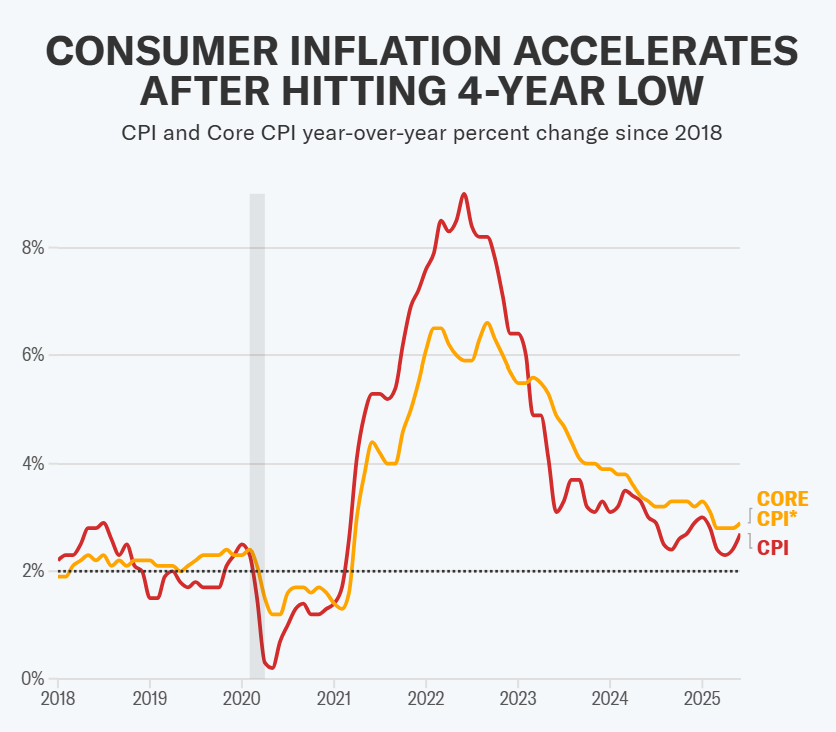

Inflation picked up speed in June, ending a four‑month cooling streak. The 0.3 % month‑on‑month rise was exactly what forecasters feared and lifted the annual CPI rate to 2.7 %, the fastest since January. Core inflation (which strips out food and energy) also inched up, underscoring that underlying price pressure is still sticky.

| May ’25 | June ’25 | Street est. | |

|---|---|---|---|

| CPI y/y | 2.4 % | 2.7 % | 2.6 % |

| CPI m/m | 0.1 % | 0.3 % | 0.3 % |

| Core y/y | 2.8 % | 2.9 % | 2.9 % |

| Core m/m | 0.1 % | 0.2 % | 0.3 % |

Tariff Fingerprints Emerge

Economists have warned that the fresh 20–50 % duties on imports from Canada, Mexico and the EU would seep into prices once pre‑tariff inventories ran down. June’s CPI offered the first broad confirmation: tariff‑exposed goods drove more than a quarter of the monthly core increase.

Biggest movers (m/m):

- Household furnishings & operations +1.0 % — largest jump since Jan 2022

- Apparel +0.4 % (footwear +0.7 %)

- Recreation commodities +0.4 % (audio‑video equipment +1.1 %)

