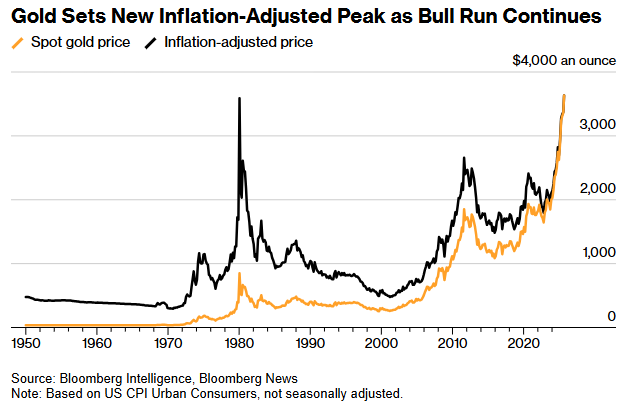

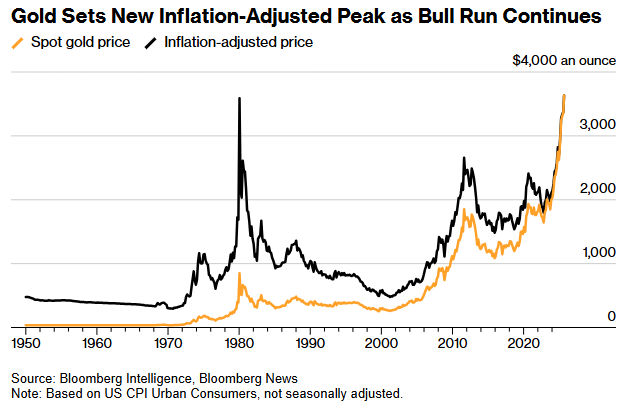

Gold prices broke through their 45-year inflation-adjusted record, hitting new highs above $3,670 per ounce, as economic worries, Trump-era tariffs, and looming Fed rate cuts drive investors toward safe havens.

Gold’s bull run continues to rewrite history. Spot prices climbed as high as $3,687.50 per ounce on Thursday, surpassing the inflation-adjusted peak set in January 1980, when bullion touched $850 per ounce—worth roughly $3,590 today after adjusting for decades of consumer inflation. Analysts agree gold has now firmly cleared that hurdle, marking a symbolic and psychological milestone in financial markets.

Why gold is soaring

Fed policy expectations: Investors are betting the Federal Reserve will cut rates next week in response to a slowing labor market, despite inflation running above the 2% target. Lower interest rates reduce the appeal of interest-bearing assets and weaken the dollar, boosting demand for non-yielding gold.

Tariff and stagflation risks: Trump’s sweeping tariffs have fueled fears of higher costs and supply shocks. Many traders see gold as protection against stagflation — slow growth combined with sticky inflation.

Safe-haven demand: Ongoing geopolitical tensions, from Russia–NATO flare-ups to Middle East instability, continue to funnel global capital into bullion as a hedge against currency and market volatility.

The numbers

Year-to-date surge: Gold has jumped 40% in 2025, smashing more than 30 new nominal records.

September momentum: In just the first 11 days of September, bullion is already up 5%, accelerating its three-year bull market.

Spot close: Prices settled near $3,656.40, still above the previous inflation-adjusted record of $3,498.77.

Historical context

The last time gold hit an inflation-adjusted record was in 1980, during President Jimmy Carter’s final year in office, as the US battled high inflation, rising energy costs, and geopolitical uncertainty. Four and a half decades later, under President Donald Trump, history has repeated itself — with gold again becoming the ultimate hedge against economic turbulence.

Analysts say the rally could extend further if the Fed opts for a deeper cut — 50 basis points instead of 25 — or if global growth continues to wobble under the weight of tariffs and debt burdens. While some warn of volatility near all-time highs, consensus holds that gold’s role as a store of value has rarely looked stronger.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CPI report shows prices climbing faster than July, What it means for Fed

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility