Nvidia was not just another big tech story in 2025. It was the story. From AI panic and China bans to trillion dollar milestones and viral CEO moments, the company sat at the center of markets, geopolitics, and the global AI race all year long.

Here is how Nvidia’s historic year unfolded, and why each phase mattered.

More about: Nvidia Earnings Takeaways: Time to Buy $NVDA?

A year that began with confidence and chaos

Nvidia opened 2025 with bold announcements at CES, pushing deeper into AI chips, robotics, and physical AI. Optimism did not last long.

In January, China’s DeepSeek shocked markets, claiming it trained a powerful AI model using weaker chips. The reaction was brutal. Nvidia lost nearly $600 billion in market value in one day, igniting fears that demand for high end GPUs could collapse.

Those fears faded by mid year. Investors accepted Nvidia’s core argument: running advanced AI still requires massive computing power, regardless of training shortcuts.

Blackwell, GTC, and the AI arms race

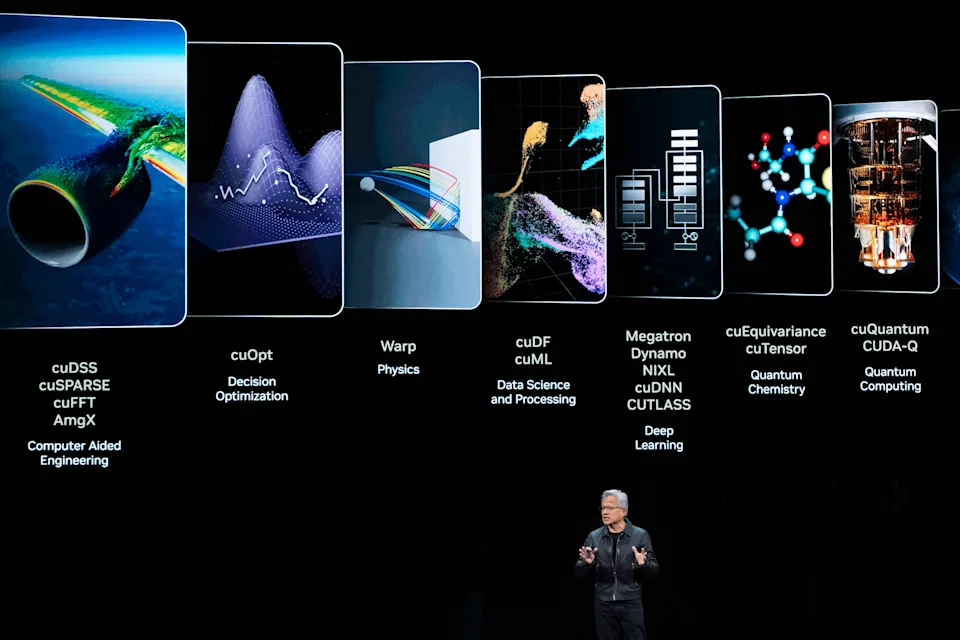

March became a defining moment. At its oversized GTC conference, Nvidia unveiled Blackwell Ultra and the GB300 superchip, signaling a shift toward AI reasoning at scale.

The event itself was symbolic. An AI chip company filling a hockey arena showed just how central Nvidia had become to the tech world.

Trade wars hit hard, then eased

April brought political pressure. Trump’s “Liberation Day” tariffs sent markets lower, dragging Nvidia shares with them. Days later, new US restrictions effectively banned Nvidia’s H20 chip from China, forcing billions in write downs.

By July, the stance softened. Nvidia regained permission to sell H20 chips, later agreeing to a 15% revenue cut on China sales. Wall Street barely flinched. Partial access was better than zero.

In December, Trump approved sales of H200 chips to China, reinforcing Nvidia’s role as a strategic bargaining chip in US China trade talks.

Trillions in market value and global expansion

Despite political risks, Nvidia kept climbing. It crossed $4 trillion in market value in July and briefly touched $5 trillion in October, an unprecedented milestone.

The company also announced plans tied to a potential $100 billion OpenAI investment, raising questions about circular AI spending and bubble dynamics.

At the same time, Nvidia pushed its “sovereign AI” strategy, securing approval to ship tens of thousands of advanced chips to Saudi Arabia and the UAE, expanding its global footprint.

Jensen Huang became a global icon

CEO Jensen Huang turned into one of the most visible figures in global business. He met with Trump, negotiated with world leaders, and even went viral after a casual fried chicken dinner with Samsung and Hyundai executives in South Korea.

In 2025, Nvidia’s brand and its CEO became inseparable from the AI boom itself.

By year end, Nvidia had survived AI panic, trade bans, tariff shocks, and bubble fears, while delivering $187.1 billion in revenue and reshaping the global tech landscape.

Few companies have ever combined market power, geopolitical relevance, and cultural influence on this scale in a single year. Whether 2026 brings consolidation or correction, Nvidia enters it as the defining force of the AI era.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Trump Says Fed Chair Should Cut Rates When Markets Are Strong

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Big Year for Old School Wall Street Trades Gets Lost in AI Hype

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch