Global financial markets opened Tuesday in a holding pattern, balancing cautious optimism over Ukraine peace talks with anticipation of the U.S. Federal Reserve’s Jackson Hole summit later this week.

Ukraine Talks: Optimism, but No Breakthrough

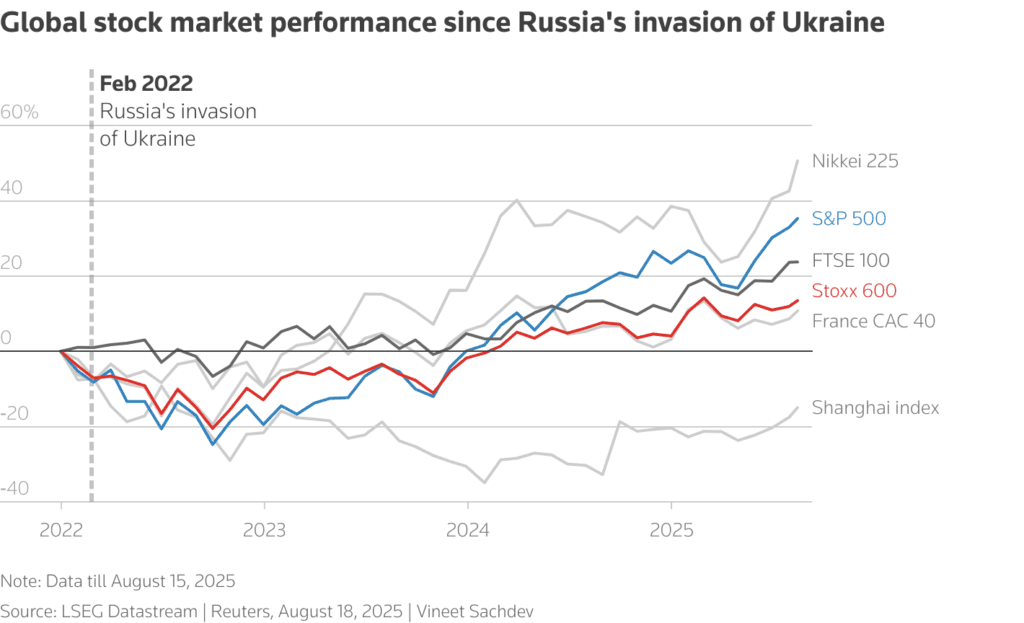

Markets took note of the Zelenskyy–Trump meeting in Washington, which ended with talk of a possible trilateral summit involving Putin. European equity futures rose about 0.2%, reflecting hopes that even incremental diplomatic progress could ease regional risk.

But investors know the road to peace is long. Oil markets, sensitive to every headline, slipped ~0.8% on speculation that a ceasefire could open the door to more Russian supply. Defense names stayed firm, buoyed by the view that even tentative talks won’t unwind Europe’s massive rearmament drive.

FOMC Has a Big Decision to Make: “Money Doesn’t Talk Anymore”

If geopolitics was the appetizer, central banks are the main course. All eyes are on Jackson Hole (Aug 21–23), where Powell may give the clearest signal yet on Fed policy.

Markets price an 83–85% chance of a 25bps cut in September, but the data is conflicted: July jobs growth was the weakest in three years, while producer prices rose at the fastest pace in two. Bond yields keep climbing, gold is steady — investors are hedging both ways.

