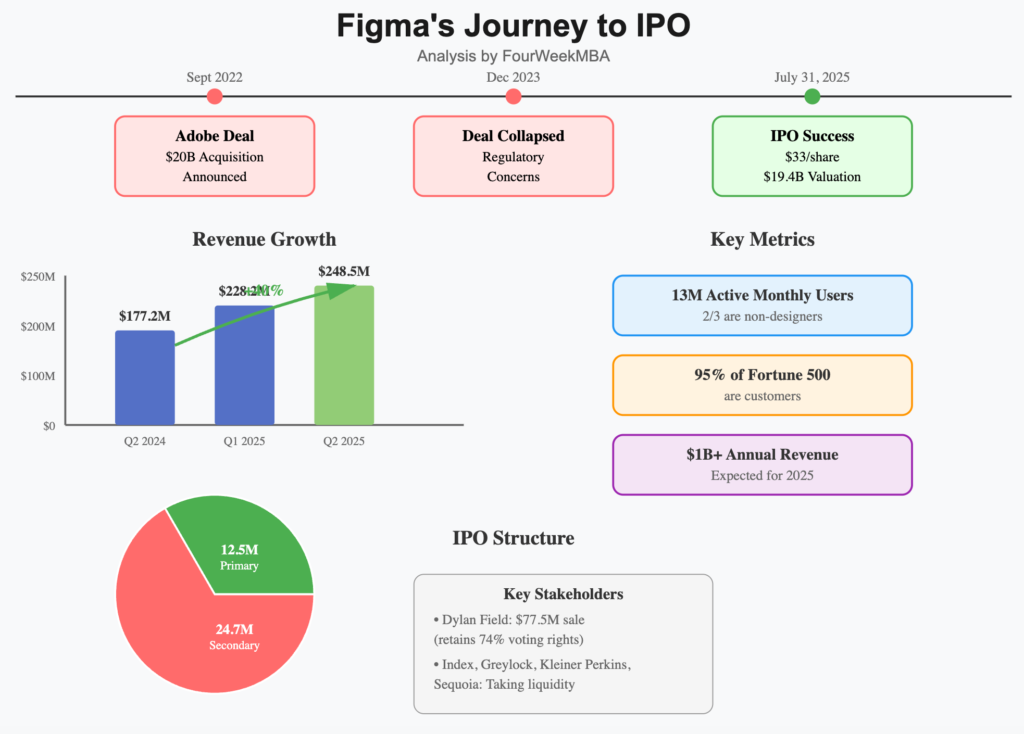

Design-software maker Figma priced its IPO at $33 a share, above its already-raised range, to raise about $1.22 billion and open today on the NYSE under ticker FIG. The deal implies a market value around $19.3–$19.8 billion depending on share count conventions, marking the largest U.S. VC-backed tech IPO since 2021, and a clear sign the “IPO window” is cracking open after a long freeze.

What just happened

After lifting its price talk from $25–$28 to $30–$32, Figma priced at $33 late Wednesday, July 30 (New York time). Today, July 31, 2025, shares begin trading. On a fully diluted basis, multiple outlets peg valuation near $19.8B; on a basic/diluted share count used by others, the headline figure is ~$19.3B. Either way, it’s a marquee listing that follows a shelved $20B Adobe deal in 2023 and re-anchors tech IPO sentiment.

- Deal size: ~$1.22B raised in total. Primary shares from Figma: 12.47M (≈$412M). Secondary shares from existing holders: 24.46M (≈$807M).

- Demand: Book was heavily oversubscribed; reporting indicated demand approached ~40× this week, after earlier reads of 30×+.

- Structure nuance: Figma used an auction-like, limit-order process to sharpen price discovery—unusual for hot tech IPOs and intended to curb an excessive day-one pop.

- Largest single seller: Marin Community Foundation planned to sell ~13.4M shares, a striking twist where a nonprofit eclipses VCs as the top seller.

