The inflation rate is a critical economic indicator that reflects the rate at which the general price level of goods and services in an economy rises over a period of time.

Understanding how to calculate the inflation rate is essential for economists, policymakers, businesses, and individuals alike, as it affects everything from the cost of living to investment returns.

Calculating the inflation rate is actually really easy. Anyone can do it with the inflation rate formula which is shown in the further paragraphs.

What is Inflation?

The steady rise in prices of goods and services over time in an economy is known as inflation. It results in a decline in the purchasing power of money, meaning that a given amount of currency buys fewer goods and services than before.

For example, if the inflation rate is 3%, a product that costs $100 today will cost $103 next year.

Types of Inflation

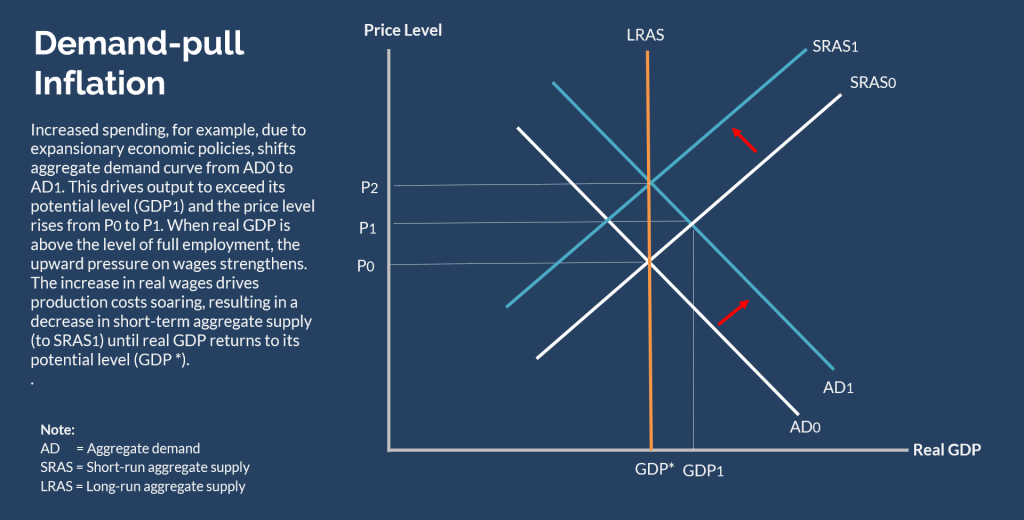

Demand-Pull Inflation

Demand-pull inflation arises when the demand for goods and services exceeds the economy’s capacity to produce them.

This imbalance between supply and demand pushes prices higher as consumers compete to purchase the available goods.

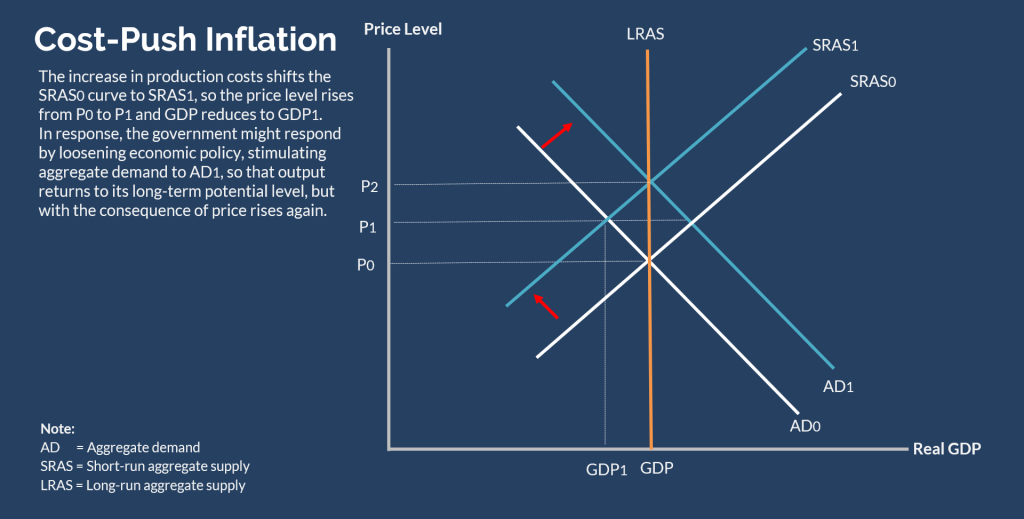

Cost-Push Inflation

Cost-push inflation occurs when the cost of producing goods and services rises. This could be due to increased costs for raw materials, labor, or other inputs.

As production becomes more expensive, businesses pass these costs onto consumers by raising prices, leading to inflation.

