Financial scams are common these days all around the globe. The aim of financial scams is often to drain money from your bank account, rack up charges on your credit card, take out loans in your name, or steal valuable personal information.

According to the data from the Federal Trade Commission (FTC), Americans lost just over $10 billion to fraud in 2023, marking a 14% increase from 2022.

Some types of fraud are escalating even more rapidly: losses from investment scams surged by nearly 21%, with consumers reporting over $4.6 billion in losses in 2023 alone.

Scammers continually refine their techniques, leveraging the latest technology to launch new schemes. To protect yourself from financial loss, staying vigilant is essential. Here are nine strategies to help you avoid falling victim to financial scams.

Understanding Financial Scams

Financial scams come in various forms, but they all have one goal: to trick you into giving away your money or personal information.

Scammers are constantly changing their tactics to exploit new technologies and trends, making it more challenging to recognize a scam when you encounter one.

Here are some of the most prevalent types of financial scams:

Phishing Scams

Phishing scams involve fraudsters pretending to be legitimate organizations, such as banks, government agencies, or well-known companies, to steal sensitive information. These scams typically come in the form of emails, text messages, or phone calls, urging the recipient to click on a link, download an attachment, or provide personal information such as passwords or credit card numbers.

How to Avoid Phishing Scams:

- Prior to sending any personal information, always verify the sender’s phone number or email address.

- Be cautious of unsolicited messages, especially those that create a sense of urgency.

- Never click on links or open attachments from unknown or dubious sources.

- Use anti-phishing software and keep your devices updated to protect against malicious attacks.

Investment Scams

Investment scams lure victims with promises of high returns with little or no risk. These scams can take many forms, including Ponzi schemes, pyramid schemes, and fake investment opportunities in stocks, real estate, or cryptocurrencies. The scammer’s goal is to convince you to invest your money in a fraudulent scheme, which ultimately results in significant financial losses.

How to Avoid Investment Scams:

- Be skeptical of investment opportunities that promise guaranteed returns or seem too good to be true.

- Research the company or individual offering the investment thoroughly before making any decisions.

- Consult with a licensed financial advisor to evaluate the legitimacy of an investment opportunity.

- Avoid making hasty investment decisions based on pressure tactics or unsolicited offers.

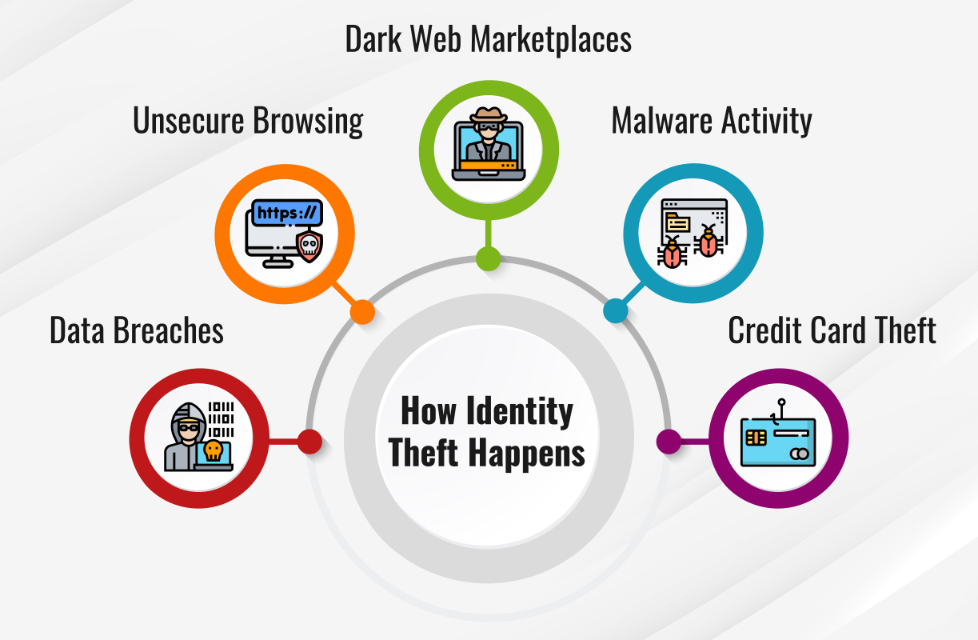

Identity Theft

Identity theft is the act of a con artist obtaining and using, without your permission, your personal information, such as your Social Security number, credit card information, or bank account information. This information can be used to open new accounts, apply for loans, or make unauthorized purchases in your name, leading to severe financial scams and legal consequences.

