Meta Platforms (META) reports Q3 2025 earnings after the market close today, and expectations are running high. Following a 25%+ rally this year, Wall Street is eager to see whether the social media and AI giant can maintain momentum amid surging capital expenditures, evolving advertising dynamics, and increased regulatory scrutiny.

Here’s everything you need to know heading into Meta’s earnings announcement — including forecasts, analyst commentary, business trends, and what could surprise markets.

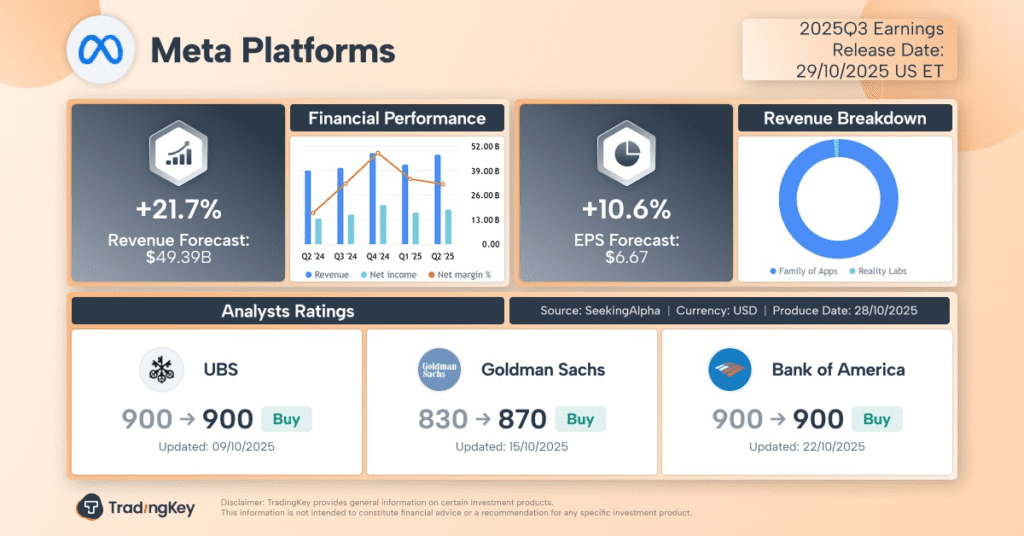

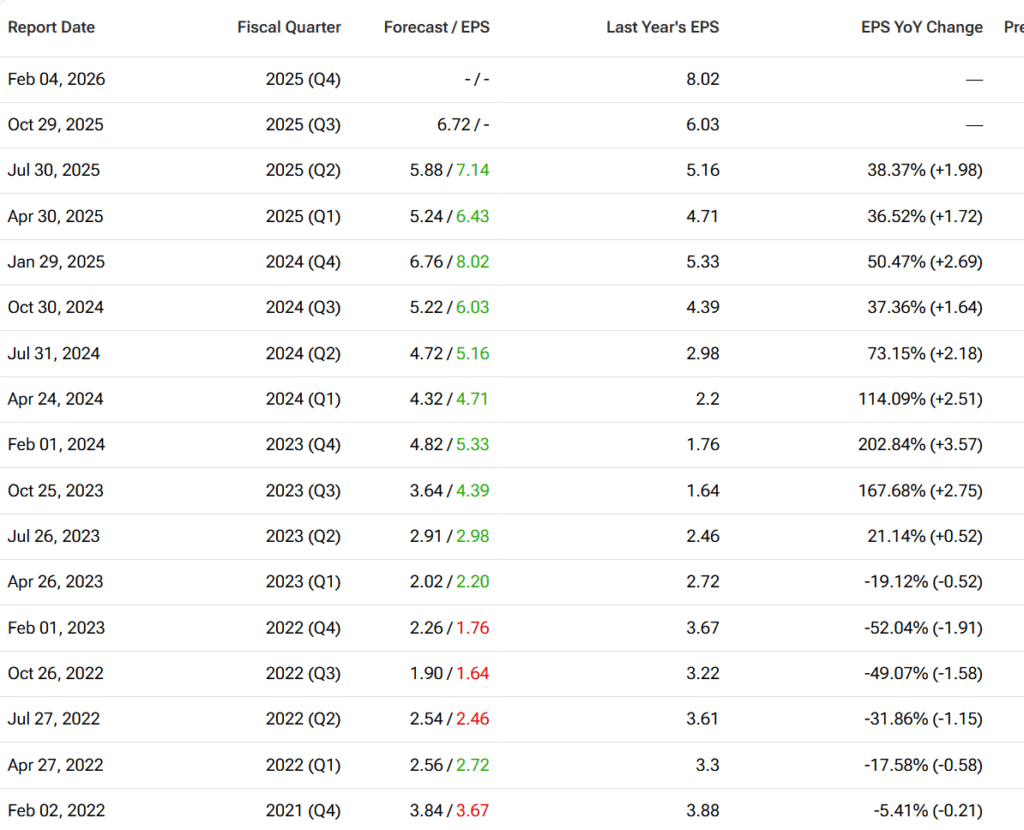

Street Consensus: Revenue Expected Near $49.5B, EPS Around $6.66

Analysts are expecting another strong quarter from Meta. According to LSEG and Bloomberg data, the consensus estimates for Q3 2025 are:

| Metric | Consensus Estimate | YoY Growth |

|---|---|---|

| Revenue | $49.4–$49.6 billion | +21–22% |

| EPS (Diluted) | $6.65–$6.70 | +10–11% |

| Operating Margin | ~38.7% | –4 pts YoY |

Meta’s official guidance from the Q2 earnings call forecasted Q3 revenue between $47.5B and $50.5B, indicating confidence in sustained ad demand. Analysts have since pushed estimates toward the upper end of that range.

