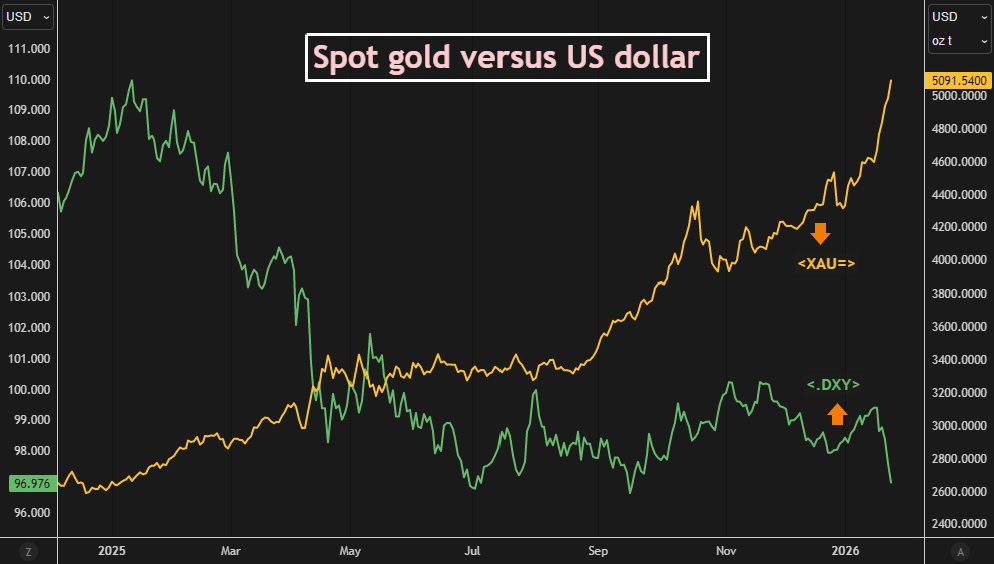

Gold surged to a new record on Monday, climbing above $5,100 an ounce as investors rushed into safe-haven assets amid rising geopolitical tensions and fresh trade fears.

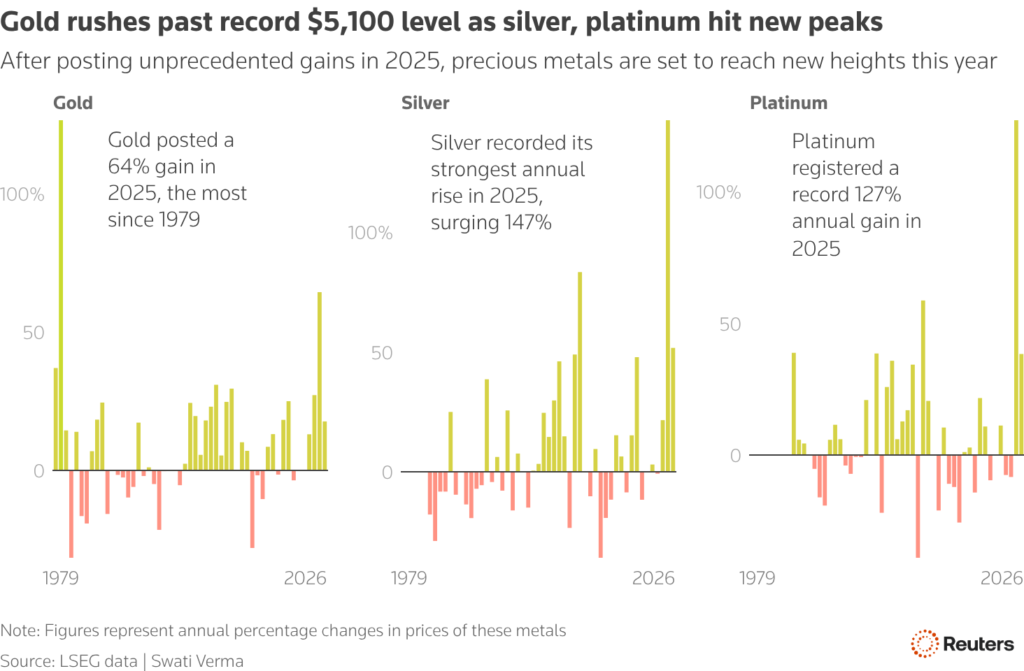

Spot gold rose 2.3% to $5,096.60, after touching an all-time high of $5,110.50. The metal is now up 18% in 2026, following a 64% rally last year.

The move was driven by President Donald Trump’s threat to impose 100% tariffs on Canada if it pursues a trade deal with China, along with uncertainty ahead of this week’s Federal Reserve meeting and political pressure on Fed Chair Jerome Powell.

“Geopolitical and economic uncertainty continues to support gold,” said Ryan McIntyre of Sprott, noting strong central bank buying and renewed ETF inflows.

Other precious metals also hit records. Silver jumped to $112.18, while platinum and palladium touched multi-year highs.

Several banks now expect further gains. Societe Generale sees gold reaching $6,000 by year-end, while Morgan Stanley’s bullish case points to $5,700.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Gold and Silver Soar as Bitcoin Falls Behind in 2025