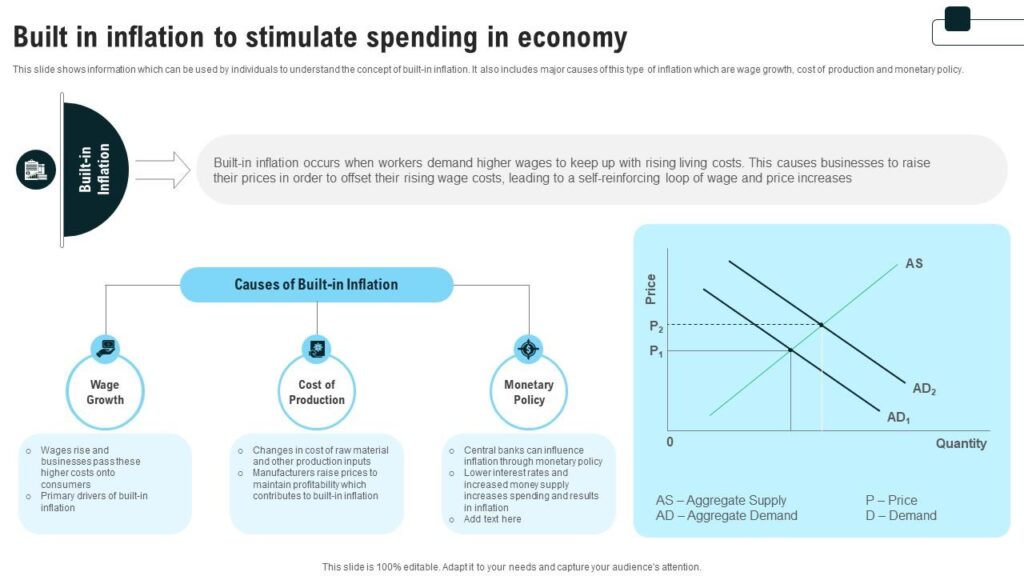

Built-In Inflation

Built-in inflation happens when workers seek higher wages to keep pace with rising living costs. To retain employees and prevent labor shortages, businesses often agree to these wage increases.

However, to cover the higher payroll expenses, companies may raise prices on their goods and services, further driving inflation.

Why is Inflation Important?

Inflation is a key economic metric for several reasons:

- Cost of Living: Inflation directly impacts the cost of living. As prices rise, households need more money to maintain the same standard of living.

- Investment Decisions: Investors need to consider inflation when making decisions. For example, a bond that pays 5% interest is less attractive if inflation is running at 4%.

- Wages and Salaries: Wage negotiations often consider inflation, as employees seek raises that keep pace with rising prices.

- Economic Policy: Central banks monitor inflation closely to set monetary policy, including interest rates, to either stimulate the economy or cool it down.

Inflation Rate Formula

To calculate the inflation rate, you’ll need a starting point, an endpoint, and data from the Consumer Price Index (CPI), which tracks the average change in prices over time and is published by the U.S. Bureau of Labor Statistics.

The inflation rate formula helps you determine the percentage change in prices between two points in time.

In this formula:

- A represents the initial CPI value for a specific good or service at the start date.

- B represents the CPI value for the same good or service at the end date.

To use the formula:

- Subtract A from B to find the change in price for the specified good or service.

- Divide the difference by A (the initial price) to obtain a decimal.

- To get the percentage, multiply the decimal by 100. This percentage is the inflation rate.

Measuring Inflation: The Consumer Price Index (CPI)

The most common way to measure the inflation rate is by using the Consumer Price Index (CPI).

The CPI tracks changes in the price level of a basket of consumer goods and services, such as food, transportation, and healthcare, which represents typical household consumption.

How to Calculate the Inflation Rate Using CPI

To calculate the inflation rate using CPI, follow these steps:

- Determine the CPI for Two Time Periods:

- Find the CPI for the base period (often the previous year or month).

- Find the CPI for the current period.

- Suppose the CPI for January 2023 is 250, and the CPI for January 2024 is 260.

Apply the Inflation Rate Formula:

The formula to calculate the inflation rate is:

Plugging in the values:

So, the inflation rate between January 2023 and January 2024 is 4%.

Alternative Measures of Inflation

While the CPI is the most widely used measure of the inflation rate, there are other indices that can also be used depending on the context:

- Producer Price Index (PPI): Calculates the average difference between the selling prices domestic producers obtain for their output. It’s often seen as a leading indicator of consumer inflation.

- GDP Deflator: Represents the average cost of all goods and services produced in a country. Unlike the CPI, which focuses on consumer goods, the GDP deflator includes investment goods, government services, and exports.

- Personal Consumption Expenditures (PCE) Price Index: The Federal Reserve uses it to track changes in the costs of consumer goods and services in order to determine inflation. It’s considered more comprehensive than the CPI.

Sources: