As a small business owner, there are many important decisions you’ll have to make. One of your biggest choices is picking the right bank for your company. A good bank can help your business grow, while the wrong one might hold you back. This article will guide you through how to choose a bank for your small business.

Why You Need a Separate Business Bank Account

Before we dive into how to choose a bank for your small business, let’s talk about why you need a business account in the first place. Here are some key reasons:

- Having a separate business bank account keeps your business and personal money separate. This makes it easier to track your business finances and avoid mixing them with your personal expenses.

- It makes doing your taxes much simpler. When all your business transactions are in one place, you won’t have to spend hours sorting through personal and business expenses.

- It makes your business look more professional. Customers can pay you with credit cards, and you can write checks from your business account.

- It can protect you if your business gets sued. If you have a separate business account, it’s harder for someone to go after your personal money if they sue your company.

How to Choose a Bank for Your Small Business: What to Look for

Now that you know why you need a business account, let’s talk about what features to look for when choosing a business bank account:

- Low fees: Look for accounts with low or no monthly fees. Some banks waive fees if you keep a certain amount of money in your account; you can go for those.

- High transaction limits: Make sure you can make enough transactions (like writing checks or making deposits) without extra fees. Some banks only allow a limited amount of transactions daily.

- Cash deposit allowance: If your business deals with a lot of cash, check how much you can deposit for free each month.

- ATM access: Find a bank with lots of ATMs near you, especially if you need to deposit or withdraw cash often.

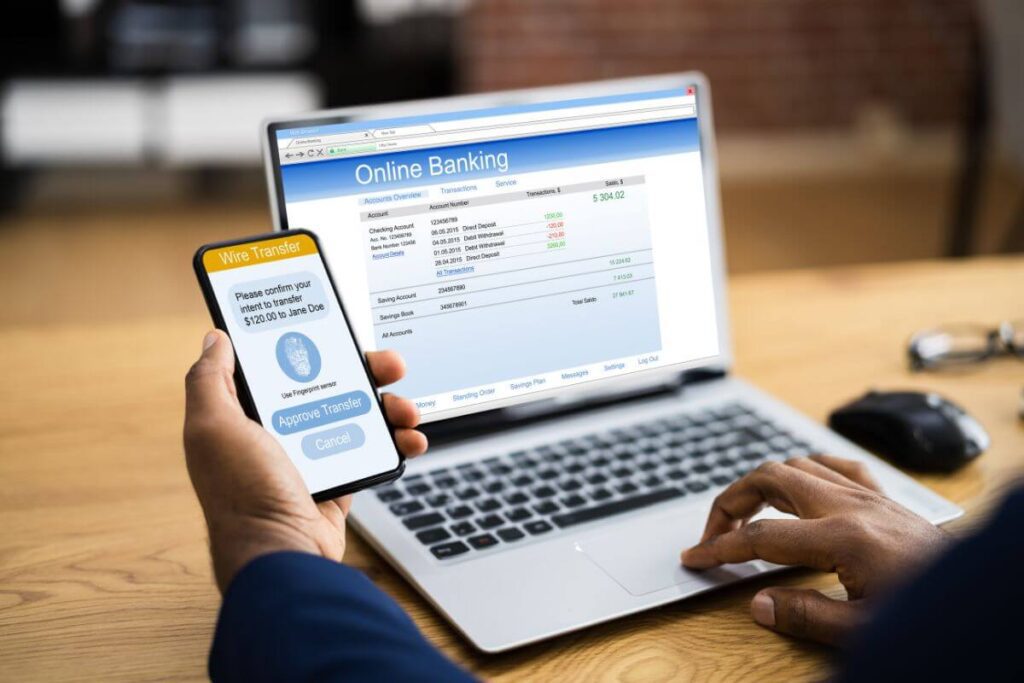

- Online and mobile banking: You need to choose a bank with good online tools that can help you manage your money from anywhere.

- Integration with other tools: Look for a bank that works well with the software you use for accounting and other business tasks. This helps ensure that everything runs smoothly.

Types of Banks to Consider

There are three main types of banks to think about:

- Traditional banks: Traditional banks have physical branches you can visit. They often offer various services but might have higher fees. Many traditional banks also have online banking tools.

- Online banks: Online banks operate entirely online. They usually have lower fees and better interest rates, but you can’t visit a branch in person.

- Credit unions: These are like banks but are owned by their members. They often have good customer service and low fees but might have fewer branches.

Steps to Choose the Right Bank

Here is a step-by-step guide on how to choose a bank for your small business:

- Think about what you need: Do you need to deposit cash often? Do you write a lot of checks? Make a list of your must-have features so that you can identify the banks that can fulfill your needs.

- Research different banks: Once you know the services you need, you need to find the banks offering them. Look at several banks and compare what they offer so that you can choose the best option.

- Read the fine print: Every bank and account type has its terms and conditions. Make sure you understand all the fees and rules for each account.

- Prepare your documents: Banks will need certain papers to open your account, like your business license and tax ID number. Prepare them ahead before going to the bank.

Top Business Bank Accounts to Consider

Here are some popular business bank accounts for people in the US to look into:

- Chase Business Complete Checking (for businesses that need both online and in-person banking)

- Capital One Spark Business Checking(offers unlimited free transactions)

- Bank of America Business Advantage Banking (offers good rewards programs and loan options)

- U.S. Bank Silver Business Checking (good for small businesses and freelancers)

- Bluevine Business Checking (offers high interest rates on your balance)

- Novo Business Checking (no monthly fees)

- Mercury Business Bank Account (good for tech companies and startups)

How to Choose a Bank for Your Small Business: Tips for Managing Your Business Bank Account

Once you’ve chosen a bank, here are some tips to manage your account well:

- Check your account regularly. Look at your transactions and balance often to catch any mistakes.

- Take advantage of online banking tools like mobile check deposit and online bill pay.

- Keep good records by saving all your receipts and bank statements for tax time.

- Build a relationship with your banker. Getting to know your banker can be helpful if you ever need advice or want to apply for a loan.