Markets opened September with a steadier tone. The US was quiet for Labor Day, Europe staged a small rebound, and precious metals broke higher. But with jobs data and tariffs hanging over investors, the calm may not last.

United States — A Pause Before the Storm

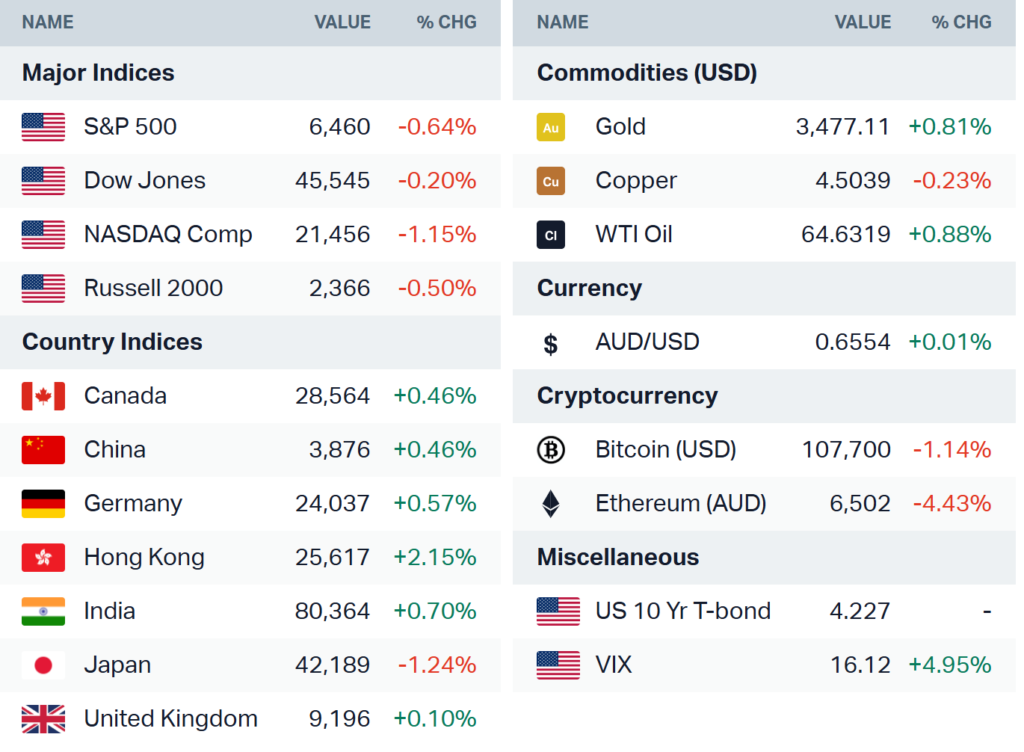

Wall Street took the day off for Labor Day, so all eyes were on futures. S&P 500 and Nasdaq 100 contracts nudged about 0.2% higher, clawing back a bit from last week’s tech-led selling.

But make no mistake: September is rarely kind to stocks. With the Fed meeting on September 17, traders know this month will test nerves. Futures markets already price over 140 bps of cuts by end-2026 — numbers you normally see only in a recession. That’s why every data point matters now.

Some analysts still strike a bullish note. Evercore ISI argues the S&P 500 could climb another 20% by 2026, powered by AI. They call pullbacks “buying chances” rather than warning signs.

Europe — Defense Leads the Way

The Stoxx 600 rose about 0.2% to start the week, recovering after five losing sessions. Defense stocks stole the show. BAE Systems and Rheinmetall surged after reports that European governments are drawing up post-conflict security plans for Ukraine.

Rolls-Royce also rallied nearly 3%, with reports it’s in talks to fund its small nuclear reactor unit. The company pushed back against IPO rumors, but traders liked the story anyway.

Elsewhere, autos ticked higher on French car sales, industrials found support from analyst upgrades, and banks bounced. Insurers struggled, though, with Zurich, Swiss Re, and Allianz all lower.

Politics is another layer. France faces a confidence vote within days, and the bond market is watching closely. The spread between French and German yields could push toward 100 basis points, a red flag for European banks. Still, Goldman Sachs expects the Stoxx 600 to reach 560 by year-end, betting growth momentum and light positioning will carry it higher.

Asia — Chips and China Diverge

Asia was mixed. Japan’s Nikkei fell 1.6%, dragged down by chipmaker Advantest, which slumped 9% after a monster rally this summer. South Korea also slipped as the US revoked waivers for Samsung and SK Hynix, meaning they’ll soon need special licenses to ship advanced chip gear to China.

China went the other way. The private manufacturing PMI climbed to 50.5 in August, back into expansion, and investors kept piling into home-grown AI plays. Alibaba’s Hong Kong stock jumped nearly 19% last week, its best day since early 2022, and optimism is spilling over into September.

