Palantir Technologies (NYSE: PLTR) is set to release its fourth-quarter earnings report on Monday, February 3, 2025, with analysts and investors eagerly awaiting the results. After a remarkable 2024, where Palantir stock surged nearly 340%, the big question remains: can it sustain this momentum?

Predictions from various experts paint a mixed picture—some are bullish, expecting further stock growth, while others caution about valuation risks. Below is a breakdown of key expert insights leading up to the earnings call.

Key Predictions on Palantir’s Q4 Performance

1. Expected Strong Revenue and EPS Growth

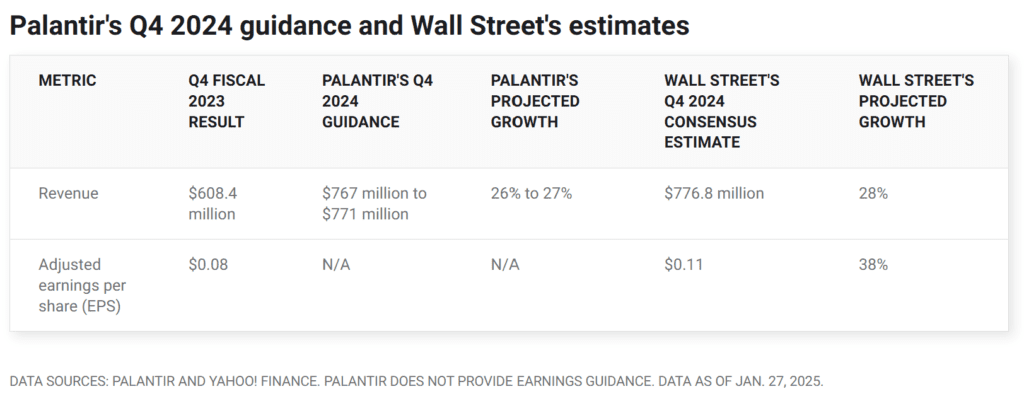

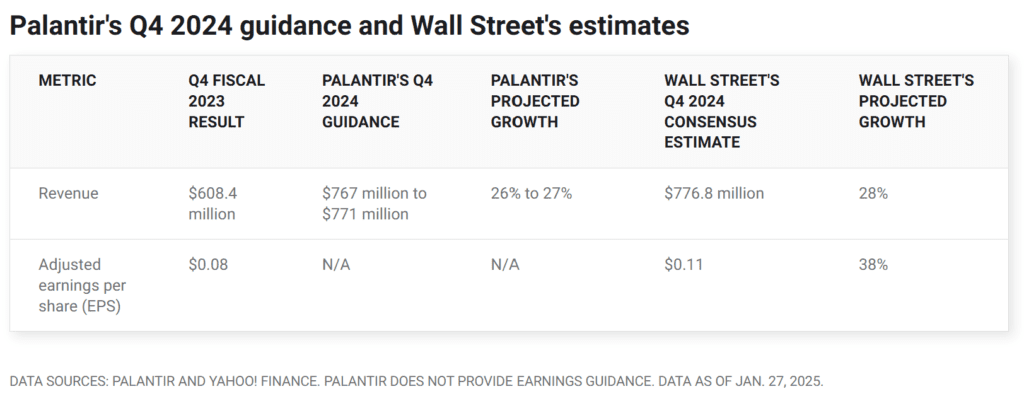

- Analysts across the board expect solid revenue growth, with consensus estimates at around $775–$781 million, reflecting a 27-28% year-over-year increase.

- Adjusted earnings per share (EPS) are projected at $0.11, a 38-39% increase compared to last year.

- Palantir’s AI-powered products, especially its Artificial Intelligence Platform (AIP), continue to drive commercial adoption, contributing to stronger revenue diversification beyond government contracts.

Sources: Investors.com, The Motley Fool, 24/7 Wall St.

2. Bullish Case: More Growth Potential Ahead?

Many analysts believe Palantir’s commercial expansion is just beginning, positioning it for long-term success.

- U.S. Commercial Revenue Growth: Palantir expanded its U.S. commercial customer base from just 14 in 2020 to over 300 today, showing significant adoption in the private sector.

- Strong AI Market Tailwinds: The company remains a leader in AI-driven data analytics, benefiting from the broader AI boom.

- Institutional Demand & S&P 500 Inclusion: Palantir’s recent inclusion in the S&P 500 has made it more attractive to institutional investors.

“Palantir is moving beyond its government contracts into the private sector at an impressive rate. The stock could see another rally if earnings exceed expectations.” – Reporteros del Sur

Sources: Investopedia, Investors.com, 24/7 Wall St.

3. Bearish Case: Overvaluation Concerns & Stock-Based Compensation Risks

Despite optimism, some analysts warn that Palantir’s stock is overvalued, which could limit near-term gains.

- Stock Valuation Risk: Palantir currently trades at a high price-to-sales (P/S) ratio, leading some experts to believe it’s priced for perfection. The consensus price target stands at $50, suggesting a potential downside from its current trading price.

- Stock-Based Compensation (SBC): Palantir’s heavy reliance on stock-based compensation (which dilutes shareholder value) remains a sticking point.

- Jefferies & Bearish Analysts: While some firms like Wedbush have raised their price target to $90, others, including Jefferies, maintain a conservative target of $28, citing potential downside risks.

“If there’s even a slight sign of slowing growth or weaker-than-expected earnings, we could see a pullback.” – Investopedia

Sources: The Motley Fool, Investors.com, 24/7 Wall St.

Conclusion:

Conclusion: Can Palantir Deliver?

With high expectations surrounding revenue and earnings growth, Palantir has strong momentum heading into its Q4 earnings report. However, the biggest risks lie in its valuation and SBC expenses.

If earnings exceed expectations, the stock could rally further, possibly testing new highs.

If results fall short or guidance disappoints, a sell-off may follow as overvaluation concerns take center stage.

What’s the most likely outcome?

- Most experts agree that Palantir’s long-term growth story remains intact due to its AI dominance.

- However, the stock may experience volatility depending on investor reaction to guidance for 2025.

Final Analyst Consensus: Cautiously optimistic, with the potential for significant stock movement based on earnings results.

Related: $PLTR – Karp: “We have three products that changed the world & We’re just getting started”

Has a new era begun? Investors have never been so optimistic…

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet – FORECAST

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.