Nvidia Corp. ($NVDA) has officially made history, becoming the first publicly traded company to reach a $5 trillion market capitalization, just four months after crossing the $4 trillion mark. The meteoric rise came not from earnings, but from an avalanche of AI-centered deals, government contracts, and major partnerships unveiled in the span of just 48 hours.

The AI chipmaker’s stock surged over 3% at the open Wednesday, pushing its valuation to $5.06 trillion, solidifying its place ahead of Microsoft ($4T) and Apple ($3.9T) as the most valuable company on Earth.

“AI is transforming every industry — and we are powering that future,” said CEO Jensen Huang during his keynote at Nvidia’s GPU Technology Conference (GTC) in Washington, D.C.

Key Takeaways from Nvidia’s Blockbuster GTC Keynote

Nvidia CEO Jensen Huang delivered a powerhouse keynote in Washington, D.C. on Tuesday, revealing that the company has secured over $500 billion in bookings for its next-generation Blackwell and Rubin GPUs over the next five quarters, and announcing a wave of major deals with the U.S. government and leading corporations

The speech, delivered at Nvidia’s annual GPU Technology Conference (GTC) — held in the U.S. capital for the first time — highlighted the company’s rapidly growing influence across defense, healthcare, telecom, and autonomous vehicles, even as it continues navigating export restrictions in China.

“This is just the beginning,” Huang said. “AI is transforming every industry — and we are powering that future.”

Seven Supercomputers for the US Government

Nvidia will build seven new AI supercomputers in partnership with the U.S. Department of Energy (DOE). The largest of them — built alongside Oracle — will feature 100,000 Nvidia Blackwell GPUs and will be used to support:

- Nuclear weapons maintenance

- Nuclear fusion energy research

- Advanced scientific simulations

The deal underscores the U.S. government’s push to expand AI infrastructure, with Nvidia emerging as a central supplier.

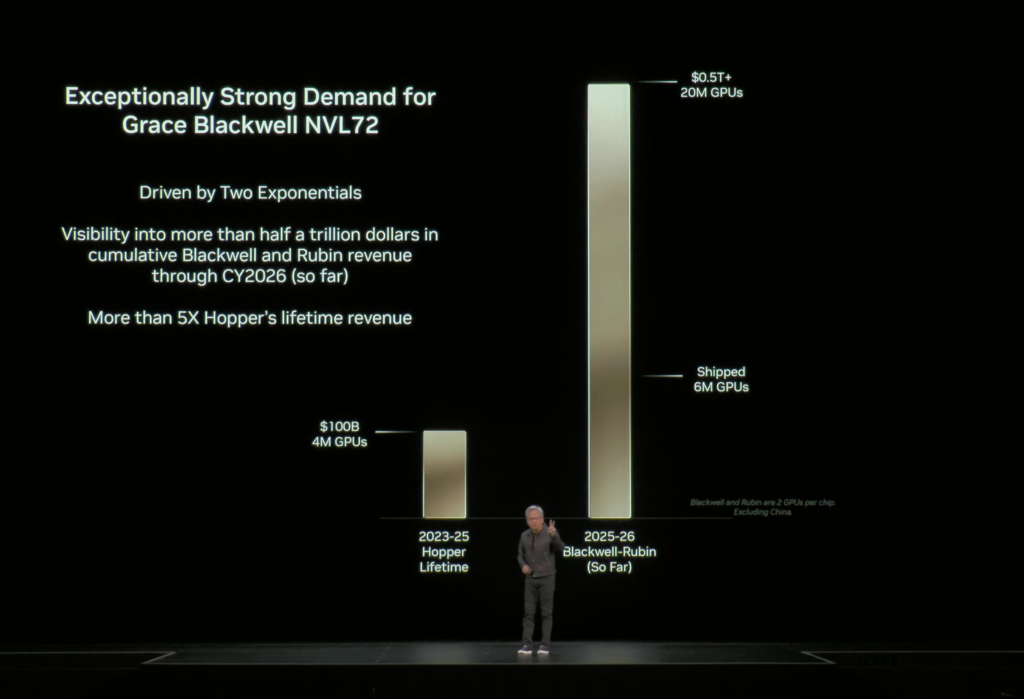

$500B in Revenue Visibility

Huang confirmed Nvidia now has visibility into $500 billion in revenue tied to its Blackwell and Rubin GPU lines, vastly outpacing the $100 billion total generated from its prior Hopper generation.