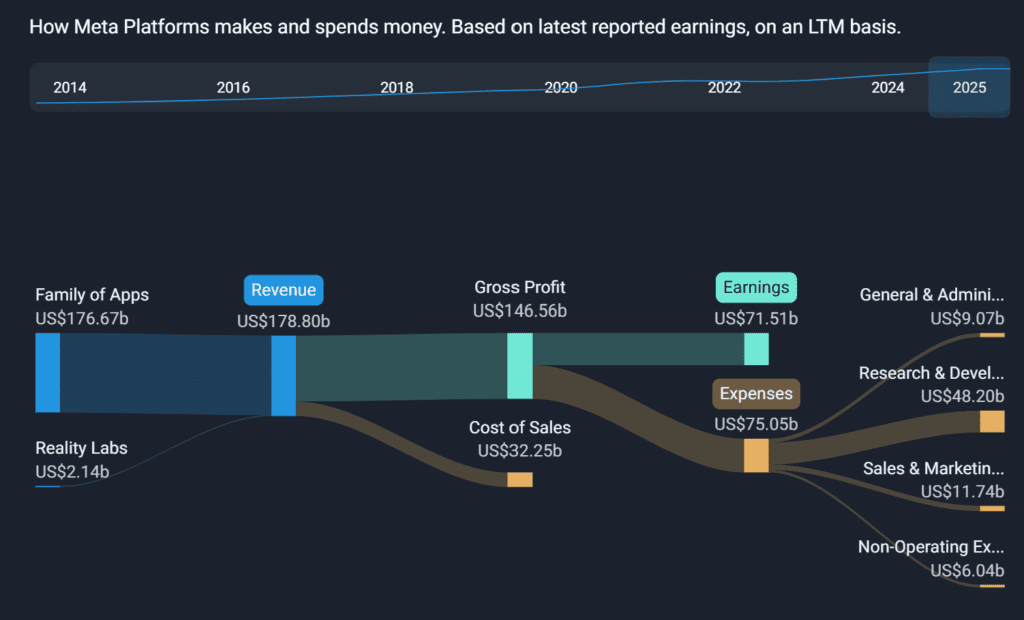

However, despite robust top-line growth, profit expansion is expected to decelerate due to higher expenses from Meta’s aggressive AI infrastructure build-out.

AI Infrastructure Push: High Risk, High Cost

Meta’s 2025 capex forecast now stands at $66–72 billion, nearly double its 2024 spend. That figure could go even higher as Meta races to build hyperscale AI data centers, GPU clusters, and proprietary AI chips.

CEO Mark Zuckerberg has repeatedly emphasized the importance of “going all in on AI” — from building models like Llama to launching AI assistants across Messenger, WhatsApp, and Instagram.

While these moves are strategically essential, they’re expensive. Free cash flow fell last quarter due to capex acceleration. With investors eyeing ROI on these investments, Meta’s forward guidance on infrastructure spending will be closely scrutinized.

Prediction: Expect a slight upward revision to 2025 capex (toward the top of the range), with executives reiterating that high short-term costs are necessary to maintain long-term leadership in AI.

Ad Business Rebound: The Engine Still Roars

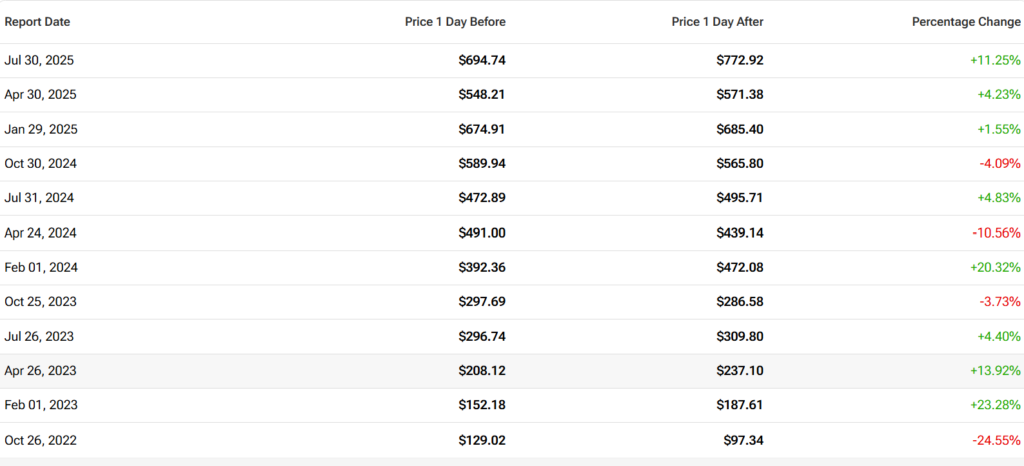

Digital ad demand continues to recover. Industry forecasts point to +20% YoY global social media ad spend, and Meta appears to be capturing a disproportionate share. Wall Street expects Meta’s ad revenue to rise ~22–23% YoY in Q3, driven by Reels, improved AI targeting, and automation.

Reels monetization in particular is hitting its stride. Meta disclosed a $10B annual revenue run rate earlier this year, and over 75% of advertisers are now running Reels campaigns.

Prediction: Meta will beat revenue estimates slightly (printing closer to $50B) on the back of strong ad performance and improved Reels monetization.

Reality Labs: Losses Remain, But Under Control

Meta’s Reality Labs (AR/VR/metaverse)

remains a major drag on profits. In Q2, it posted a $4.5B loss on $370M in revenue. Full-year losses are expected to exceed $18B.

But there are some green shoots. Ray-Ban smart glasses sales reportedly tripled YoY in H1 2025, and the upcoming Meta Connect conference on Sept. 17 may preview new AR features and Quest hardware updates.

Prediction: Reality Labs losses will hover around $4.5B again, but Meta may tease next-gen glasses and downplay short-term financial pressure to preserve its long-term AR narrative.

Regulatory and Cost Risks Loom Large

While Meta’s core business is healthy, legal and regulatory threats — especially in Europe — are growing. The EU’s Digital Services Act enforcement is underway, and officials have accused Meta of breaching transparency rules.

Meanwhile, operating expenses are forecast to grow 20–24% YoY in 2025, with further increases projected in 2026. If costs run hotter than expected, margin pressure could intensify.

Prediction: Meta will stick to the midpoint of its expense guidance, but CFO Susan Li may hint at upward risk for 2026 opex if depreciation and AI hiring continue to ramp.

Key Investor Focus Areas:

- Capex and cash flow outlook: Will Meta revise its spending plans upward again?

- AI product traction: Any metrics on Meta AI assistants, Llama model integration, or Advantage+ ad suite adoption?

- Reels revenue updates: Has monetization closed the gap with Feed?

- Reality Labs: Is the spend manageable, and are there signs of traction?

- EU regulation: Will Meta quantify potential impact from compliance?

Can Meta Keep the Balance?

Meta’s AI-led resurgence has impressed Wall Street — but the expectations bar is now high. This quarter isn’t about survival; it’s about showing that Meta can grow aggressively while controlling costs, monetize its engagement surfaces (Reels, WhatsApp, Threads), and keep regulators at bay.

With top-line growth still accelerating and user metrics strong, we believe Meta is well-positioned to beat on revenue. The bigger risk lies in how investors digest its ballooning infrastructure costs and early AI monetization efforts.

Prediction: Meta beats on revenue, matches on EPS, reaffirms capex plans, and reiterates its long-term AI + AR/VR strategy. The stock may trade modestly higher post-earnings unless there’s a surprise upward revision to 2026 spending.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.