It was Tuesday, night before a likely Fed rate cut, and the markets had gone quiet, even record Nasdaq highs stopped stirring. By Wednesday, all eyes turned to the most dramatic FOMC meeting in a year, with traders bracing for the start of a cutting cycle, even as prices remain uncomfortably high.

What we know, what’s priced in

All eyes are on the oft-criticised FOMC decision at 2pm ET today. The U.S. Federal Reserve is widely expected to deliver its first interest-rate cut of 2025 today.

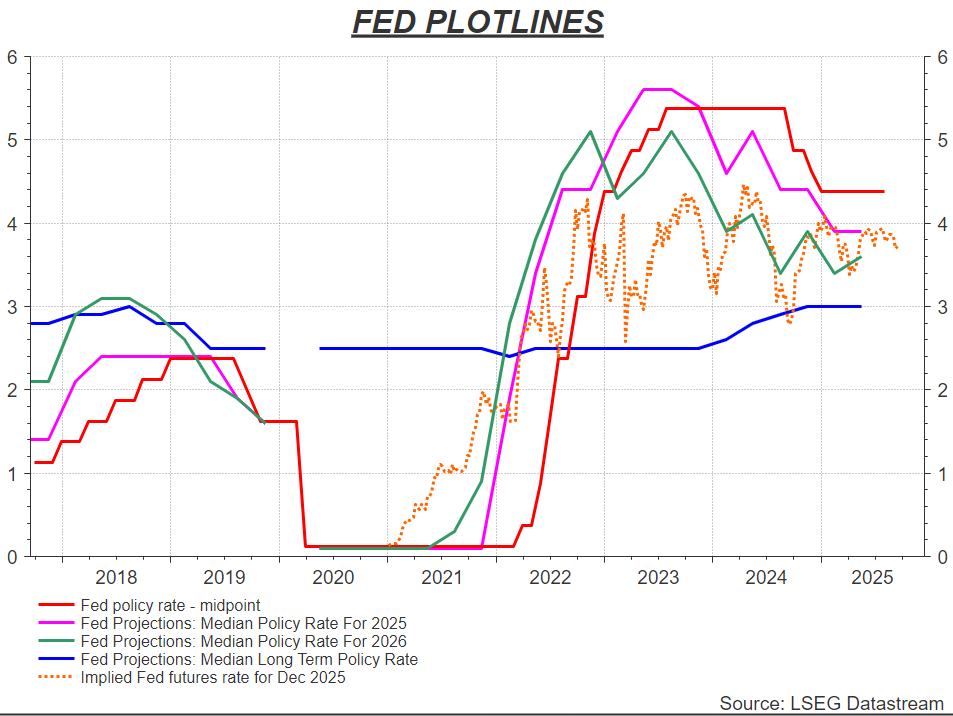

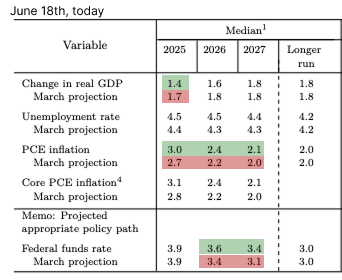

Alongside the rate move, the Fed will unveil its dot plot, the chart showing where policymakers see rates and inflation heading through the final two meetings of 2025, and into 2026 and 2027.

The last dot plot (June) had to factor in tariffs driving prices higher. This time, traders want clarity: are cuts just beginning, or will Powell push back against Wall Street’s hopes?

Mortgage rates: have dropped to a 3-year low. Compared to March, June projections already showed members bracing for higher price climbs and higher-for-longer rates. Today’s update will be dissected line by line.

According to CME FedWatch, there’s now a 96% chance of a 25-basis-point cut, the first easing move of 2025. That would take the Fed Funds range down to 4.00–4.25%.

The Fed’s Struggle

The Fed’s biggest test? Looking through tariff-driven price spikes and deciding if underlying inflation is actually cooling.

And in a twist, Treasury Secretary Scott Bessent said for the first time that Trump could accept rate hikes if inflation spikes. That’s a sharp contrast to months of political pressure.

