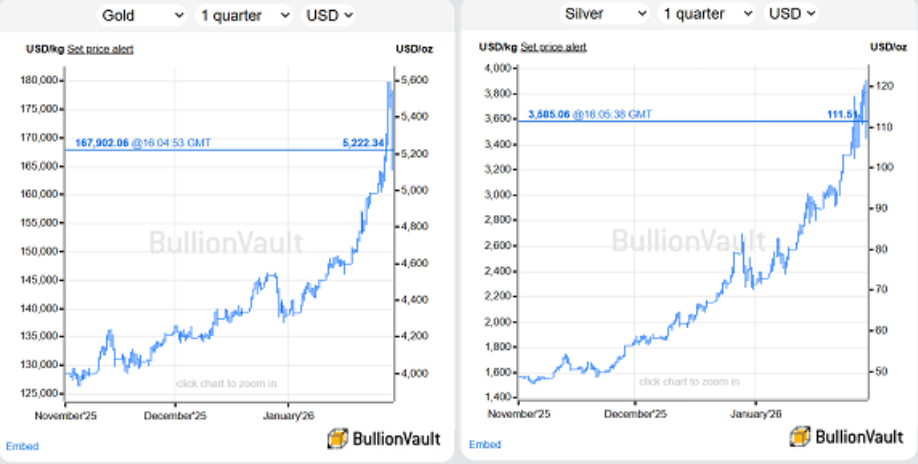

Gold and silver prices fell hard on Thursday after hitting fresh record highs, as a sharp selloff in US tech stocks rattled markets and triggered a rush out of so-called safe havens.

Gold dropped nearly $500 per ounce from its peak, sliding to around $5,100. The move erased an estimated $3.4 trillion from the total value of all gold above ground, following an 8.7 percent plunge in a single session.

Silver suffered an even steeper fall. After climbing above $121 per ounce earlier this week, the metal sank nearly 12 percent to around $107, marking one of the sharpest reversals in recent history.

More about: Gold’s Rally Isn’t Over: Why Analysts Say the Metal Could Reach $6,000 This Year

The pressure came as major US technology stocks slid, led by a sharp drop in Microsoft, which lost close to 12 percent after earnings showed slower growth in its Azure cloud and AI business. Weakness also spread across the AI sector, with Oracle falling more than 5 percent and Nvidia down nearly 3 percent at the open.

Market analysts said extreme volatility was amplifying the move in precious metals. As prices swung rapidly, liquidity thinned, and banks reduced risk exposure, worsening price fluctuations. Trading volumes in gold-linked ETFs surged, while silver futures and ETF activity cooled after earlier record levels.

Despite the sharp selloff, both metals later stabilised, recovering part of their losses but remaining well below their recent highs. The US dollar edged slightly higher after sliding earlier in the week, adding further pressure to commodity prices.

The episode has fueled growing concern that the AI-driven rally across tech and commodities may be entering a more volatile and fragile phase.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.