The Magnificent Seven tech giants are facing sharp corrections, but for savvy investors, that spells opportunity. Following a tough start to 2025, analysts are highlighting two standout recovery plays: Tesla and Alphabet.

Magnificent Seven at a Glance:

- Alphabet (GOOGL): -16.35% YTD / +7.33% 1-Year

- Amazon (AMZN): -13.16% YTD / +9.63% 1-Year

- Apple (AAPL): -12.74% YTD / +22.49% 1-Year

- Meta (META): -4.05% YTD / +15.74% 1-Year

- Microsoft (MSFT): -8.53% YTD / -8.24% 1-Year

- Nvidia (NVDA): -15.94% YTD / +31.42% 1-Year

- Tesla (TSLA): -40.13% YTD / +30.70% 1-Year

Tesla: A New Political Catalyst?

Tesla’s 40% plunge YTD may seem steep, but analysts argue it’s an opportunity. With Elon Musk now entrenched in politics via the Department of Government Efficiency (DOGE), Tesla has gained a “political valuation layer”. Musk’s role in cutting $2 trillion in government spending has sparked backlash, yet he’s also become a symbol for reform. As President Trump brands violence against Tesla as “domestic terrorism”, TSLA could rally as a MAGA movement icon, adding to its tech-auto hybrid appeal.

Alphabet: The Smart Long-Term Play

Google’s parent company Alphabet remains a cornerstone of U.S. influence. Despite calls for Google to divest from Chrome, analysts see this as reducing future antitrust liability. AI-powered products like Gemini and YouTube moderation tools fortify Alphabet’s dominance. With an average price target of $219.29 (high estimate at $250), GOOGL shares (currently $159.79) offer significant upside.

What’s Weighing on Others?

- Microsoft (MSFT): Azure growth slowing (from 33% to 31%).

- Amazon (AMZN): AWS annualized growth stuck at 19%, missing revenue targets.

- Apple (AAPL): Heavily reliant on stock buybacks as smart device sales stall.

- Meta (META): Most resilient; leveraging Llama AI across its massive user base.

- Nvidia (NVDA): Despite dominance in AI chips, a 15.94% drop YTD reflects valuation concerns after a massive 2024 run.

Why Tesla & Alphabet Are Top Picks Now:

- Tesla’s Valuation Catalyst:

- Emerging as a political symbol, TSLA could benefit from Trump’s presidency and GOP support.

- Potential utility-like stable cash flows if Musk’s full self-driving and ride-sharing vision materializes.

- Alphabet’s AI & Cloud Dominance:

- Despite regulatory risks, Alphabet’s AI advancements and deep data moat make it a long-term compounder.

- Waymo’s progress gives Alphabet an edge in the autonomous vehicle race.

With Tesla down 40% YTD and Alphabet at a 16% discount, both stocks offer compelling recovery upside. Analysts highlight these two as prime Magnificent Seven picks for the next growth phase.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

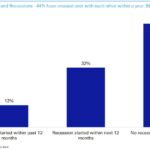

How often do market corrections lead to a recession in the US? – Research

Google Bought Wiz for $32 Billion: What to expect

The Most Undervalued Stocks In The Market

BYD Launches Megawatt Super Charging System to Rival Tesla and NIO in China’s EV Race

Amazon Undercuts Nvidia With Aggressive AI Chip Discounts

Warren Buffett’s Berkshire Has Been Selling US Stocks. Where It’s Buying Now

Will Trump Use the Federal Reserve as Leverage in Global Finance?

Key Events and Earning Calendar to Watch This Week (17-21 March)

Facebook’s secrets, by the insider Zuckerberg tried to silence