Palantir Technologies (PLTR) will report its Q3 2025 earnings after the market closes on Monday, November 3. With the stock up over 150% year to date, investor expectations are sky-high, centred around the explosive growth of its Artificial Intelligence Platform (AIP), expanded government contracts, and accelerating commercial adoption.

While the company has repeatedly beaten top-line expectations in recent quarters, the valuation bar is steep. Analysts and investors are laser-focused on whether Palantir can sustain ~50% revenue growth, protect its best-in-class margins, and show tangible momentum in AI adoption across industries.

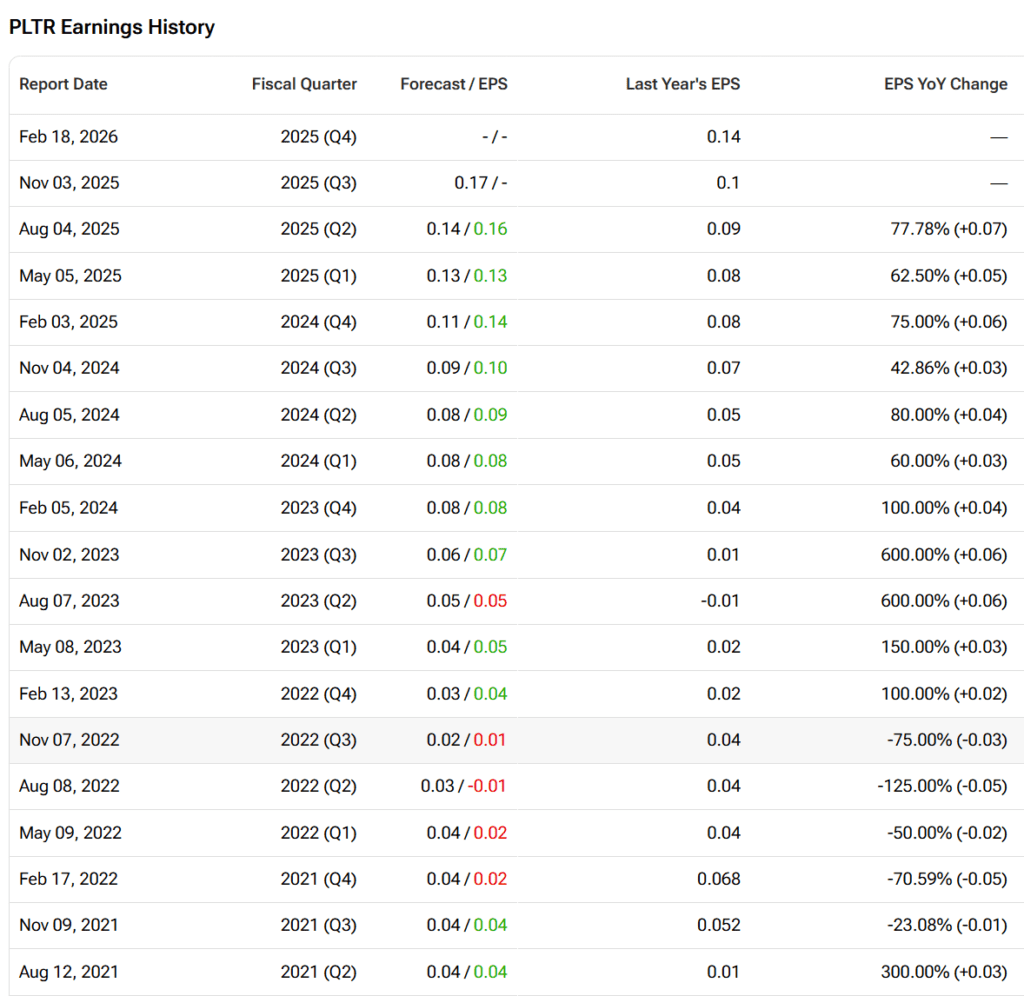

Q3 2025 Street Forecast: Revenue Hits $1.09B, EPS Jumps to $0.17

| Metric | Q3 2024 (Actual) | Q3 2025E (Consensus) | YoY Growth |

|---|---|---|---|

| Revenue | $726M | ~$1.08B-1.09B | +50% |

| Adjusted EPS (diluted) | $0.06 | $0.17 | +183% |

| Operating Margin (Adj.) | 36% | ~43–45% | +7–9 pts |

Palantir previously guided for Q3 revenue between $1.076B and $1.102B and expects strong performance in both commercial and government segments. The company is also targeting another quarter of profitability under GAAP, marking its fifth consecutive quarter in the black.

