Wall Street is fighting to regain momentum after a two-day pullback, with strong economic data colliding with investor hopes for further Fed easing.

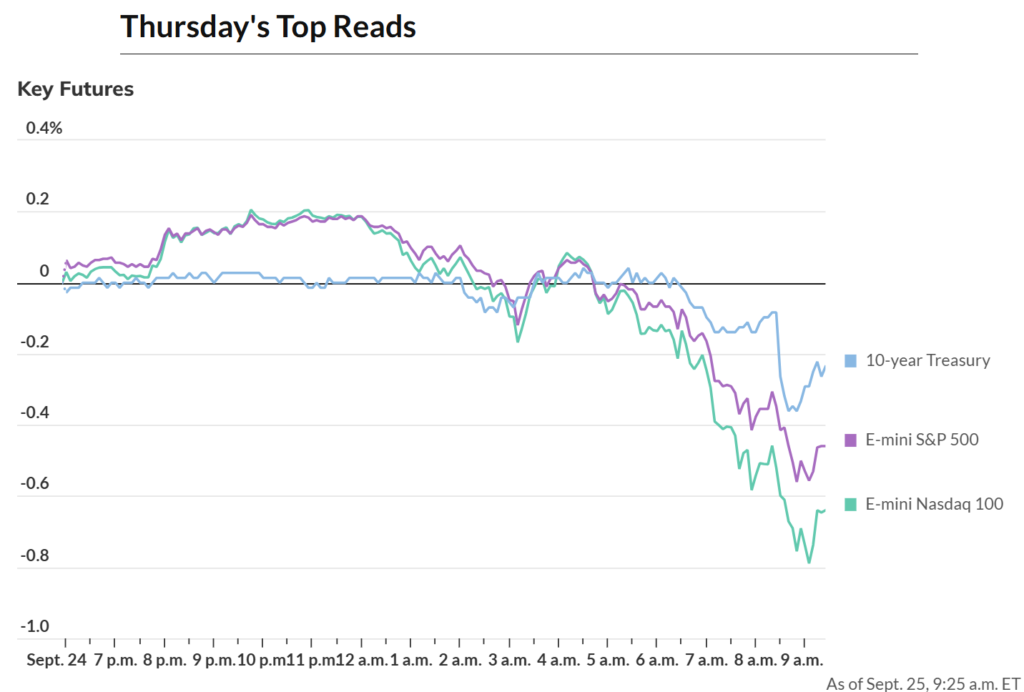

US markets opened Thursday on shaky ground, as S&P 500 futures slipped 0.5%, the Nasdaq-100 dropped 0.7%, and Dow futures fell 0.2%. The weakness comes despite better-than-expected economic data, as investors weighed the risk that resilient growth and a strong labor market could slow the Federal Reserve’s rate-cutting path.

Stronger Data, Higher Yields

Fresh figures from the Commerce Department showed the US economy grew at an annualized 3.8% in Q2, up from the earlier 3.3% estimate, thanks to stronger consumer spending and lower imports. Meanwhile, initial jobless claims fell to 218,000, well below forecasts of 235,000, underscoring a labor market that—despite slowing hiring—is still proving resilient.

The data pushed Treasury yields to three-week highs, with the 10-year yield nearing 4.19%. Rising yields weighed heavily on tech stocks and rate-sensitive sectors, undermining the Fed cut optimism that helped power markets to record highs earlier this week.

Tech & AI Trade Hit Again

The most pressure came from the once-unshakable AI trade. Oracle (ORCL) slid nearly 4% in premarket trading after Rothschild Redburn issued a sell rating, warning its cloud business is unlikely to see the AI boost investors have priced in. The call added fuel to a three-day decline that has already pushed Oracle more than 10% off its highs.

Nvidia (NVDA) was also down about 1%, extending a pullback that has traders questioning whether AI valuations have become stretched. Both stocks, which helped lead the summer rally, are now at the center of a broader debate about whether enthusiasm has run too far ahead of fundamentals.

Policy, Politics, and Shutdown Risks

The Fed cut rates by 25 basis points, but markets are now questioning how many more reductions will come this year. While Powell acknowledged a “softer labour market” earlier this week, the combination of stronger GDP, firmer consumer spending, and low jobless claims gives policymakers reason to hesitate.

Investors are also monitoring Washington. The White House ordered agencies to prepare mass layoff plans in case of a government shutdown next week — a move that raised political and economic stakes just as markets seek clarity from the Fed.

Looking Ahead

The next test comes Friday, with the release of the Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge. A softer print could revive expectations for more cuts, while a hot reading would reinforce today’s concern that easing will be limited.

Meanwhile, Costco (COST) reports earnings after the bell, offering another look at consumer resilience in a high-rate environment.

Markets are caught between solid economic strength and investor hopes for more Fed easing. Strong GDP and jobless claims show the economy isn’t cracking, but higher yields and AI stock weakness remind traders that record highs aren’t easy to defend.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Trump Turns Washington Into America’s Biggest Activist Investor With Intel Deal

Trump’s 10% Stake in Intel: A “Great Deal” or Political Gamble?

Intel Secures $2 Billion Lifeline From SoftBank, Shares Jump

Intel’s Best Week in 25 Years: Trump’s Lifeline or Just Burning Billions?