Meta delivered its strongest revenue growth in over a year, but surging expenses and a sweeping AI-focused reorganization signal that the company’s next phase will be defined by scale, not savings.

Finblog’s pre-earnings research predicted a solid ad-driven beat, and that’s exactly what happened, but the post-report tone now shifts to whether Meta can control the cost of its AI ambition.

Referred article: Meta Q3 2025 Earnings Preview and Prediction: What to Expect

From Forecasts to Reality

Meta’s Q3 2025 earnings easily cleared revenue expectations but raised new concerns about profitability, capital intensity, and headcount expansion.

| Metric | Street / Finblog Forecast | Actual (Q3 2025) | Outcome |

|---|---|---|---|

| Revenue | $49.4 – $49.6 B (+21–22%) | $51.24 B (+26%) | ✅ Beat – strongest growth since early 2024 |

| EPS (Adjusted) | $6.65 – $6.70 | $7.25 (ex-tax charge) | ✅ Beat |

| Reported EPS | n/a | $1.05 (after $15.9 B tax charge) | ⚠️ One-time distortion |

| Operating Margin | ~38.7% | 35.5% (est.) | ⚠️ Slight compression due to higher costs |

| Capex (2025 Guidance) | $66 – 72 B | $70 – 72 B | ✅ In line with upper range |

| Expenses (2025 Guidance) | $114 – 118 B | $116 – 118 B | ✅ On target, but 2026 flagged higher |

Meta’s top-line beat reaffirmed its strength in digital advertising and Reels monetization. However, the results also underscored what Finblog previewed: that the company’s AI push is an expensive long-term play, not a short-term profit driver.

Ad Engine Still Dominates

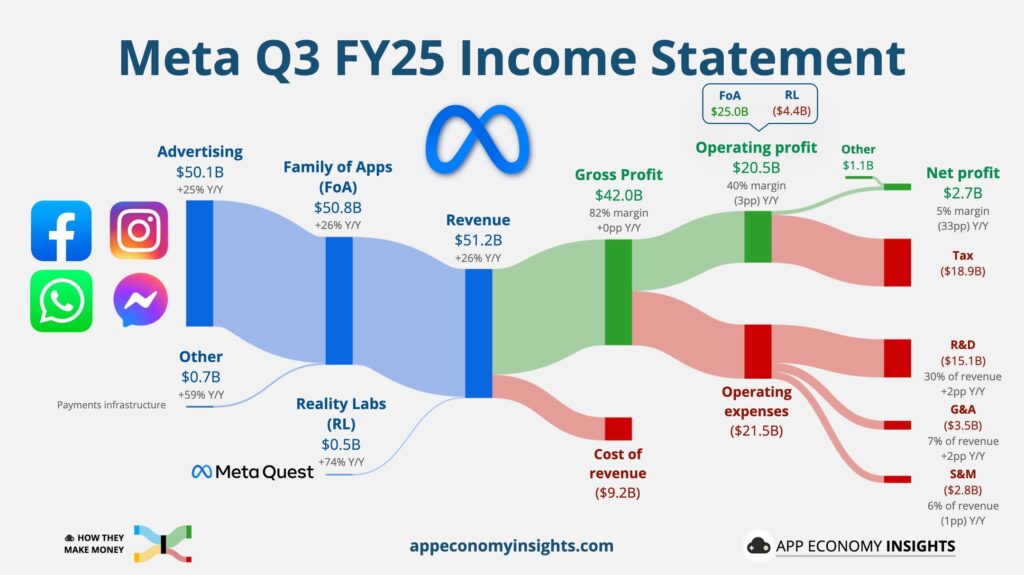

Meta’s advertising revenue rose to $50.08 billion, a 25% YoY increase, beating all major forecasts.

Daily active users hit 3.54 billion, and engagement across the Family of Apps improved for the sixth consecutive quarter.

Reels and AI-driven ad targeting remained key growth levers. The company credited its Advantage+ suite and AI-driven recommendations for improving ad yield, with the share of Reels campaigns surpassing 75% of advertisers — in line with Finblog’s pre-earnings analysis.

This confirms that Meta’s core business remains exceptionally healthy, even as the company doubles down on AI infrastructure and research spending.

AI Infrastructure: The Cost of Ambition

Finblog’s preview projected that Meta would lift capex toward the top of its $66–72 billion range — and the report confirmed it.

Meta now expects 2025 capex of $70–72 billion, while forecasting 2026 expenses to grow “significantly faster” than 2025’s, due to accelerated AI infrastructure buildout and rising personnel costs.

CFO Susan Li said total expenses will reach $116–118 billion this year, and that 2026 expense growth will outpace revenue growth “as AI-related costs scale sharply.”

She emphasized that employee compensation is the second-largest driver, reflecting full-year pay for new hires across AI engineering and infrastructure teams.

Headcount and Restructuring: The AI Realignment

Meta’s headcount reached 78,450 as of September 30, up 8% YoY, even after cutting around 600 roles in its AI division during the quarter.

Hiring is now concentrated almost entirely in AI, technical, and compute roles, while non-core positions are being trimmed — marking a strategic workforce pivot from general growth to deep specialization.

