US stocks faltered overnight after Jerome Powell’s Rhode Island remarks poured some cold water on hopes for aggressive rate cuts. The Fed Chair warned there is “no risk-free path” as tariffs push up prices and the labour market softens, noting stocks look “fairly highly valued.” (More about: Takeaways from Jerome Powell: No Risk-Free Path, Weak Jobs, and AI Winners)

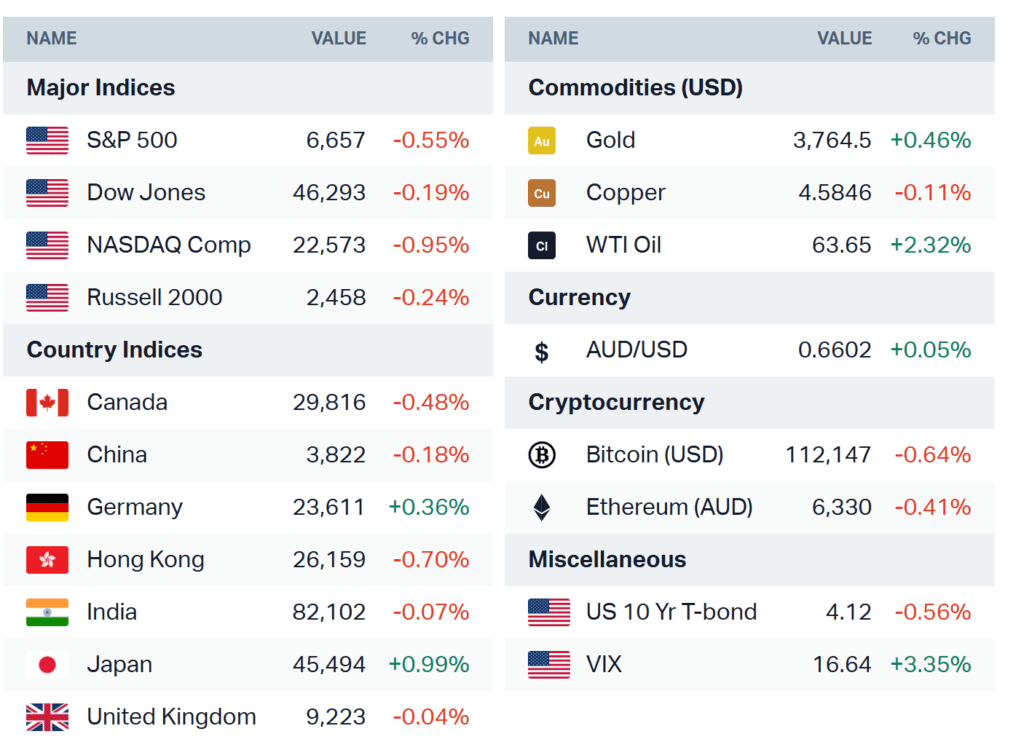

- S&P 500: -0.6% (6,656)

- Dow: -0.2% (-88 pts)

- Nasdaq: -1.0%

All of the “Magnificent Seven” closed in the red, with Nvidia off -2.8% and Amazon also weighing. Still, enthusiasm for AI hasn’t gone away — Micron brought fresh optimism later in the session.

Micron’s Beat

Micron’s Q4 earnings came in strong:

- Revenue: $11.3B (vs. $11.15B expected)

- EPS: $3.03 (vs. $2.84 expected)

The driver was DRAM chips, up nearly 70% YoY to $9B, fueled by AI data center demand. Guidance for Q1 topped forecasts too ($12.2–12.8B vs. $11.9B expected). CEO Sanjay Mehrotra put it plainly: “Over the coming years, trillions will be invested in AI, and a significant portion will be spent on memory.”

Shares jumped after-hours toward fresh highs, underlining Micron’s rise as a key AI beneficiary.

Asia Session

Asian stocks were choppy, reflecting Wall Street’s stall. Japan’s Nikkei and Korea’s Kospi slipped, while Hong Kong and Shanghai got a lift from Chinese tech:

- Alibaba surged up to +7.8% after pledging more AI investment.

- Chinese chipmakers rallied after Morgan Stanley’s upgrade and Huawei’s push to rival Nvidia in AI chips.

- Trading in Hong Kong was thinned by Super Typhoon Ragasa, but tech carried the tone.

MSCI Asia ex-Japan held modestly green (+0.1%).

Commodities

- Gold: +0.5%, new record at $3,764/oz, with safe-haven demand still strong.

- Oil: Brent steady at $67.66, WTI at $63.46. API data showed US crude stocks fell -3.82M barrels, adding supply pressure. Ongoing pipeline halts in Iraq’s Kurdistan region and constraints in Venezuela added support.

- Iron Ore: -0.6% at $106, pausing recent gains.

Bonds & FX

Treasury yields slipped, 10Y at 4.11%, as investors rotated into safety. The dollar was broadly flat. EUR ticked to 1.18, AUD softened to 0.6598, while Bitcoin hovered near $112K.

Cryptocurrencies were mixed, with Bitcoin slipping 0.7 per cent to US$112,004, while Ether edged up 0.2 per cent to US$4,184.

Europe’s Session

European equities eked out gains yesterday, Stoxx 600 up 0.3%, lifted by:

- Luxury (LVMH, L’Oréal) on upbeat forecasts

- Retail (Kingfisher +14% on a beat-and-raise)

- Energy (BP, Shell, Equinor) tracking oil higher after NATO warnings on Russian incursions

Healthcare lagged after a broker downgrade hit AstraZeneca, Roche, and Novo Nordisk

What to Watch Today

- US Data: MBA Mortgage Apps, New Home Sales (Aug), EIA crude stocks

- Earnings: Cintas (CTAS), Thor Industries (THO), KB Home (KBH)

- Europe: Germany Ifo business climate survey

- Fed Speak: Daly on tap later today

Markets are in a choppy reset phase. Powell’s cautious tone took the steam out of Wall Street’s record run, but Micron’s results remind us the AI trade still has legs. Asia is split — China tech buzzing, but Japan and Korea dragging. Commodities are steady with gold at fresh records, oil finding a floor. Today’s US housing data and oil inventories could test the cautious optimism.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Takeaways from Jerome Powell: No Risk-Free Path, Weak Jobs, and AI Winners

Trump’s UN Speech: Key Messages, Battles, and What Comes Next

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Powell Frames Cut as “Risk Management” Amid Weakening Jobs, Tariff Risks