Tariffs

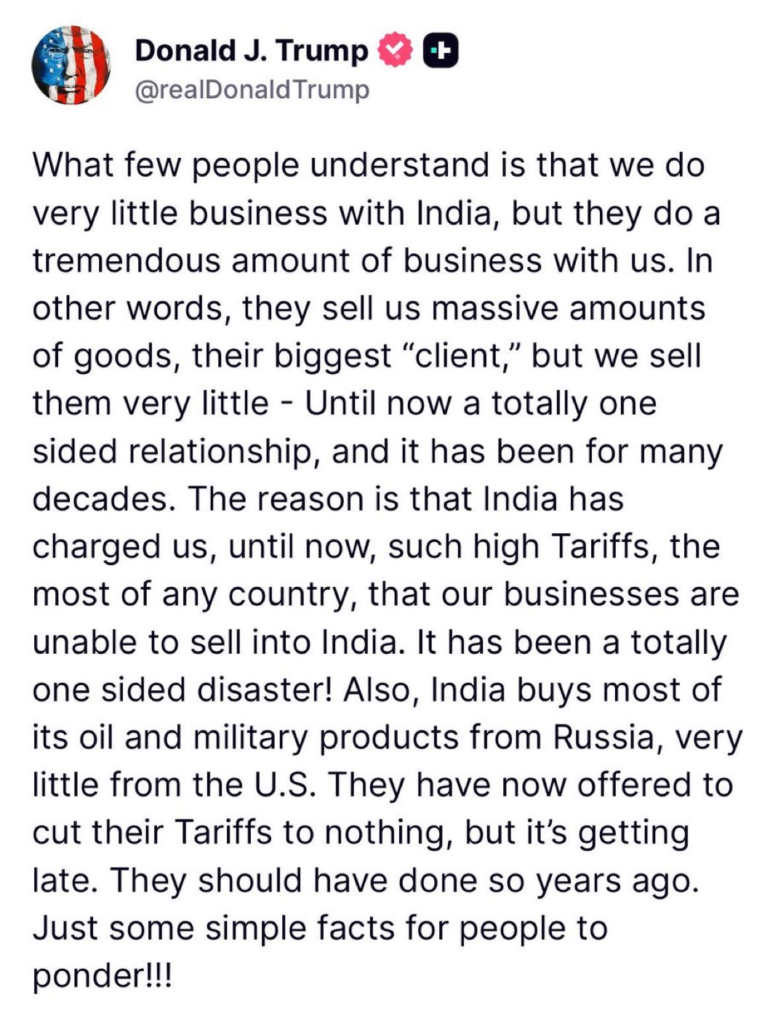

The US said trade talks will continue despite last week’s court ruling against Trump-era tariffs. But tensions with India escalated after President Trump blasted the relationship as a “totally one sided disaster!” following Prime Minister Modi’s visit to China.

Trump claimed India had offered to cut tariffs to zero but said it was “too late,” while defending his move to impose 50% tariffs on Indian goods and extra duties on Russian oil imports. India has called the measures “unfair and unjustified.”

WTO data shows India’s average tariff on US goods was 6.2% in 2024, compared with 2.4% the US levied on Indian imports. Analysts warn the friction is pushing New Delhi closer to Beijing, even if long-term partnership remains uncertain.

Commodities — Gold and Silver Shine

The biggest story overnight was metals. Gold hit $3,476 an ounce, just shy of record highs. Silver cracked $40 for the first time since 2011, while platinum and palladium both gained nearly 3%.

Oil was steadier, with Brent crude up about 1% to $68. Supply risks remain in focus, from Russian export routes to EU sanctions on Indian refineries. Bulk commodities lagged: iron ore dropped 1.8% to $101.65.

Crypto was mixed. Bitcoin reached above $110,000, but ether slid 3.4% to $4,300.

Bonds and Currencies

Bond markets were calm in thin holiday trading. US 10-year yields held at 4.23%, while Australian equivalents sat at 4.31%.

Currency moves were small. The Australian dollar inched up 0.2% to 65.5¢ on stronger metals. The euro and yen were steady.

What’s Next — All Eyes on Jobs

| Event | US Time (ET) | UK Time (BST) |

|---|---|---|

| S&P Global US Manufacturing PMI (Aug, final) | 9:45 AM | 2:45 PM |

| ISM Manufacturing PMI (Aug) | 10:00 AM | 3:00 PM |

| US Construction Spending (Jul) | 10:00 AM | 3:00 PM |

NIO (NIO) – Earnings (BMO)

Signet Jewelers (SIG) – Earnings (BMO)

Academy Sports & Outdoors (ASO) – Earnings (BMO)

Zscaler (ZS) – Earnings (AMC)

HealthEquity (HQY) – Earnings (AMC)

Today brings the US ISM Manufacturing PMI and construction spending data. But the real test lands Friday, with non-farm payrolls. Forecasts range wildly — from zero to +110k — after July’s weak report. A soft print would lock in a Fed cut; a hot one could delay easing.

Meanwhile, tariffs are still a wild card. A US court ruling declared most Trump-era tariffs illegal but left them in place until October pending appeal. The White House is pressing ahead with sector talks anyway, while Europe is working on rolling back industrial tariffs.

With CNN’s Fear & Greed Index still in Greed territory, markets are stretched and sensitive. September has a history of volatility, and with data and politics colliding, this one looks no different.