But inflation isn’t the only mandate. The Fed’s dual role includes the job market, and it’s flashing red.

- The BLS revised job creation lower by nearly 1 million over the past year.

- Unemployment is edging higher.

- Weak job growth is now the main case for cuts, outside of Trump’s pressure campaign.

The Bright Spot: Consumers

Not all is bleak. Retail purchases rose last month, according to government data. Americans still feel in a good spending mood.

Analyst Bret Kenwell at eToro told Bloomberg: “Would the recent job weakness impact consumer spending? The short answer appears to be no.”

Independence at Risk?

Here’s where it gets political.

A CNBC survey found 82% of fund managers and economists believe Trump’s Fed pressure is an attack on independence. Nearly a third warned that losing independence risks higher inflation and slower growth.

The fear: politicians chasing short-term wins by printing money and cutting rates, while ignoring long-term damage.

Who’s Voting Today: Stephen Miran was confirmed to the Fed Board in a 48–47 cliffhanger. He rattled bonds by suggesting the Fed has a “third mandate”: to regulate long-term interest rates. Lisa Cook is still in. A judge blocked Trump’s attempt to fire her, so she’ll vote today.

Bitcoin, Gold & Commodities

Bitcoin has rallied ~4% recently, tracing rate-cut hope and broader dovish sentiment, above 117K.

Gold is pushing record-territory (or near it) as investors seek hedges with rate cuts expected and a weaker dollar.

Oil and some commodities are steady, with oil prices getting a mild boost from geopolitical jitters and supply concerns.

U.S. & Global Markets

The U.S. dollar has weakened significantly, hitting a four-year low versus the euro.

Wall Street is treading water: S&P 500, Nasdaq are slightly down or flat, as investors await the Fed’s statement.

European markets are seeing mild declines, especially in rate-sensitive sectors like banks and insurance.

What to Watch Today

The Fed’s dot plot, which shows where voting officials expect interest rates to go over time, will be key. Will they suggest more cuts this year

Comments from Fed Chair Jerome Powell, especially around inflation, labor market strength or weakness, and how “sticky” inflation is.

Market reaction: whether stocks, gold, and crypto rally after the decision — or whether there’s a “sell the news” moment.

Short-term bond yields and the shape of the yield curve (2-yr vs 10-yr) will give clues on how much easing is priced in

Economic Data & Events (ETS\BTS)

08:30 AM | 1:30 PM — US Housing Starts

10:30 AM | 3:30 PM — US Crude Oil Inventories

11:30 AM | 4:30 PM — Atlanta Fed GDPNow

02:00 PM | 7:00 PM — Fed Interest Rate Decision

02:30 PM | 7:30 PM — Fed Chair Powell Press Conference

– British consumer price index (CPI) for August

– Euro zone consumer price data for August, final

– Germany’s reopening of 23-year and 31-year government debt auctions

– Meta opens its annual Connect conference at its Menlo Park, California-based headquarters

– StubHub, WaterBridge Infrastructure go public in New York

Earnings

Pre-Market (US / UK): 07:00 AM | 12:00 PM — Manchester United ($MANU), Before Open (time not exact) — General Mills ($GIS)

After-Market (US / UK): 04:00 PM | 9:00 PM — Nano Dimension ($NNDM), 04:00 PM | 9:00 PM — Cracker Barrel ($CBRL)

Regarding analysis, the latest data and sentiment, the Fed is almost certain to cut rates today, the first move of 2025, but the real test is whether Powell signals the start of an easing cycle or a cautious one-off. Markets are tense but calm, with stocks flat, gold near records, and Bitcoin climbing. For investors, the dot plot and Powell’s words will matter more than the cut itself: they’ll set the tone for the rest of the year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

UK set to announce closer co-operation with US on cryptocurrencies

Trump’s UK Visit Sparks Tech Momentum: Which Sectors in Spotlight

Trump UK State Visit: What’s on the agenda, schedule, what to expect