Why this listing matters

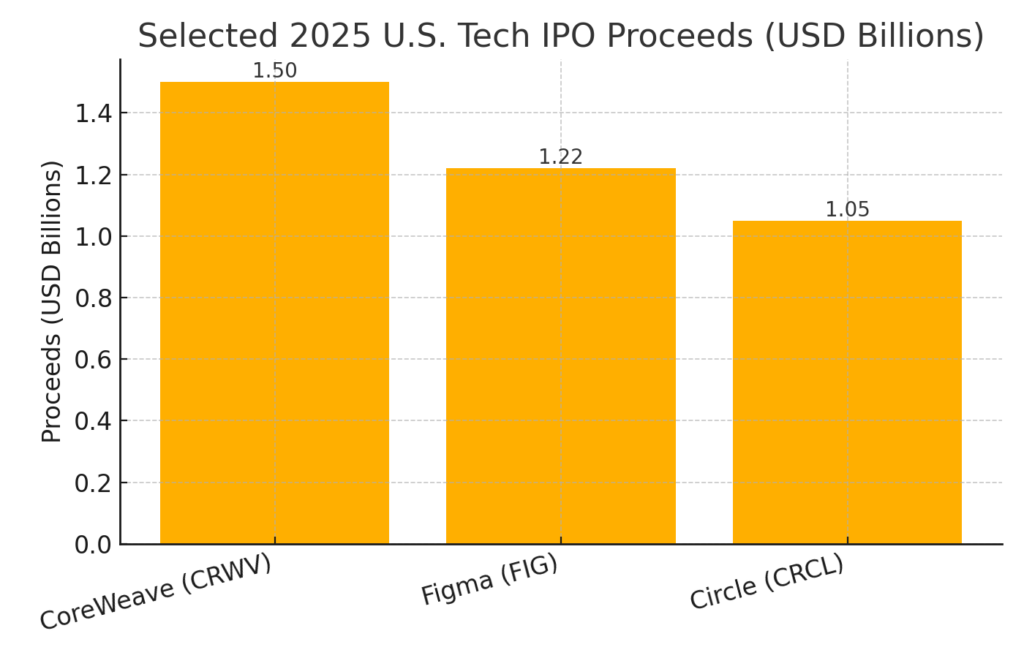

Market signal: The listing helps “re-open” the tech IPO window; it follows 2025 offerings like CoreWeave ($1.5B) and Circle ($1.05B)—Figma’s $1.2B now sits between them.

Scale & rarity: It’s the largest VC-backed American tech IPO in years, boosting confidence for late-stage unicorns eyeing the tape (e.g., Canva, Databricks).

Oversubscribed & price discovery: Coverage reportedly stretched to ~30–40× demand as Figma used an auction-like order process (investors submit price/size explicitly), helping the deal clear at $33.

Unusual cash split: With roughly 2× more secondary than primary, the deal maximizes liquidity for early holders while limiting dilution—rare for growth software listings.

Human angle: In a twist, a nonprofit (Marin Community Foundation) emerged as a major selling stockholder via a pre-IPO share donation, expected to sell ~13.4M shares.

Figma at a glance: growth, profits, and product scope

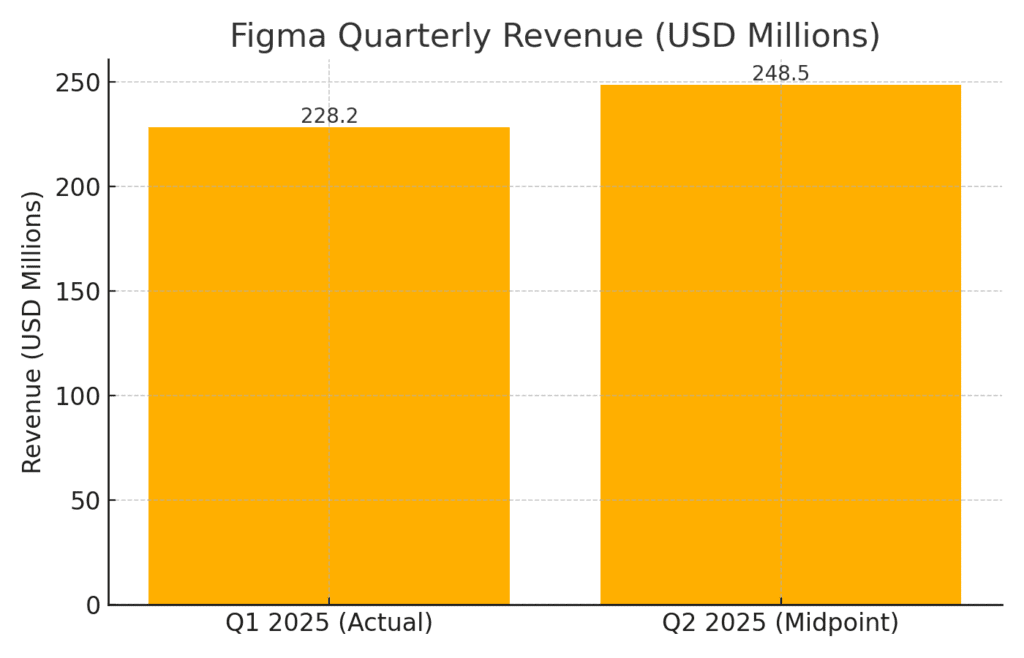

Figma’s filing and pre-results show rapid growth and improving profitability: Q1 2025 revenue grew 46% to $228.2M with $44.9M net income, and Q2 2025 preliminary revenue was $247–$250M (≈+40% YoY at the midpoint). Management highlighted 13M MAUs and penetration at 95% of the Fortune 500 as of March 31.

Graph — Figma Quarterly Revenue (USD millions): Q1 2025 (actual $228.2M) vs. Q2 2025 (midpoint $248.5M). (Midpoint derived from company’s Q2 range.)

How Figma makes money

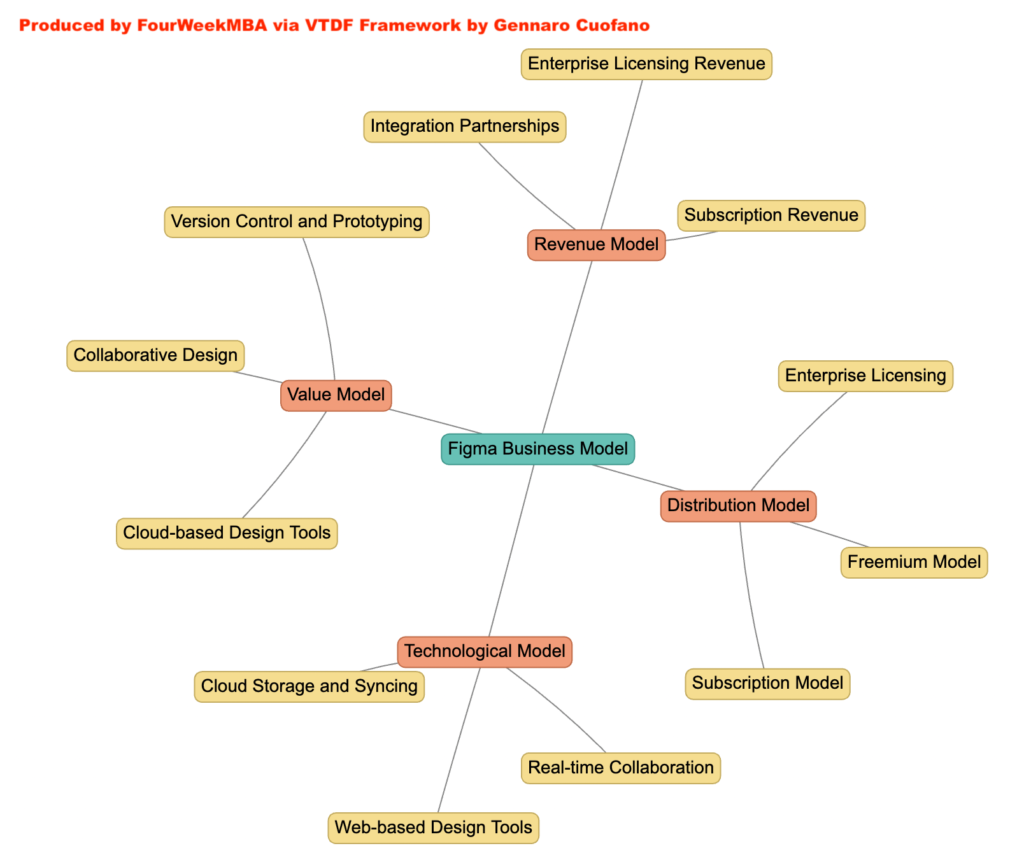

Figma’s business model centers on cloud-based, real-time collaborative design delivered via a freemium distribution engine that converts up to team and enterprise tiers. It monetizes mainly through subscriptions, with add-on streams that reinforce platform lock-in across large organizations.

Before we detail each stream, it’s useful to note that Figma’s browser-native collaboration, versioning, and developer-handoff features allow it to spread beyond “designers” into product, engineering, and marketing teams—expanding its paid seat footprint enterprise-wide.

- Subscriptions (Individuals & Teams): Monthly/annual plans that unlock advanced design/prototyping features, permissioning, and collaboration at scale. This is the core revenue driver.

- Enterprise Licensing: Custom security, governance, SSO/SCIM, analytics and admin controls for large organizations; priced per seat with enterprise SLAs.

- Education & Institutional Plans: Discounted access and tailored features for schools and programs, feeding the top of the funnel and long-term adoption.

- Plugin/Integration Ecosystem: A revenue-sharing model with third-party developers integrates Figma into broader product workflows (handoff, design systems, QA), adding incremental platform revenue.

