Wall Street’s rally stalled on a weak US payrolls report, Europe wobbled, and Japan’s prime ministerial resignation rattled currency markets. Investors enter the new week focused on inflation data, Fed policy bets, and shifting commodity flows.

Last Week in Review

United States: From Tech Relief to Labor Shock

Markets kicked off September on a fragile note. Midweek, sentiment was lifted by Google’s antitrust win that preserved a lucrative $20B search deal with Apple, and by Broadcom’s AI-fueled earnings beat. Yet the optimism crumbled on Friday after the Labor Department reported only 22,000 jobs added in August, far short of estimates, while June was revised into negative territory for the first time since 2020. Unemployment rose to 4.3%, the highest since 2021, fueling fears of an economic slowdown even as bets on Fed rate cuts surged.

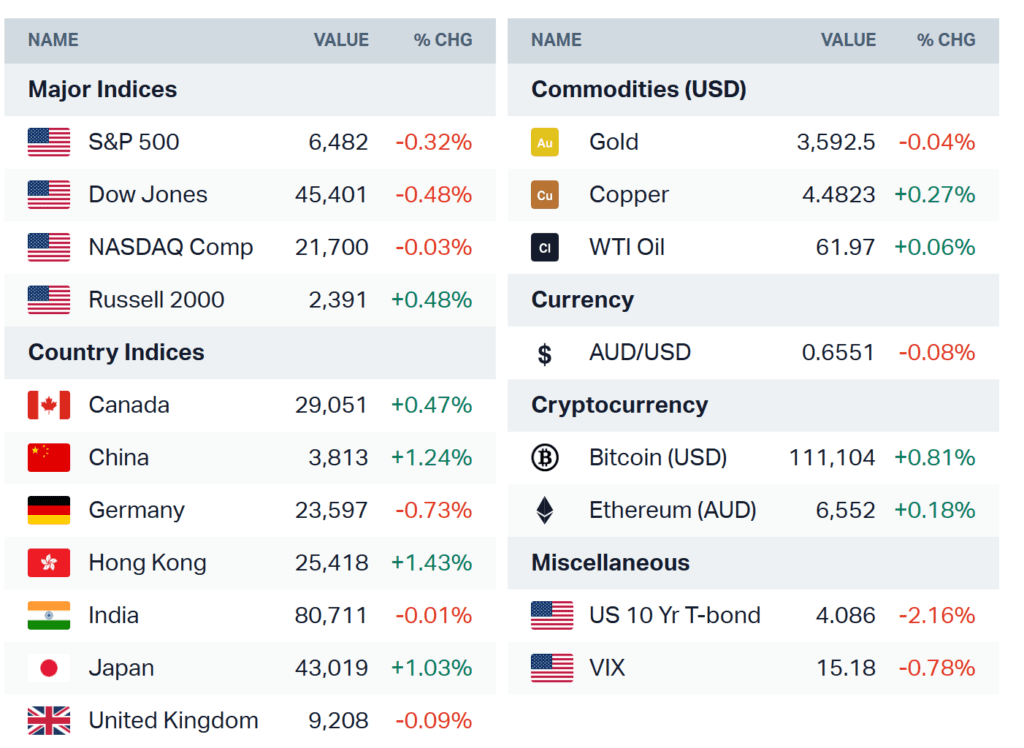

- Indexes (weekly): Nasdaq +1.14%, S&P 500 +0.33%, Russell 2000 +1.04%, Dow −0.32%

- Jobs data: August NFP +22k (vs ~77k est), June revised −13k, unemployment 4.3%

- Rates: Markets now fully price a 25 bps Fed cut in September; odds of 50 bps cut ~10%

- Sector split: Banks and brokers sold off, while tech held up on Broadcom’s strength

- Safe havens: Gold and bitcoin surged as investors sought protection

Europe: Growth Concerns Eclipse Inflation Stability

European equities mirrored Wall Street’s swings, with optimism on early Fed cuts giving way to worries about US growth. Inflation stayed close to target, keeping the ECB sidelined for now, while banks underperformed and industrials held firm.

- STOXX 600 −0.17%, DAX −1.28%, CAC 40 −0.38%, FTSE 100 +0.23%

- Eurozone inflation: headline 2.1%, core 2.3%

- Laggards: banks, energy; outperformers: industrials, resources

Asia: Political Upheaval and Trade Worries

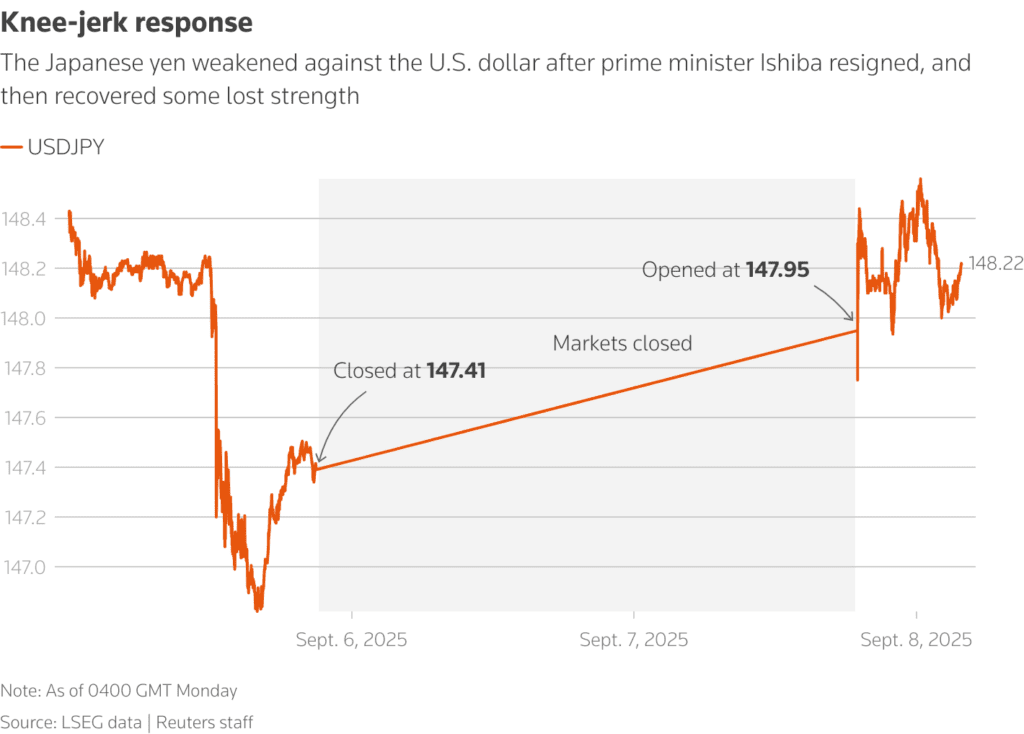

Japan’s markets advanced last week, but politics dominated into the weekend as Prime Minister Shigeru Ishiba resigned amid mounting pressure over fiscal management. The news rattled investors, weakening the yen to near ¥148/$, while uncertainty clouded the Bank of Japan’s policy outlook. Meanwhile, Chinese shares slipped after August’s liquidity-driven rally, though Hong Kong equities gained on AI optimism and risk appetite.

- Nikkei +0.70%, TOPIX +0.98%

- JGB 10-yr ~1.57%; yen volatile around Ishiba’s departure

- CSI 300 −0.81%, Shanghai −1.18%, Hang Seng +1.36%

How We Started This Week

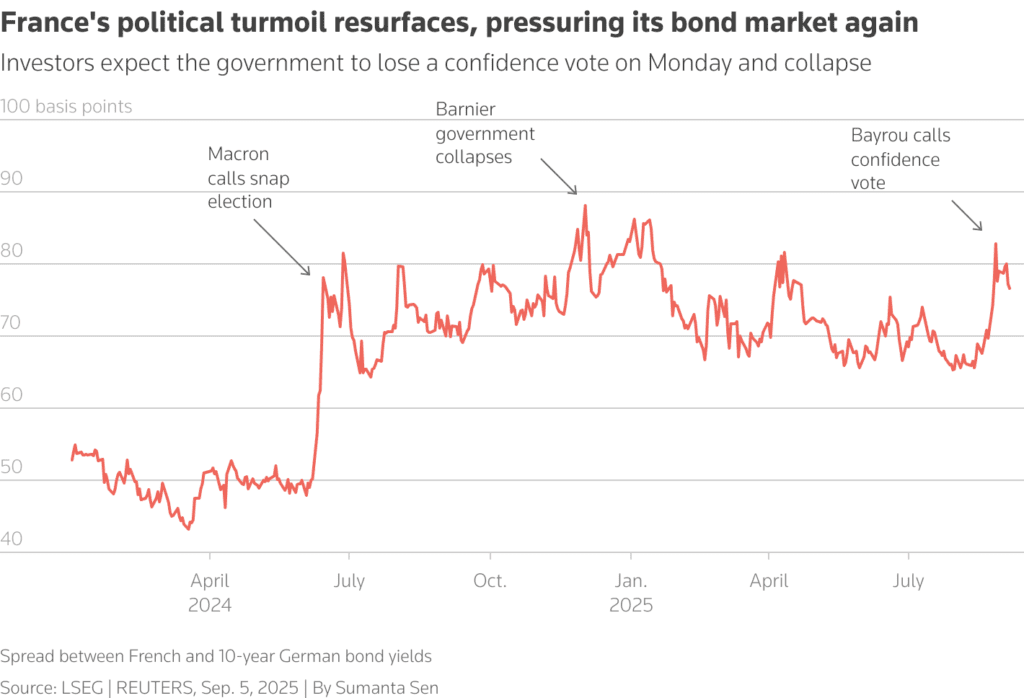

Global markets opened the week cautiously. US futures edged higher Sunday night, with Dow, S&P 500, and Nasdaq contracts up 0.2–0.4%, suggesting resilience despite Friday’s stumble. European futures were flat, with investors eyeing political turmoil in France as President François Bayrou faces a confidence vote. In Asia, the yen stayed weak after Ishiba’s resignation, helping push the Nikkei close to record peaks, while Chinese shares dipped on lingering trade-war worries.

- US futures: Dow +0.2%, S&P 500 +0.2%, Nasdaq +0.4%

- Europe: flat start expected, focus on France’s leadership crisis

- Japan: yen weak near ¥148/$, Nikkei near all-time highs

- China: CSI and Shanghai under pressure; Hang Seng firmer

Commodities & Crypto

The shift toward safe havens was the biggest theme into the weekend, and it continues to color Monday’s open.

- Gold: surged to a fresh record, closing US$3,586/oz after touching US$3,594 intraday; up ~37% YTD

- Oil: Brent −2.2% to US$65.50/bbl, WTI −2.3% to US$62.05, pressured by OPEC+ signaling October supply hikes

- Iron ore: steady near US$105/t; supportive for miners despite global slowdown worries

- Copper/base metals: mixed as demand concerns offset supply tightness

- Bitcoin: holding just above US$110,000, little changed but supported by its safe-haven narrative

- Other crypto: modest gains across majors, with Ethereum trading higher in tandem with bitcoin stability

The Week Ahead

Inflation Data: The Decider for Fed

All eyes are on US PPI (Wednesday) and CPI (Thursday), which will determine whether September brings a standard 25 bps cut or raises the possibility of a 50 bps move. Soft prints could unleash another rally in tech and rate-sensitive sectors; sticky services would restrain the dovish bets.

Central Bank Path

With the Fed now in blackout mode, markets will take their cues solely from data. The ECB is expected to hold steady, but speculation is rising about another cut later in the year. In Japan, Ishiba’s resignation has deepened uncertainty over BOJ policy timing.

Tariffs and Trade

Fresh headlines on Trump’s tariff strategy — particularly for chips, autos, and metals — will remain a driver for sectors tied to global supply chains. Japan’s new trade deal with Washington adds another layer of complexity, with South Korea and Europe watching closely.

Continue here: What To Watch in Markets This Week: Inflation in Focus