How to Avoid Identity Theft:

- Protect your personal information by using strong, unique passwords for online accounts and enabling two-factor authentication.

- Before discarding any documents that contain sensitive information, shred them.

- Monitor bank statements and credit reports regularly to make sure there’s no suspicious activity.

- Be cautious when sharing any personal information online or over the phone.

Online Shopping Scams

With the rise of e-commerce, online shopping scams have become increasingly common. Scammers create fake websites or social media profiles that mimic legitimate retailers, offering products at unrealistically low prices. Once the victim makes a purchase, they either receive counterfeit goods or nothing at all.

How to Avoid Online Shopping Scams:

- Shop only on reputable websites with secure payment methods (look for “https://” in the URL).

- Read user reviews and check the seller’s ratings before making a purchase.

- Be wary of deals that seem too good to be true, especially from unfamiliar sellers.

- Avoid making payments through wire transfers or prepaid gift cards, as these are common methods used by scammers.

Lottery and Sweepstakes Scams

Swindlers that prey on lottery and sweepstakes victims often claim that you have won a substantial quantity of money or a priceless item. To claim the winnings, the victim is asked to pay taxes, and fees, or provide personal information. However, no legitimate lottery or sweepstakes requires payment to receive a prize, and victims end up losing money instead of winning.

How to Avoid Lottery and Sweepstakes Scams:

- You can’t win a lottery or sweepstakes that you did not enter.

- Be suspicious of any request for payment or personal information to claim a prize.

- Verify the legitimacy of the organization by researching online or contacting them directly through official channels.

- Report any suspicious communications to the relevant authorities.

Romance Scams

Romance scams prey on individuals looking for companionship or love through online dating platforms. Scammers create fake profiles to establish relationships with their victims, often gaining their trust over time. Once the emotional connection is established, they start asking for money, claiming they need it for an emergency or to visit the victim in person.

How to Avoid Romance Scams:

- Be cautious when interacting with individuals you meet online, especially if they quickly express strong emotions or ask for financial help.

- Avoid sharing personal or financial information with someone you have not met in person.

- Do not send money or gifts to someone you have only communicated with online.

- Research the person’s profile and be wary of inconsistencies or red flags.

Tech Support Scams

Tech support scams involve fraudsters posing as legitimate tech support representatives from well-known companies. They claim that your computer has a virus or other issue and offer to fix it remotely for a fee. In reality, they gain access to your computer and steal sensitive information or install malicious software.

How to Avoid Tech Support Scams:

- Be skeptical of unsolicited phone calls or pop-up messages warning you of computer issues.

- Never give control of your computer to someone who contacts you unexpectedly.

- Use official customer support channels for any tech-related concerns.

- Keep your computer’s security software updated to prevent unauthorized access.

How to Protect Yourself from Financial Scams

While scammers are continually devising new ways to exploit unsuspecting victims, there are steps you can take to protect yourself from financial scams:

- Stay Informed: Educate yourself about the latest scams and how they operate. Awareness is your first line of defense against fraud.

- Trust Your Instincts: If something feels off or too good to be true, it probably is. Trust your gut and take time to verify any suspicious offers or requests.

- Secure Your Information: Use strong, unique passwords for your online accounts, and enable two-factor authentication whenever possible. Be cautious about sharing personal information, especially online or over the phone.

- Verify Before You Act: Before responding to any request for money or personal information, take the time to verify the legitimacy of the source. Contact the company or individual directly using official contact information.

- Report Suspicious Activity: If you encounter a scam or believe you have been targeted, report it to the relevant authorities, such as the Federal Trade Commission (FTC) or your local consumer protection agency. Reporting scams helps prevent others from falling victim.

Sources: