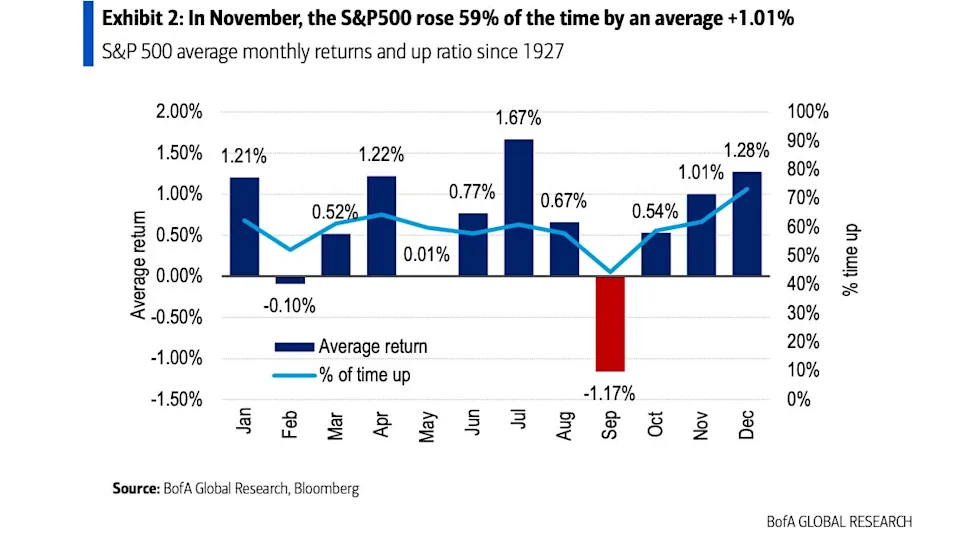

November has long been one of the strongest months for US stocks, and this year, the setup appears favourable. According to BofA, the S&P 500 has delivered gains in 59% of Novembers since 1927, with an average return of around +1%.

Here are the sector bets BofA recommends to capitalise on the seasonal tailwind:

- Consumer discretionary stocks. The discretionary sector has historically led stock returns during the month of November, BofA said. The sector has been up 80% of the time since 1927, with an average gain of 3.14%.

- Tech stocks. The Nasdaq 100 has been up 69% of the time in November, with an average gain of 2.47%.Tech stocks within the S&P 500, meanwhile, were up 71% of the time in November with an average gain of 3.1%.

- Healthcare stocks. Since 1927, the healthcare sector has been up 83%, with an average gain of 2.52%.

- Industrial stocks. The industrial sector was up 80% of the time in November with an average gain of 3.02%.

- Small-cap stocks. The Russell 2000 has been up 70% of the time in November since 1927. The average gain for the index has been 2.64% for the month, analysts said.

Why Now Looks Good

This is the first year of a new presidential cycle, a time when November performance tends to be stronger.

The S&P is on track to close October strongly — historically, when October is up in a presidential year, November has been positive ~92% of the time.

Yes, history backs November as a strong month for stocks, but no seasonal pattern is bulletproof. As one strategist reminded: “economic conditions, earnings, geopolitics … are much bigger drivers of price action.”

Still, if you’re looking at the next 4-6 weeks, tech, consumer discretionary, healthcare, and small-caps are where BofA sees the best probability-adjusted upside.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.