“These orders span data centers, enterprises, government contracts, and cloud platforms,” Huang said. “And that doesn’t even include China.”

He clarified that the $500 billion figure covers five quarters, through late 2026.

China Still a Wildcard

Although the company has designed lower-power H20 chips for China, Huang reiterated that Nvidia currently assumes zero revenue from China in its forecasts due to ongoing policy uncertainty.

“A return to China would be a huge bonus,” Huang said. “We need that $50 billion market to reinvest in U.S.-based innovation.” (Jensen Huang Says Nvidia Went From 95% Market Share to 0% in China)

Despite recent approvals to sell limited AI chips to China, demand has lagged, and legal structures for proposed revenue-sharing deals remain unsettled. (More: Nvidia CEO Jensen Huang says US-China Trade Deal Nears)

Trump, currently in Asia ahead of a Thursday summit with Xi Jinping, has left the door open to Blackwell chip discussions in U.S.-China trade talks.

Strategic Partnerships Announced

In just 48 hours, Nvidia confirmed new multi-billion-dollar collaborations across sectors:

| Partner | Project | Highlights |

|---|---|---|

| Nokia ($NOK) | 6G Networks | $1B investment; co-developing Nvidia ARC hardware for AI-native base stations |

| Palantir ($PLTR) | Enterprise AI | Joint AI stack for complex logistics (e.g. Lowe’s global supply chain digital twin) |

| Eli Lilly ($LLY) | AI Drug Discovery | Supercomputer powered by 1,000+ B300 GPUs; 100% renewable-powered |

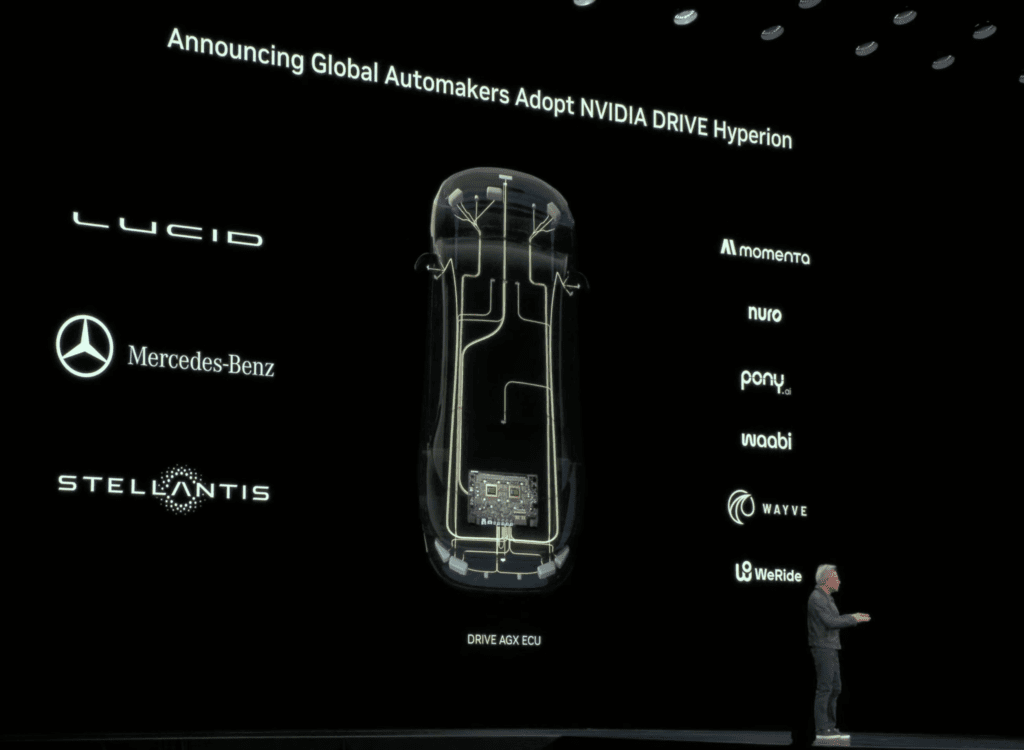

| Uber ($UBER) | Robotaxi Platform | 100,000 vehicle target; uses new DRIVE AGX Hyperion 10 w/ dual Thor chips |