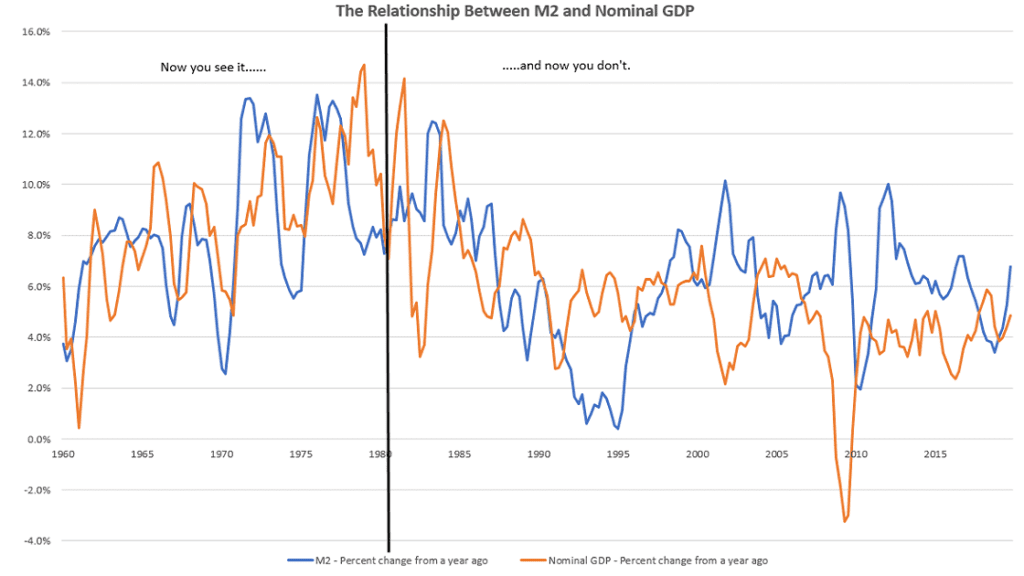

J.P. Morgan’s David Kelly says the old playbook is gone: “Money doesn’t talk anymore.” M2 no longer predicts inflation, so the Fed is now guided by demand-side data — consumer spending, housing, investment, and jobs.

If Powell tilts toward growth risks, rate cuts stay on the table. If he doubles down on inflation, markets may need to rethink their bets. Jackson Hole could be Powell’s most consequential speech — and maybe his last at this summit.

Market Snapshot

Key Movers:

- Stock Futures: Slightly lower, with Dow, S&P 500, and Nasdaq futures all off by ~0.1–0.2% as investors wait on retail earnings and Powell’s Jackson Hole speech.

- Treasury Yields: The U.S. 10-year yield rose again, marking its fourth straight session higher, as bond markets brace for the Fed’s policy outlook.

- Bitcoin: Dropped below $115,000, extending its slide. The crypto has weakened since Treasury Secretary Scott Bessent said the U.S. won’t expand its Bitcoin reserves, cutting off a major source of potential demand.

- Oil: Slipped ~0.8% on speculation that a Ukraine ceasefire could unlock more Russian supply.

- Gold: Held steady as investors balanced Fed uncertainty with geopolitical risk.

- Asia: Mostly flat. The Nikkei eased 0.1%, while mainland China stocks held near decade-highs.

- Europe: Gains were modest, led by the Euro Stoxx 50 and German DAX edging higher

Investors are in “wait-and-see mode,” preferring not to chase risk until Powell sets the tone.

Retail Earnings Next

On top of geopolitics and central banks, corporate earnings will test the market’s resilience.

- Home Depot kicks off U.S. retail results today.

- Target and Walmart report later this week, offering a window into consumer strength as tariffs and inflation pressures weigh on households.

Weak numbers could strengthen the case for Fed cuts, while strong numbers may give equities another leg higher—at least outside the war-driven sectors.

Outlook: Tightrope Week

This is shaping up to be a tightrope week for global markets:

- Geopolitics: A diplomatic thaw could lift European equities and weigh on energy prices.

- Fed policy: Powell’s speech may confirm the first cut of the cycle—or remind markets that inflation risks still matter.

- Corporate health: Big-box earnings will show whether consumers can keep carrying growth.

Until then, expect choppy but contained trading—equities near record highs, bonds testing yield ceilings, oil reacting to every peace rumor, and defense stocks riding the war premium.

Related: Zelenskyy–Trump Summit: Key takeaways from Diplomatic Optics to Defense Deals

Zelensky–Trump Meetings: How 2025 Shaped Energy & Defense Stocks