- Major appliances +0.3 %

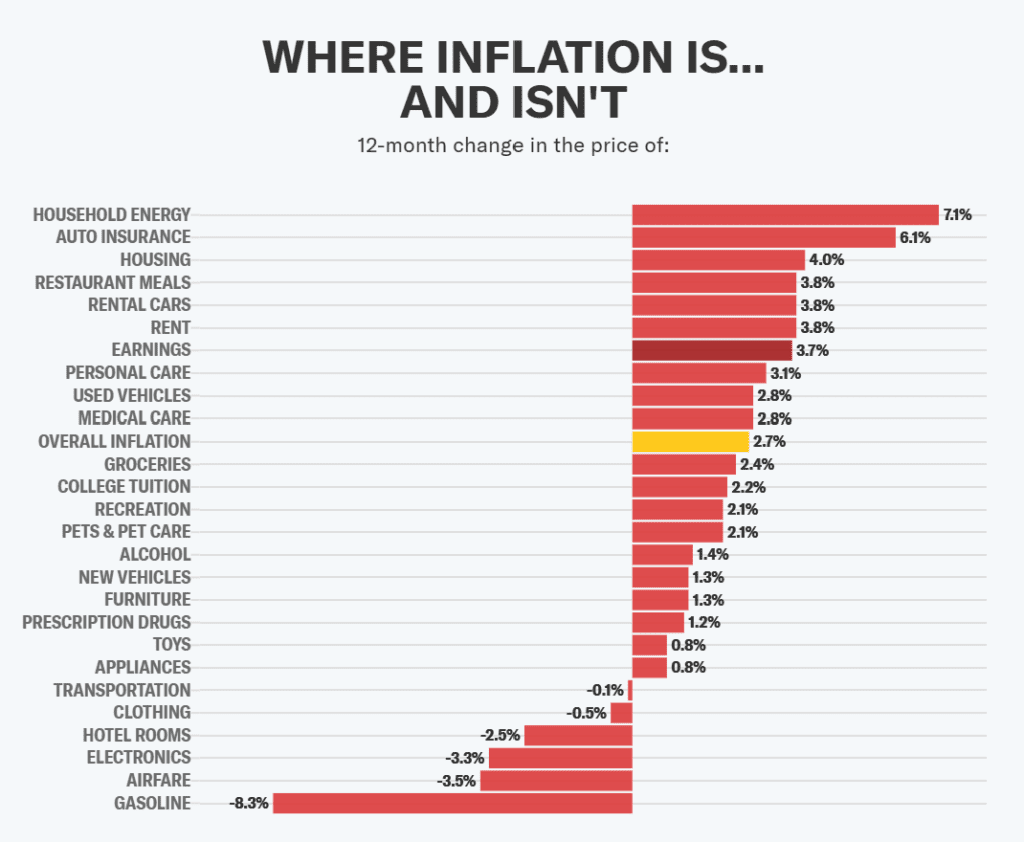

What’s Getting Pricier — Category Deep‑Dive

Beyond tariffs, the usual inflation pain points still nipped consumers. Food and medical bills kept climbing, while shelter costs—though easing—remained the biggest single CPI driver.

| Category | MoM % | YoY % | Quick take |

|---|---|---|---|

| Coffee | +2.2 | +4.7 | Arabica futures + tariff pass‑through |

| Beef (ground) | +0.9 | +9.8 | Drought & feed costs |

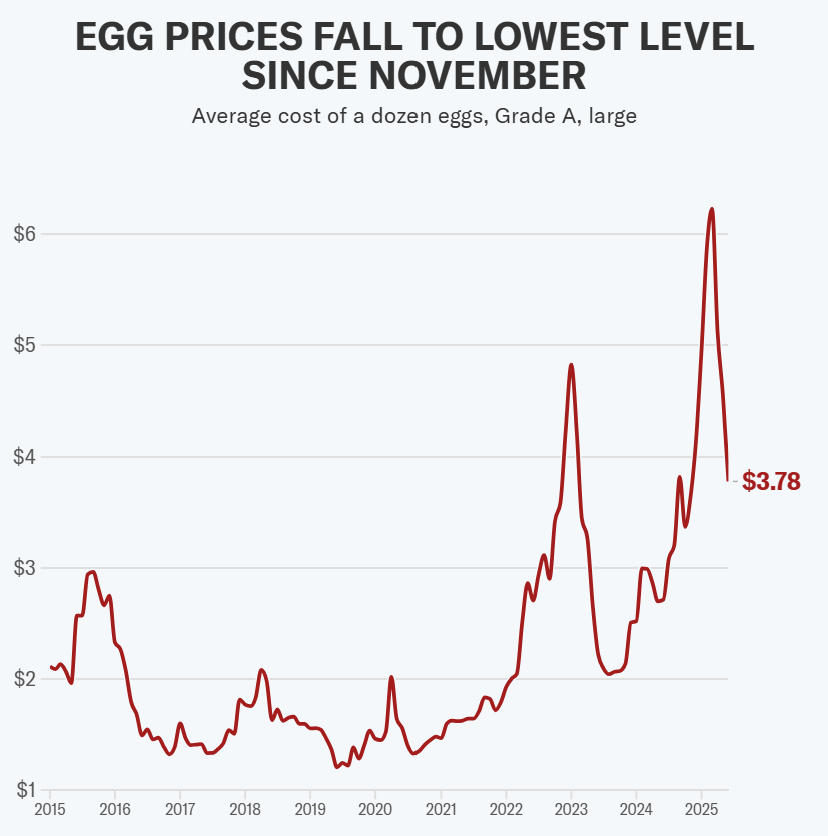

| Eggs | –7.4 | +27.4 | Avian‑flu recovery, but still elevated |

| Medical services | +0.6 | +3.4 | Hospital costs +0.7 % |

| Shelter | +0.2 | +3.8 | Slowest annual gain since 2023 |

| Used cars | –0.7 | +2.8 | Pandemic spike unwinding |

| Gasoline | +1.0 | –8.3 | Still cheaper than a year ago |

How Markets Reacted

Traders viewed the report as a modest setback for rapid Fed easing—but not a game‑changer. Bond yields edged up, the dollar’s bounce fizzled, and equities kept a cautious bid.

- Two‑year Treasury: +5 bp to 4.59 %

- Fed‑funds futures: September‑cut odds fell to ~40 %

- S&P 500 futures: trimmed early gains but stayed positive, buoyed by Nvidia chip news

- Dollar Index: gave back a knee‑jerk pop; euro holds near $1.17

What It Means for the Fed

The data landed just as President Trump labeled Chair Jerome Powell a “knucklehead” for not slashing rates below 1 %. Economists say the report hands Powell cover to sit tight in July and maybe September:

- Scott Anderson, BMO: June is “a step in the wrong direction that will keep the Fed on the sidelines.”

- Seema Shah, Principal: Tariff levies are “slowly filtering through core goods prices,” so the Fed should wait for the full impact.

Futures now imply fewer than two rate cuts in 2025, down from three just a week ago.

Looking Ahead

Tariff escalation and housing‑market cooling will dominate the next data prints. If Trump’s across‑the‑board 15 %–20 % levy launches on Aug 1, economists warn of a second inflation bump into Q4.

| Date | Event | Why it matters |

|---|---|---|

| Jul 24 | Fed Beige Book | First anecdotal take on post‑tariff price hikes |

| Jul 30 | FOMC meeting | 95 % odds of “hold” |

| Aug 1 | Tariffs on Canada, EU, Mexico take effect | Direct hit to durable‑goods CPI |

| Aug 12 | July CPI | Last read before the September FOMC |

| Mid‑Aug | Big‑box retailer earnings | Corporate color on pass‑through |

| Sep 11 | Aug CPI | Potential decider for a fall rate cut |

Tariff timer: Aug 1 duties on Canada, Mexico and the EU could add fresh bumps in coming months.

Fed watch: Next pivotal data points are July PPI (Aug 14) and August CPI (Sep 11), the last read before the September FOMC.

Corporate lens: Big‑box retailers and appliance makers will face pointed questions on pass‑through in Q2 calls over the next three weeks.

Inflation isn’t back to the 2022 panic highs, but tariffs are finally starting to bite—one sofa, steak and cup of coffee at a time—leaving the Fed little room to loosen policy until the trade smoke clears.

The main source is Yahoo. Finance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans

Hegseth Orders Every US Squad Armed by 2026: Defense Stocks Up

Tesla Paid for Elon’s Politics — Will the “America Party” Help or Hurt?

Shaken, Not Stirred: Markets brush off Trump’s latest tariff barrage

Wall Street Remains Resilient Amid New Tariff Threats

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners