As the holiday season approaches, global markets are heading into the final trading days of 2025 with a mix of optimism, fatigue, and unresolved uncertainty. Stocks are sitting just below record highs, investors are watching for a traditional Santa Claus rally, and delayed economic data is slowly emerging after weeks of shutdown-related disruptions.

It has been a year shaped by trade wars, inflation shocks, AI-driven concentration, bond volatility, and geopolitical tension, and the final week is doing little to simplify the picture.

Stocks Near Records, But the Mood Is Fragile

US stocks rallied on Friday to close out the final full trading week of the year on a mixed note. For the week:

- The Nasdaq Composite rose about 0.4%

- The Dow Jones Industrial Average fell roughly 0.7%

- The S&P 500 finished little changed

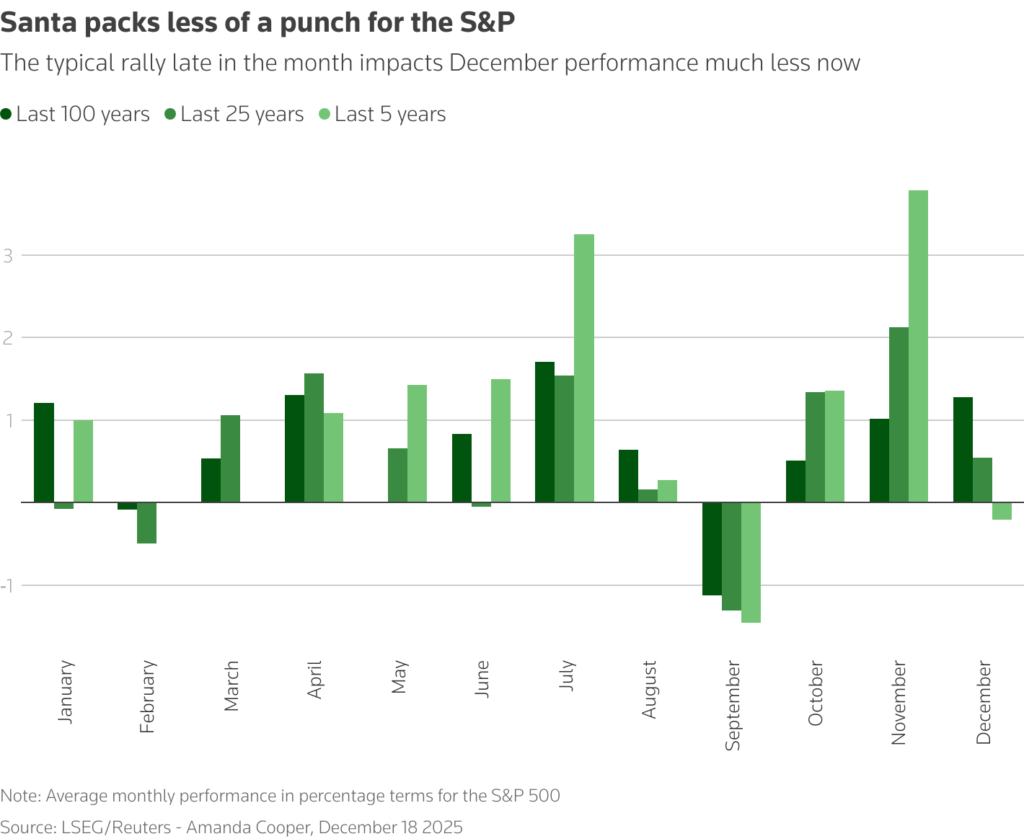

Despite the uneven performance, all three major indexes enter the last seven trading sessions of 2025 within 3% of record highs. That positioning keeps hopes alive for a Santa rally, traditionally defined as gains during the final five trading days of the year and the first two of January.

More about: Why Wall Street Still Believes in a Santa Rally

History offers mixed encouragement. Over the past century, December has delivered average gains of 1.28% for the S&P 500. But that strength has faded. Over the last 25 years, December’s average gain drops to 0.5%, and over the last five years, it has averaged a 0.2% loss, making it one of the weaker months outside September.

Still, traders are holding on. With valuations stretched and liquidity thinning, even modest moves could have outsized effects.

Holiday Trading Meets Delayed Data

The coming week will be shortened by the holidays. US markets will be open for a half-day Wednesday, closed Thursday for Christmas, and many international markets will remain closed Friday. Thin trading conditions increase volatility risk, especially as delayed US economic data continues to arrive after the 43-day government shutdown.

Investors will get:

- Third-quarter GDP

- Durable goods orders

- Industrial production

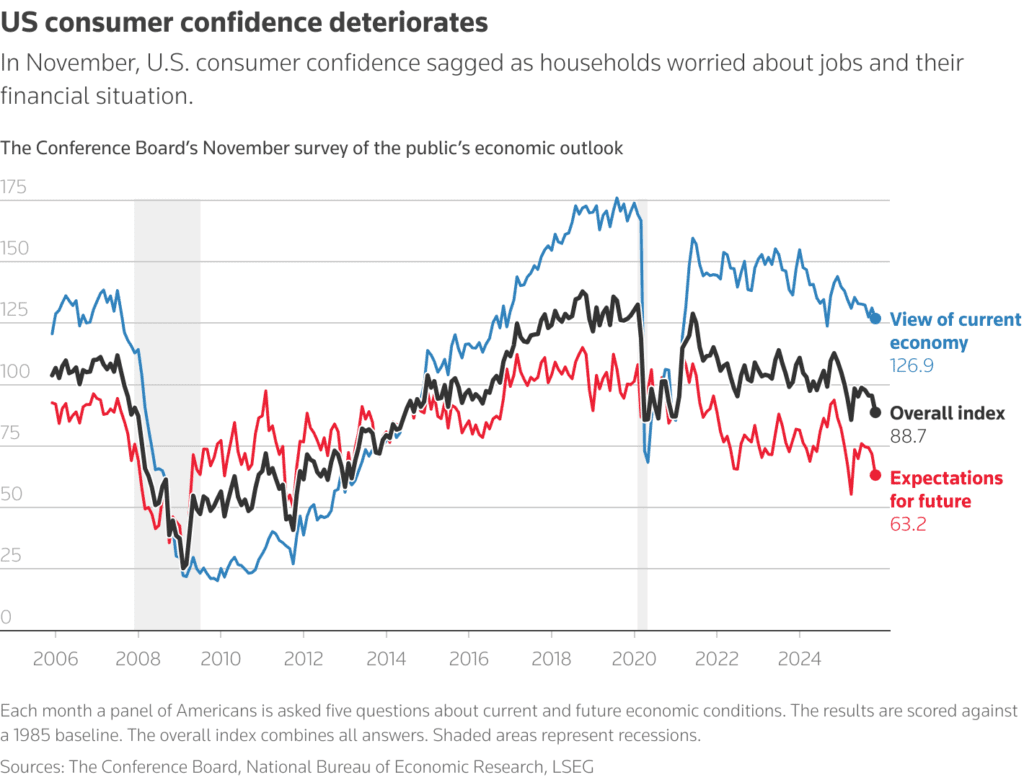

- Consumer confidence from the Conference Board

Consumer confidence is drawing particular focus. University of Michigan data showed a slight improvement in December, but sentiment remains deeply depressed at 52.9, nearly 30% below last year’s level.

Joanne Hsu, who oversees the survey, said households believe the economic outlook has worsened meaningfully during 2025. That weakness aligns with broader concerns around jobs, housing, and affordability.

More about: Economists Urge Caution After November CPI Shows Softer Inflation

The K-Shaped Consumer Still Dominates the Story

One of the defining narratives of 2025 remains the K-shaped economy. Data from Bank of America shows that upper-income households account for more than half of consumer spending, while roughly a quarter of Americans are living paycheck to paycheck.

More about: Why US Economy Is Being Called “K-Shaped” Again

Housing sales have risen for three straight months, but total sales are still on track to finish the year at a 25-year low, according to the National Association of Realtors. Economists note that inflation may be cooling statistically, but households do not feel relief evenly. Essentials outside shelter continue rising in price, reinforcing consumer anxiety.

Jeffrey Roach of LPL Financial described the divide clearly: affluent consumers are fine or even thriving, while lower-income households struggle with rent, delinquencies, and job uncertainty.

Inflation Cools, But Skepticism Remains

November’s CPI surprised markets by showing headline inflation at 2.7%, below expectations. Core inflation came in at 2.6%, breaking a long stretch near 3%.

But economists caution against overconfidence. October CPI data was never collected due to the shutdown, and much of November’s data was gathered during Black Friday discount periods, potentially distorting price readings.

Federal Reserve Chair Jerome Powell warned that policymakers would take a skeptical view of the data. Still, some economists believe the report gives the Fed room to cut rates further in 2026 after delivering 75 basis points of cuts in 2025.

Bill Adams of Comerica said the data strengthens the case for easing next year, even if households remain unconvinced.

TOO MUCH STICKY STUFF

Outside the US, markets face their own tensions.

Oil prices have fallen below $60 a barrel, pressured by rising global supply even as geopolitical risks remain elevated. Investors are watching:

- Potential shifts in Russian oil flows linked to Ukraine talks

- US pressure on Venezuelan oil exports

- The broader supply-demand imbalance heading into 2026

In Japan, traders are focused on the Bank of Japan. The central bank recently raised rates to 0.75%, the highest in three decades. Minutes from its October meeting and fresh CPI data later this week may offer clues on the pace of tightening next year, with global implications for yields and currency markets.

Meanwhile, global bonds remain uneasy. Government debt markets have grown nervous amid large deficits, trade uncertainty, and shifting central bank demand. Gold has posted its best year since 1979, while the US dollar is down about 9% in 2025.

More about: Japan Bond Market Explained: Why Yen Carry Trade Still Moves Stocks And Crypto?

AI Optimism Returns, But Valuation Fears Linger

Big Tech helped lift markets late in the week. Oracle surged after reports it is part of a US-led effort to buy TikTok. Nvidia rose on reports the Trump administration is reviewing plans to allow sales of advanced H200 chips to China. Micron’s strong earnings eased fears around AI demand.

Still, strategists warn that enthusiasm has become a crutch. Valuations remain elevated, and market leadership is narrow.

Capital analyst Kyle Rodda noted that softer labor data, cooling inflation, and a notionally dovish Fed support equities, but valuation concerns are keeping markets from pushing decisively to new highs.

What to Watch This Week

With markets closing out the year, investors are watching several key signals:

- Consumer confidence on Tuesday

- Durable goods and GDP revisions

- Signs of a Santa rally amid thin liquidity

- Oil price volatility

- Japan’s inflation and rate signals

Despite uncertainty, many Wall Street strategists remain constructive heading into 2026. Goldman Sachs believes the market remains in an early optimism phase, where earnings growth and valuation expansion coexist, and expects that trend to continue next year.

The final days of 2025 arrive with stocks near records, inflation cooling unevenly, consumers divided, and global risks unresolved. Holiday calm may dominate the calendar, but beneath the surface, markets are quietly setting the tone for 2026.

Whether Santa delivers or not, the signals investors read now may matter more than the final headline return.

Related: 6 Charts That Show How Stock Markets Got Reshaped in 2025

How Big Tech Created the 2025 AI Boom on Debt

Big Year for Old School Wall Street Trades Gets Lost in AI Hype

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.