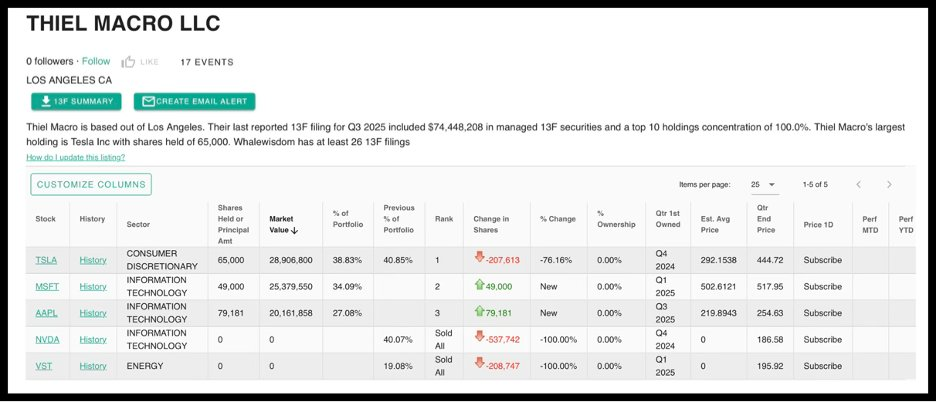

Billionaire tech investor Peter Thiel has made one of the most eye-catching moves of the quarter: his hedge fund, Thiel Macro LLC, has completely exited its Nvidia stake, selling roughly 537,742 shares, a position previously worth close to $100 million. The sale, disclosed in the latest 13F filing, comes at a moment when Wall Street has been treating Nvidia as almost untouchable, with the stock recently pushing past a $5 trillion valuation.

Thiel’s decision is striking not only because he sold out entirely, but because his fund’s entire US equity book shrank from $212 million to just $74 million in the same period. This is not a trim, it’s a decisive retreat from one of the world’s most dominant AI companies at the height of its power.

And he isn’t alone. SoftBank, another major tech investor, also revealed last week that it had dumped its entire Nvidia position as it doubled down on OpenAI and other AI bets. Two major tech players stepping back from the same stock in the same quarter has sharpened debate over whether the AI boom has reached an overextended phase.

A sharp portfolio pivot toward safety, and away from AI hardware risk

Thiel Macro now holds only three positions:

Microsoft, Apple, and Tesla, with Tesla heavily reduced compared to prior quarters. Nvidia and Vistra Energy — previously the two biggest holdings, were removed entirely.

The shift tilts the portfolio toward large, diversified tech platforms rather than a single explosive AI hardware leader. Microsoft and Apple offer broad exposure to AI adoption without the extreme revenue swing that can accompany the GPU cycle.

The rebalance also fits Peter Thiel’s long-standing warning: that the AI hype cycle is running ahead of real monetization, echoing concerns voiced recently by Jeff Bezos, David Solomon, and “Big Short” investor Michael Burry.

Still, Nvidia’s fundamentals have remained exceptional. Quarterly revenue has surged from $39 billion to $46.7 billion, datacenter sales climbed more than 56%, and analysts see a potential path to $1 trillion annual revenue by 2030. That makes the full exit even more notable, this wasn’t a case of weak fundamentals prompting the sell.

Why sell now? Three likely reasons

The timing suggests a combination of motives:

1. Classic profit-taking after a historic run

Nvidia has gained more than 1,000% since early 2023. For a hedge fund managing risk into year-end, locking in those gains and shrinking exposure ahead of volatile macro data is textbook discipline.

2. Concern that AI valuations are getting stretched

AI spending is still growing, but at these valuations, even strong results may not produce strong stock returns. Thiel may see signs of the market pricing in too much, too quickly — similar to the dot-com period he often references.

3. A shift toward platform stability over hardware cyclicality

Microsoft and Apple provide AI exposure through cloud, software, and devices — businesses with smoother revenue. Nvidia, by contrast, remains tied to hyperscaler capex cycles and supply bottlenecks such as power constraints.

None of these motives imply that Nvidia is “done.” Instead, they suggest that Thiel wants to step back from the hottest part of the AI trade and position the fund for a more balanced risk environment.

Will the market care? In the short term — yes

Big exits by “smart money” almost always trigger a short-lived wobble in sentiment. Nvidia, AI server makers, and semiconductor suppliers can all feel pressure when 13Fs hit the headlines.

But historically, these effects fade quickly. What truly matters for Nvidia’s trajectory is:

- hyperscaler AI budgets (Microsoft, Amazon, Google)

- power availability at datacenter scale

- demand for next-gen Blackwell and Blackwell Ultra systems

- networking and HBM supply

- cluster build-out timelines for 2026

If those remain strong, Nvidia’s long-term thesis won’t be decided by a single fund stepping out.

What investors should watch now?

The key catalysts ahead:

- Nvidia guidance on Blackwell shipments, networking growth, and power constraints

- Cloud capex commentary from Amazon, Google, and Microsoft

- AI server supply chain checks, especially HBM memory and thermal systems

- Fund positioning trends — whether other hedge funds follow Thiel and SoftBank’s lead

If more institutional investors trim AI exposure, it may confirm a broader positioning shift. If not, Thiel’s move may simply reflect firm-specific risk management.

A headline, not a verdict

Peter Thiel’s exit adds drama to a market already debating whether the AI trade has run too far, too fast. SoftBank’s full Nvidia sale only amplifies that conversation.

But none of this changes the structural drivers: hyperscaler AI budgets, ongoing platform ramps, power-driven infrastructure expansion, and Nvidia’s unmatched ecosystem advantage.

If those fundamentals remain strong, Nvidia’s long-term story is still intact. Thiel Macro’s exit is an important data point — but not the final word on the AI cycle.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The United States, Switzerland, and Liechtenstein Reach a Historic Trade Deal

Warren Buffett Reveals New $4.3B Alphabet Stake, And Sells More Apple Ahead of Buffett’s Exit