Prediction: Palantir likely beats on revenue and EPS, but stock reaction depends on commercial deal metrics and forward guidance.

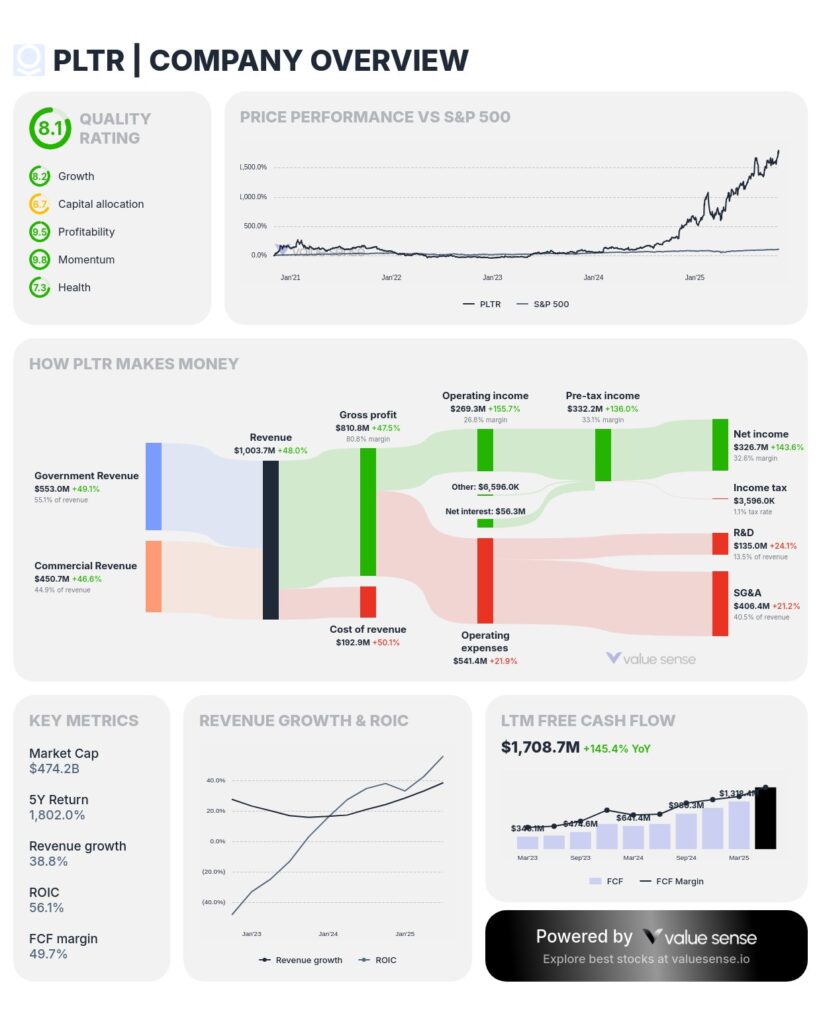

What Are Palantir’s Products, and How Does the Company Make Money?

Palantir provides enterprise software platforms focused on data integration, decision-making, and, increasingly, artificial intelligence. Its two flagship products are:

- Foundry – a data integration and operational intelligence platform used by commercial clients to centralize, manage, and act on massive volumes of structured and unstructured data.

- Gotham – originally developed for the U.S. intelligence community, Gotham is used by government agencies for defense, intelligence, and public safety operations.

In 2023, Palantir launched AIP (Artificial Intelligence Platform), which allows clients to build and run large language model (LLM)-driven applications using their own secure data. AIP is now central to the company’s commercial growth strategy.

How Palantir makes money:

Palantir earns revenue through long-term software subscriptions, platform licensing, and custom implementations. The company reports results across two main segments:

- Government – primarily U.S. federal and allied nation contracts (DoD, intelligence, public health).

- Commercial – enterprise clients across sectors like finance, manufacturing, healthcare, and logistics.

Most revenue is recurring or subscription-based, with high dollar retention and long sales cycles. Palantir’s model blends product revenue with services and deployment support, typically via multi-year contracts.

Commercial Segment: AIP Momentum Across Industries

Palantir’s commercial business continues to outpace government growth, powered by rising adoption of AIP, the company’s enterprise-ready AI platform. In Q2 2025, US commercial revenue surged 93% YoY, and customer count grew 43% YoY globally.

Analysts expect that trend to continue in Q3, with forecasted commercial revenue reaching ~$494M — up over 55% YoY. Key drivers include:

- Expanded use of AIP in manufacturing, finance, healthcare, and supply chain analytics.