The shift follows two years of volatility: from 86,000 employees at the end of 2022 down to 67,000 in late 2023, before re-expansion began.

Executives described this as an “investment in long-term efficiency and innovation,” but analysts view it as a realignment of human capital around AI capabilities — a restructuring, not just a rebuild.

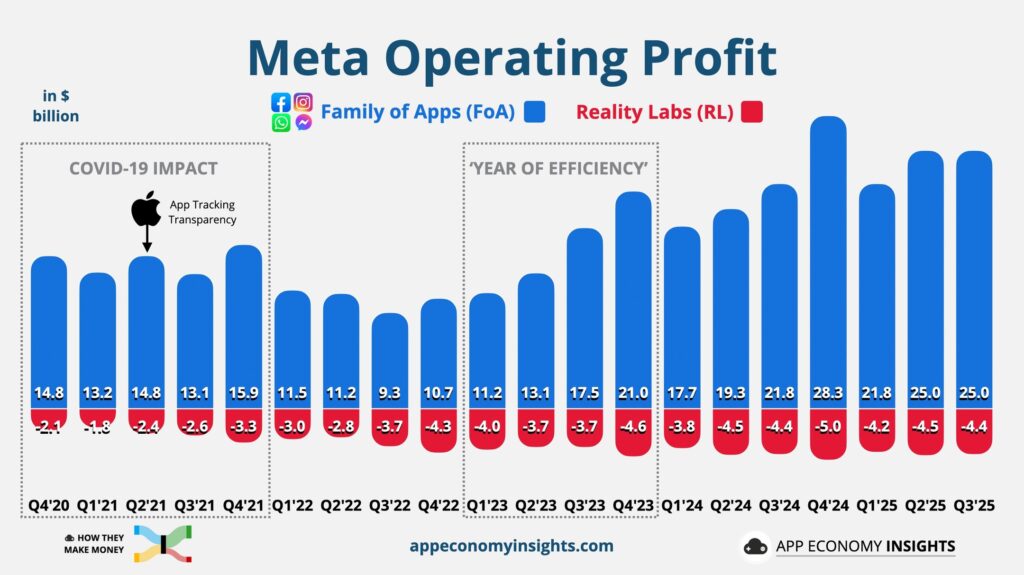

Reality Labs: Persistent Drag Amid Wearables Momentum

Reality Labs, Meta’s AR/VR unit, posted another $4.4 billion quarterly loss on $470 million in sales, consistent with expectations.

The division remains deeply unprofitable but gained some positive headlines after Ray-Ban Display smart glasses sold out shortly after launch.

CEO Mark Zuckerberg reiterated that Reality Labs is “a long-term investment,” framing it as part of Meta’s broader AI + spatial computing convergence.

Meta’s AI Era: Scale Over Margins

Zuckerberg described Meta as operating in a “perennially compute-starved state,” explaining the urgency behind record data center expansion and a $27 billion joint venture with Blue Owl Capital in Louisiana.

He argued that AI infrastructure isn’t optional — it’s essential to maintain core product efficiency and stay ahead of peers in AI personalization.

The company’s tone marked a clear shift: AI is no longer a project — it’s Meta’s operating system.

Market Reaction and Analyst Response

Despite strong revenue and user growth, shares of $META fell nearly 7%, heading for their worst day since 2022, as investors focused on swelling cost guidance and tax-related EPS distortion.

- Gene Munster (Deepwater): “Meta’s expense trajectory for 2026 flips the script — costs are rising faster than revenue. That’s a red flag.”

- Evercore ISI: “This was a solid quarter, but the margin picture now weakens the 2026 outlook.”

- JPMorgan: “AI buildout remains critical, but the Street needs to see evidence of monetization before sentiment recovers.”

Finblog Forecast Accuracy

| Area | Result |

|---|---|

| Revenue growth / Ad performance | ✅ Beat matched expectations |

| Capex revision (top of range) | ✅ Accurate |

| EPS trajectory | ✅ Adjusted EPS beat; reported distorted by tax charge |

| AI cost escalation | ✅ Confirmed |

| Reality Labs losses | ✅ On target |

| Expense outlook for 2026 | ⚠️ Worse than expected |

| Stock reaction | ⚠️ Direction correct, but magnitude larger |

| Overall Forecast Accuracy | A– (≈85%) |

Key Takeaways

- Meta reported record quarterly revenue of $51.2 billion (+26% YoY).

- Adjusted EPS beat expectations, but a $15.9 billion tax charge slashed reported earnings.

- AI spending is accelerating, with capex at $70–72 billion and 2026 costs expected to rise even faster.

- Headcount climbed 8% to 78,000, underscoring a massive AI-focused workforce pivot.

- Ad revenue remains the profit engine, offsetting Reality Labs’ losses.

- The stock fell sharply as investors digested higher expense forecasts and shrinking margin visibility.

Meta’s Q3 2025 earnings confirm that the company has entered the heavy-lift phase of its AI transformation — one defined by record scale, swelling costs, and an evolving workforce built for the long haul.

The advertising engine is stronger than ever, but AI infrastructure now dominates the story, pulling margins tighter even as revenue accelerates.

The result: a company growing faster than it can save, betting that the cost of leading AI today will buy dominance tomorrow.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.