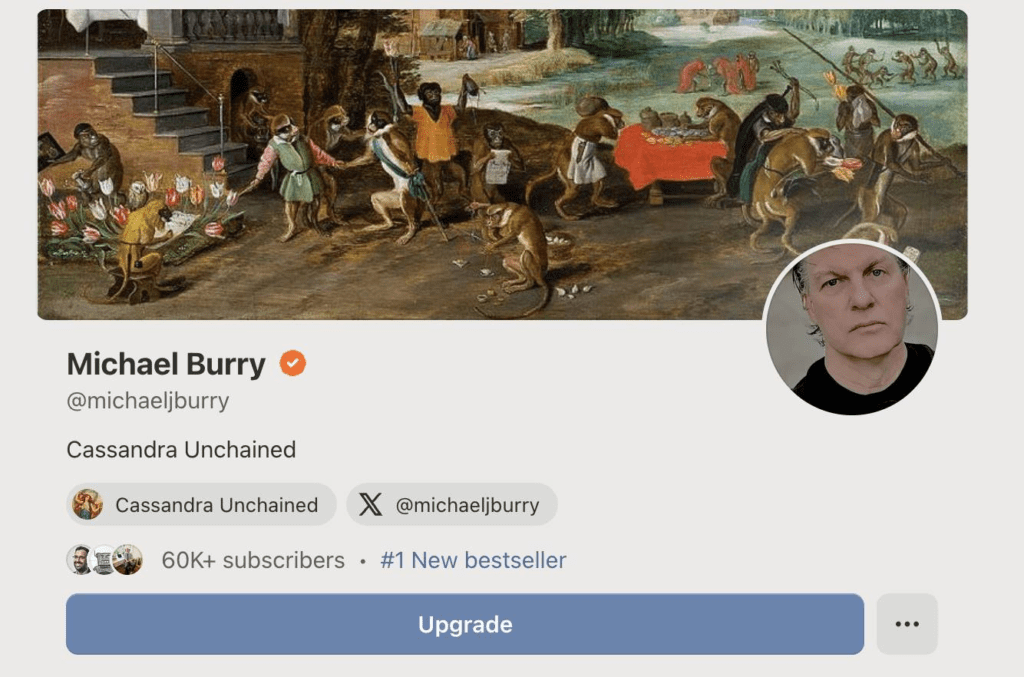

Michael Burry, the investor who famously called the 2008 housing crash, has shut down his hedge fund Scion Asset Management and relaunched himself as a full-time writer with a paid Substack called Cassandra Unchained.

The newsletter costs 39 dollars per month or 379 dollars per year and already has tens of thousands of subscribers, according to Substack and early media reports. Burry says he is “not retired” and that the blog now has his full attention, freeing him from the regulatory limits that restricted what he could say while running outside money.

In his first posts he revisits his late-1990s tech calls and warns about what he sees as a new AI bubble, criticizing the boom in cloud and data-center spending and the accounting used by some big tech firms.

From short seller to content business

For years Burry’s SEC filings and occasional tweets could move stocks, yet he often complained that public markets misread his positions. Running a paid newsletter lets him explain his thinking in detail while earning recurring subscription income that is not tied to daily market swings.

That model is becoming common. Commentators in Chinese tech media noted that Burry’s move into paid content comes just as other political and financial figures launch high-priced clubs and communities, arguing that “real opportunities only circulate quietly inside closed circles.”

One high-profile example is Donald Trump Jr.’s “Executive Branch” club, a private membership network reported to carry a 500,000 dollar fee, designed to gather wealthy conservatives and business figures in an exclusive setting.

End of the free information era?

Analysts see a bigger trend behind these launches. After years when Twitter and other platforms felt like places where anyone could read expert opinions for free, more star investors and influencers are putting their detailed views behind paywalls. Public feeds become marketing and branding, while specific trade ideas, macro views, and networking migrate into private newsletters, Discords, and clubs.

For ordinary investors, that could mean:

- Less high-quality insight available in open channels

- A growing “information gap” between people who can pay for access and those who cannot

- More risk that retail traders react to old or second-hand narratives while professional circles see the primary research first

For Burry, Cassandra Unchained is a way to speak directly to a paying audience without worrying about front-running his trades or triggering headlines every time his 13F changes. For markets, his shift is another sign that information itself is becoming an asset class, sold through subscriptions rather than given away on social media.

Related: Michael Burry Takes Aim at Big Tech’s AI Profits

Michael Burry Shuts Down Scion Asset Management — Hints at New Project Coming November 25