- Growing number of multi-million dollar enterprise contracts and expansions from existing clients.

- New strategic partnerships, such as the $200M Lumen Technologies alliance for embedding AIP in enterprise networks.

Prediction: Commercial revenue grows ~55–60% YoY with strong contribution from AIP-based deployments and continued customer expansion.

Government Segment: Steady Defense Pipeline, New Contracts

Government remains Palantir’s foundational segment, expected to generate ~$602M in Q3 — up 47–48% YoY. Key narratives include:

- Continued execution on U.S. defense contracts, including the $10B multi-year U.S. Army framework award.

- Growth from intelligence, homeland security, and public health agencies.

- International contracts expanding across NATO, the EU, and Middle East partners.

While federal budget timing and political volatility remain watchpoints, Palantir’s long-term, multi-year contracts offer stability. Analysts expect high renewal rates and continued revenue visibility through FY2026.

Prediction: Government revenue remains strong and predictable, growing ~48% YoY, with commentary focused on pipeline conversion and new award timing.

AIP and AI Strategy: Platform as a Differentiator

AIP has become the central pillar of Palantir’s growth story. The platform allows customers to quickly deploy secure, domain-specific large language model (LLM) applications on top of enterprise data — all integrated with Palantir’s Foundry ecosystem.

Analysts consider Palantir’s AI edge to stem from:

- Tight integration of governance, security, and decision-making within AI workflows.

- Broad LLM support (OpenAI, Mistral, LLaMA, Anthropic) within a single architecture.

- Turnkey deployment and operational tooling across sectors.

While rivals like Microsoft (Copilot, Azure AI), Snowflake, and Databricks offer modular platforms, Palantir aims to own the operational layer of AI deployment.

Prediction: AIP commentary remains bullish, with metrics pointing to broader enterprise adoption and deepening wallet share. Investors may want to see more breakout metrics around AIP-specific revenue or customer cohort growth.

Margins and Free Cash Flow: Scalable Profit Engine

Palantir continues to pair top-line growth with exceptional profitability:

- Adjusted operating margin expected to hit ~43–45% in Q3.

- Adjusted free cash flow is on track to exceed $2B for the full year.

- Stock-based compensation remains high (~$500M/year), but GAAP net income has turned consistently positive.

While recent hiring increases may temporarily pressure operating leverage, the company’s “Rule of 40” score (revenue growth + margin) remains among the highest in software.

Prediction: Margins hold steady or improve, reinforcing the scalability of Palantir’s model. FCF remains robust.

