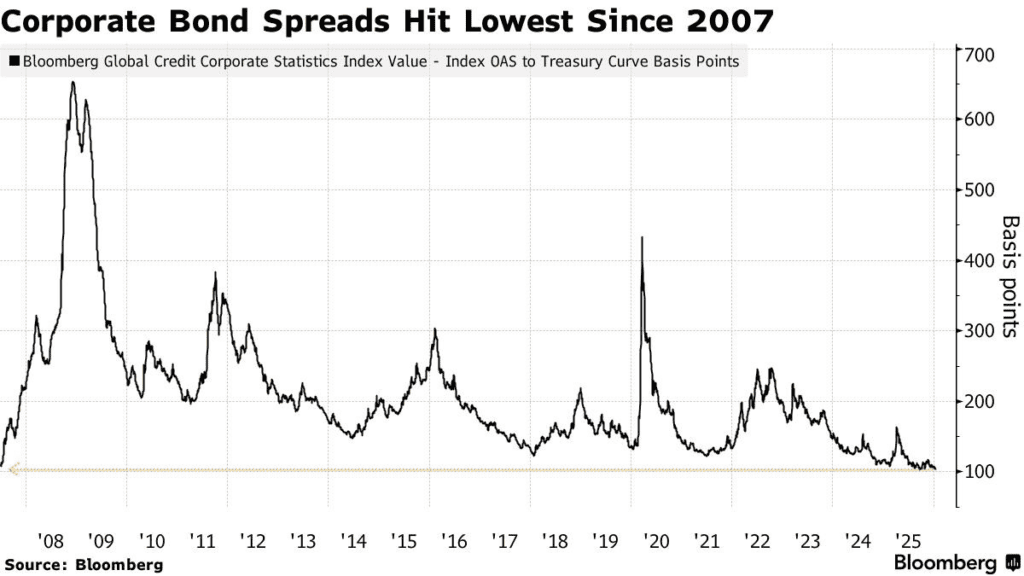

Yield premiums on global corporate bonds have narrowed to their tightest level in nearly two decades, underscoring strong investor confidence in credit markets at the start of 2026.

Global credit spreads have fallen to 103 basis points, the lowest since June 2007, according to an index tracking corporate bonds across currencies and ratings. High-yield bonds have also seen spreads compress to multi-year lows as investors continue to chase returns.

The rally is being fueled by expectations that the Federal Reserve and other major central banks will begin cutting interest rates, lowering borrowing costs and supporting economic growth. Optimism has also been reinforced by the World Bank, which recently raised its global GDP growth forecast to 2.6%.

Lower yields are helping offset risks tied to US trade policy under President Donald Trump and ongoing geopolitical tensions. Still, some investors warn that shrinking spreads leave little room for error.

“Complacency is probably the most dangerous thing in risk markets right now,” said Luke Hickmore, investment director at Aberdeen Investments, cautioning against overexposure to the riskiest parts of the market.

Corporate issuance has surged alongside demand. Companies have sold about $435 billion in bonds in the first half of January alone, a record for the period. Goldman Sachs added momentum this week with a $16 billion bond sale, the largest ever by a Wall Street bank, signaling what could be a historic year for borrowing.

Investor appetite remains strong despite the supply wave. Asian credit has stood out, with high-quality dollar bonds from the region returning 8.7% in 2025, outperforming comparable US debt.

Still, caution is growing. Strategists at Pacific Investment Management Co. say tight spreads may be masking vulnerabilities if corporate fundamentals weaken.

For now, demand and rate-cut hopes continue to support global credit markets. But with risk premiums near historic lows, investors face a narrowing margin for error.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.