| Lucid ($LCID) | Self-Driving EVs | Level 2+ now, Level 4 autonomy by 2027 using Thor-based compute |

| CrowdStrike ($CRWD) | Cybersecurity | Integrating AI defense tools into enterprise and government systems |

| US DOE (Quantum) | Quantum Computing | New NVQLink connects Nvidia GPUs with quantum processors |

The Scale of Nvidia’s Rise

Nvidia’s market cap now exceeds Germany’s 2024 GDP ($4.6T)

The stock is up 50% in 2025, and more than 44,000% over the last decade

A $1,000 investment in 2015 would now be worth $441,000

Jensen Huang’s net worth has ballooned to $174.4B, making him the 8th richest person in the world

Why This Matters

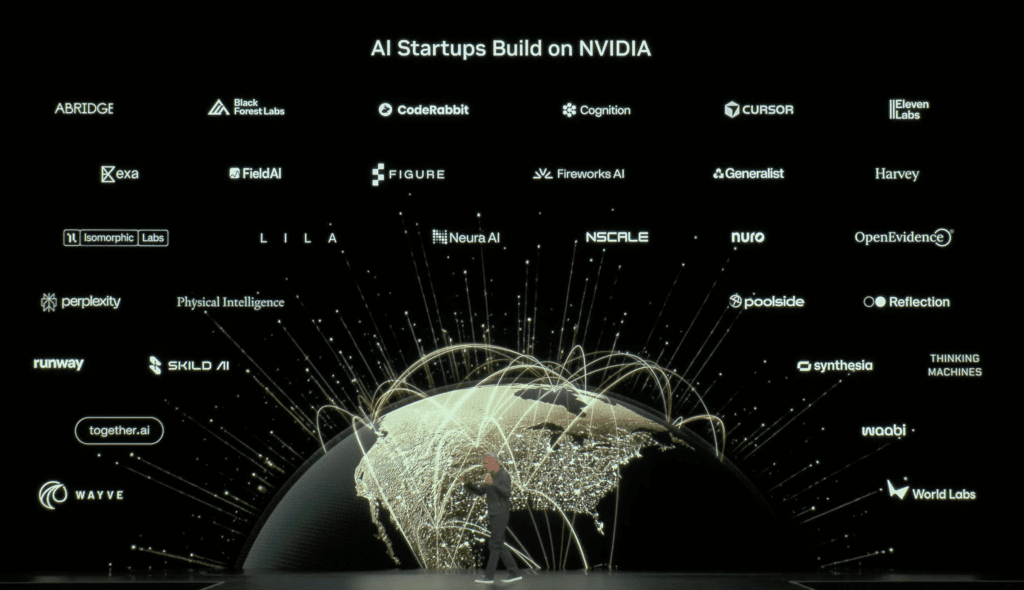

Nvidia is no longer just a chipmaker. It is building infrastructure for global AI dominance — across data centers, national defense, healthcare, telecom, quantum computing, and even robotics.

“Humanoid robots will be the largest electronics market in the future,” Huang predicted, closing his keynote.

The company now leads not only in chips, but also in software frameworks, AI model development, and even energy-efficient infrastructure, while securing government contracts that stretch deep into the next decade.

Nvidia has transformed from a niche GPU vendor into the strategic linchpin of the AI economy. Its $5 trillion valuation isn’t just a financial headline, it’s a signal of where power, policy, and innovation now intersect.

And with Trump–Xi trade talks, supercomputers in progress, and more deals expected in South Korea, this could be just the beginning of Nvidia’s next trillion.

In addition to the article: $NVDA CEO: “I don’t believe we’re in an AI bubble, we are going through a natural transition from old computing model to accelerated computing model… All of these different AI models we’re using, we’re using plenty of services & paying happily to do it”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.