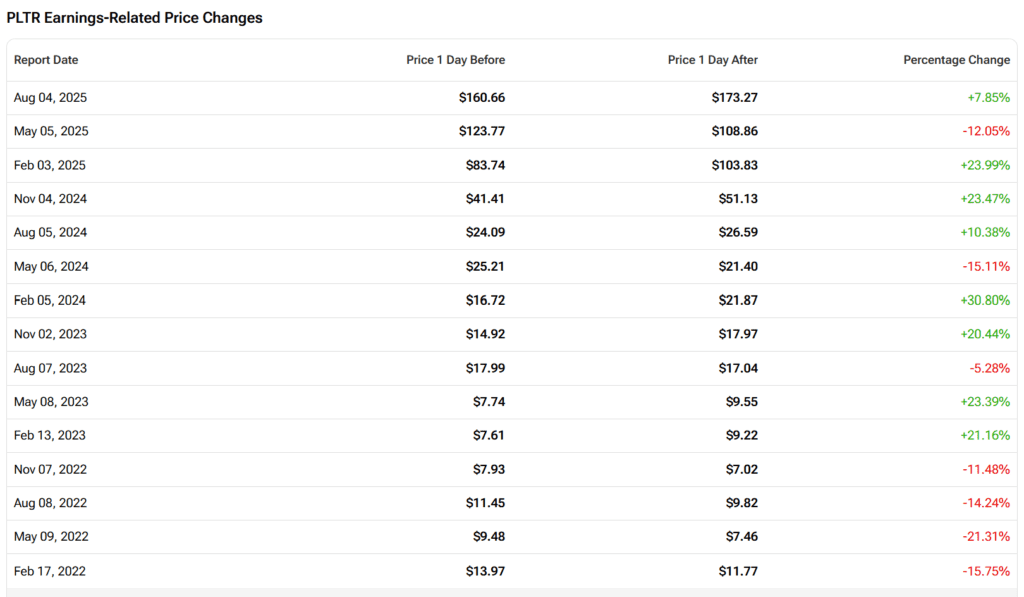

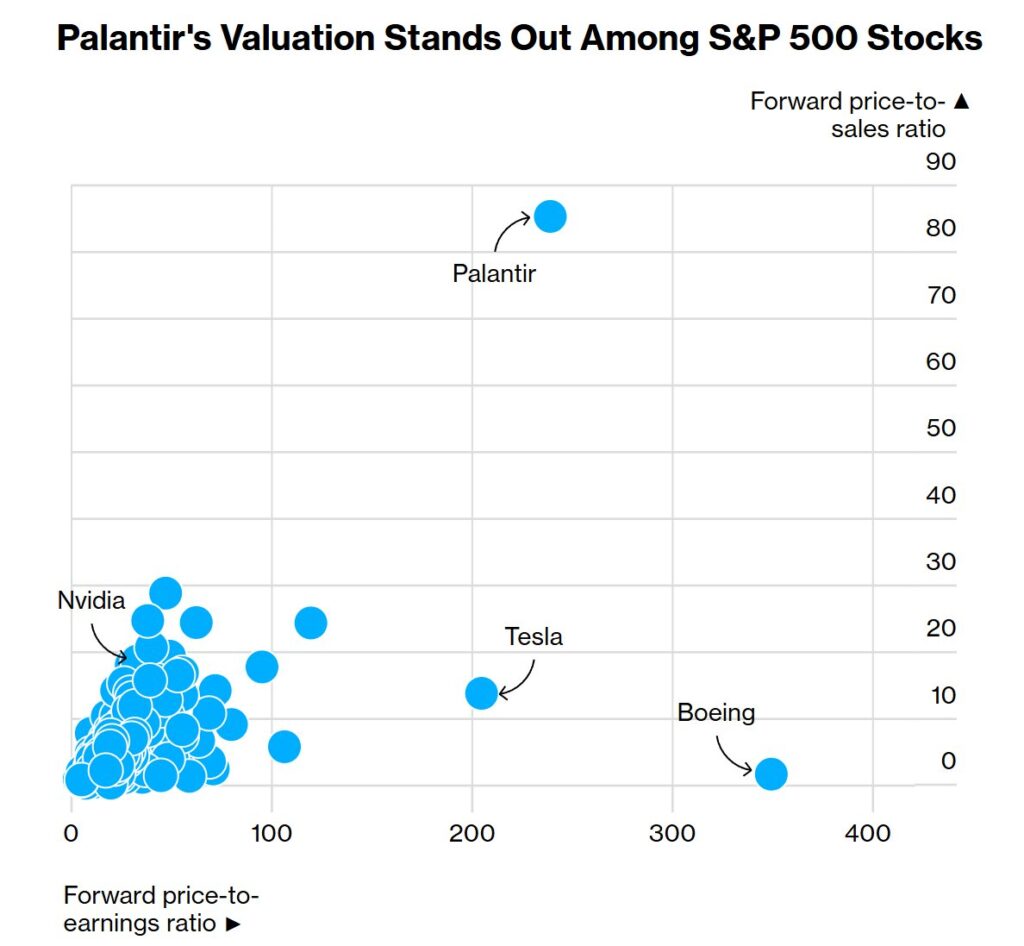

Analyst Sentiment: High Hopes, Cautious Valuation

Palantir stock has surged over 150% YTD, but the valuation remains a sticking point. It trades at a forward P/E north of 200× and P/S over 30× — higher than virtually all software peers.

Wall Street sentiment is split:

- Bulls see Palantir as a foundational AI infrastructure play with irreplaceable national security ties.

- Bears flag extreme valuation, reliance on adjusted metrics, and aggressive SBC (stock-based comp).

Recent analyst targets range from $140 to $210 (current price: ~$195), with about 25% of analysts rating it a “Buy.”

Prediction: Sentiment leans cautiously optimistic. A beat-and-raise quarter is priced in — any guidance miss could spark a pullback.

Will Palantir Prove Its AI Flywheel Is Spinning?

Palantir has emerged as one of the most visible enterprise AI winners of 2025. Its AIP platform has driven rapid commercial growth while its government base remains solid.

But the stock’s soaring valuation means execution must remain flawless. Investors will look for:

- High commercial growth (>55% YoY)

- Strong AIP adoption metrics

- Stable margins and FCF

- Confident guidance into Q4 and FY2026

Final Call: Palantir likely delivers a clean top and bottom-line beat. Stock reaction will hinge on guidance tone and AIP scaling evidence. A confident Q4 outlook could send shares higher, but any softness or deceleration might lead to a swift valuation reset.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.