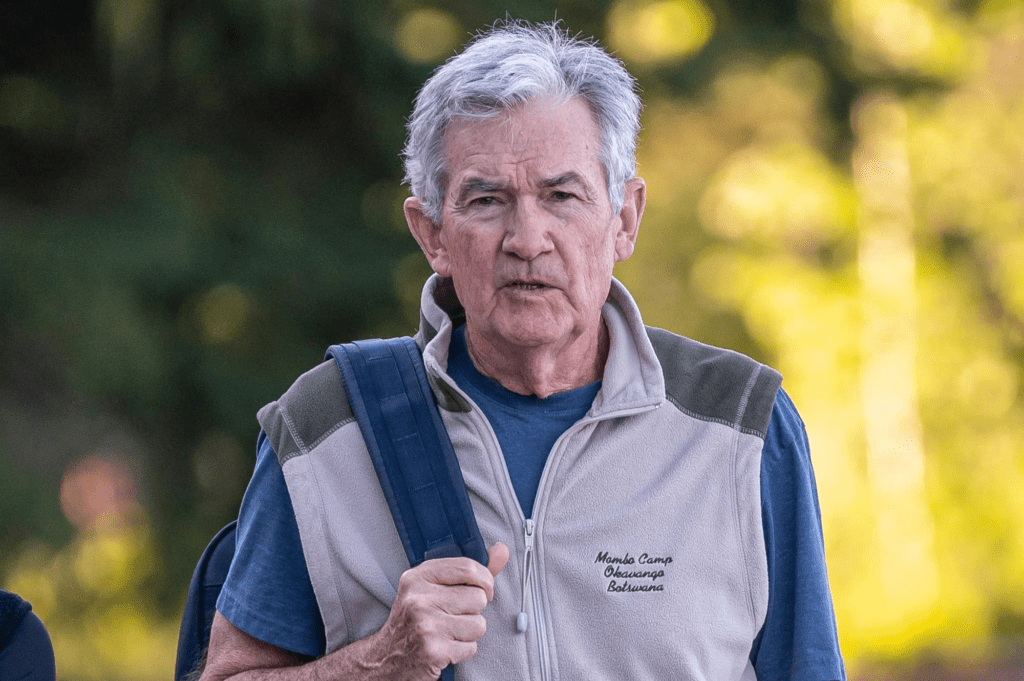

Powell at Jackson Hole

The Federal Reserve’s annual Jackson Hole Symposium (Aug. 21–23) culminates Friday when Jerome Powell gives what may be his final speech as chair.

Markets are 85% priced for a 25bps September rate cut, with odds of further cuts in October and December. Investors will parse Powell’s words for clarity on:

- How aggressive the Fed will be in cutting.

- His view on inflation risks after July’s hotter-than-expected PPI.

- Whether dissent within the FOMC could derail the easing cycle.

For Powell, who entered Jackson Hole in 2018 as a pragmatic risk manager, this could be a legacy moment. The White House now derides him as “Too Late,” underscoring the political pressure on the Fed.

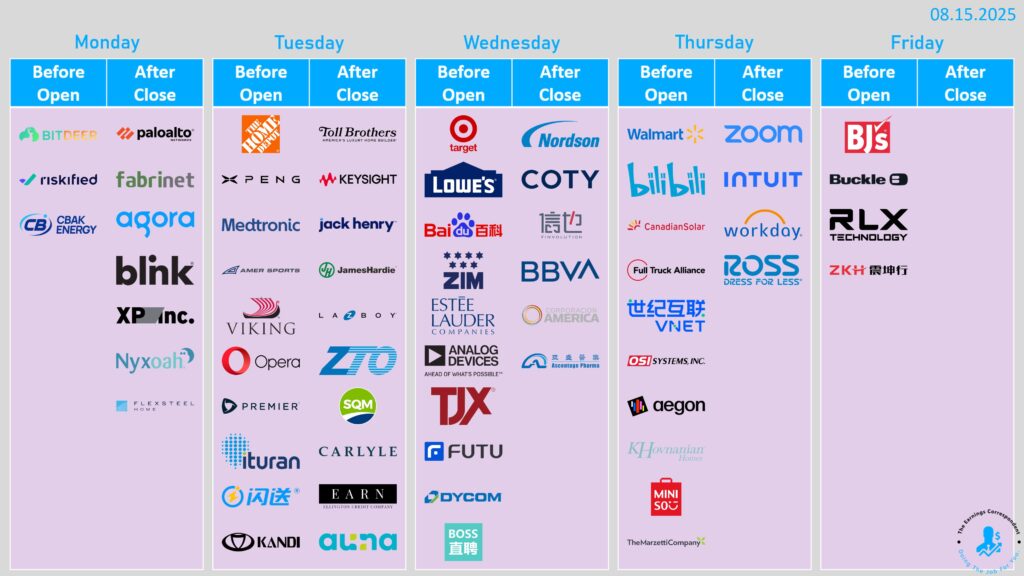

Retail Earnings in Focus

This week also puts retail front and center:

- Walmart (Thursday): Expected US same-store sales +4% YoY. Stock +10% YTD. Investors will watch if consumer “choicefulness” has shifted toward more confident spending.

- Target (Wednesday): Shares –20% YTD amid leadership questions.

- Home Depot (Tuesday): Navigating a soft housing market, though interest rates may spark recovery.

Together, these results will shape the market’s view on US consumer resilience in the face of tariffs, inflation, and shifting household budgets.

Economic Calendar

| Day | Economic Data | Key Earnings |

|---|---|---|

| Mon, Aug 18 | NAHB Homebuilder Sentiment (34 exp., 33 prev.) | Palo Alto Networks (PANW), Blink Charging (BLNK) |

| Tue, Aug 19 | Housing Starts (–2.4% exp.), Building Permits (–0.2% exp.) | Home Depot (HD), XPeng (XPEV), Medtronic (MDT), Amer Sports (AS), Toll Brothers (TOL), La-Z-Boy (LZB) |

| Wed, Aug 20 | FOMC Minutes (Jul 30–31), MBA Mortgage Apps (+10.9% prev.) | Target (TGT), Baidu (BIDU), Lowe’s (LOW), TJX (TJX), Estée Lauder (EL) |

| Thu, Aug 21 | Jobless Claims (224K prev.), US PMI (Manuf. 49.8, Services 55.7 prev.), Existing Home Sales (–0.8% exp.) | Walmart (WMT), Intuit (INTU), Workday (WDAY), Ross Stores (ROST), Zoom (ZM) |

| Fri, Aug 22 | Powell speaks at Jackson Hole (10 a.m. ET) | BJ’s Wholesale (BJ), Buckle (BKE) |

Outlook

The week ahead blends monetary drama and geopolitical gambits. On one side, Powell faces pressure to anchor markets with a dovish tone at Jackson Hole. On the other, Trump seeks to realign Russia away from China while forcing Europe to shoulder more defense costs.

Markets remain constructive, with equity indices near records, but volatility could spike if:

- Powell tempers rate cut expectations.

- Trump–Zelensky talks collapse without progress.

- Retail earnings confirm deeper cracks in US consumer spending.

In short: this week offers investors a stress test of both global politics and central bank credibility. The outcome could reset the tone for the rest of 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.