Table — Figma revenue model (summary)

| Revenue stream | What it is | Why it matters to growth |

|---|---|---|

| Subscriptions (Individual/Team) | Per-seat access to design & prototyping features | Predictable ARR; viral adoption via freemium → team upgrades. |

| Enterprise Licensing | Security, admin, compliance for big orgs | Larger ACVs, lower churn, deep org embed. |

| Education/Institutional | Discounted seats/tenants | Talent seeding and future conversion pipeline. |

| Plugin/Integration fees | Revenue sharing with ecosystem | Extends use cases; increases switching costs. |

Competitors and alternatives

Figma’s competitive arena spans design/prototyping tools and collaboration/project management platforms that interlock with product workflows. The matrix below shows where buyers typically cross-shop.

Before the list, remember Figma’s differentiator is browser-native, real-time collaboration at scale—with shared component libraries and developer handoff—rather than a single-user desktop model. This helps it compete both with design point tools and with adjacent collaboration suites that invade design territory.

- Design & Prototyping rivals: Adobe XD, Sketch, InVision/Studio, Axure RP, Proto.io, Marvel, Balsamiq. These compete on vector editing, prototyping depth (micro-interactions, conditional logic), and design-system tooling.

- Collaboration & PM overlaps: Miro, Zeplin, Jira, Trello. These tools buttress discovery, documentation, and handoff stages around design workflows and sometimes substitute for slices of Figma use.

- Broader “alternatives” lists: Some buyer guides also include Penpot, Webflow, Moqups, Mockitt, Axure, Miro, and more, depending on team needs (open source, animation depth, or no-code site fidelity).

IPO structure, who sold what, and governance

Figma’s offering was secondary-heavy (roughly 2:1 secondary to primary), providing liquidity to early holders while limiting new dilution—again a signal of strong demand and balance-sheet sufficiency. The auction-like limit-order process sought better price discovery. And in an unusual twist, the Marin Community Foundation surfaced as the largest selling stockholder. Founders/VCs sold modest blocks; founder-CEO Dylan Field still retains super-voting control post-IPO.

Valuation context & financial profile

At $33, Figma’s IPO values the company near $19–20B, just shy of Adobe’s 2022 offer and well ahead of a 2024 private-market reset. With 40%+ revenue growth in Q2 (prelim) and Q1 profitability, bulls view the multiple as a premium for category leadership and AI leverage. Bears will note the “priced for perfection” risk typical of premium SaaS.

- Market-cap framing: ~$19.3B on commonly cited diluted count; ~$19.8B fully diluted per WSJ Pro.

- Run-rate framing: Q1 2025 revenue $228.2M; Q2 prelim $247–250M (+40% YoY midpoint); 13M MAUs; 95% of Fortune 500 customers.

- “IPO window” narrative: Multiple outlets cast Figma as reopening the venture-backed tech IPO lane.

Strategic storylines to watch

Figma’s independence after the Adobe deal collapse reshaped its path—arguably accelerating product velocity (including AI-assisted prototyping) and expanding beyond pure designer seats. The company also authorized “blockchain common stock” in its charter (no current plan to issue), a forward-looking gesture toward tokenized equity mechanics. Board adds like Mike Krieger (Instagram cofounder; now at Anthropic) and Luis von Ahn (Duolingo CEO) reinforce product-led governance.

Risks & debates

Even with momentum, there are sober watch-items that could drive volatility post-listing. Before the bullets, note that these are normal for newly public software platforms and often resolve over multiple quarters rather than weeks.

- Premium valuation versus SaaS comps; execution must sustain 40%+ growth.

- AI disruption risk: Generative tools could compress design workflows (Figma is also investing there).

- Competitive pressure from Adobe/Canva and niche, AI-native entrants; switching costs vs. innovation pace will be tested.

- Secondary-heavy optics: Big early-holder liquidity can tamp day-one pops and sharpen scrutiny of next-quarter prints.

What to watch next

- Trading mechanics today (July 31, 2025): Does the auction-like build curb day-one volatility?

- Follow-ons / lock-ups: Secondary-heavy IPOs can see supply overhang if more stock frees up post-lockup.

- Execution vs. multiple: With ~40% YoY growth targets in view, sustaining momentum while shipping AI features will be critical to justify ~19× revenue.

- Tech IPO window: If FIG trades well, it strengthens the case for other high-profile software unicorns to file.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: US IPOs Soar 53% in 2025, Led by Circle and CoreWeave — But Can the Boom Last?

The IPO market in 2025 is being driven by a clear theme — bigger is better

Medtech IPOs Spur Talk of Broader US Health-Care Listing Revival

Sources: Figma blog (pricing details & share counts) • Reuters (pricing/valuation & IPO market signal) • WSJ Pro (largest VC-backed U.S. tech IPO since 2021; ~$19.8B fully diluted) • MarketWatch (raise amount; primary vs. secondary breakdown; fully diluted share count) • Financial Times (oversubscription; Q1 results; super-voting control; underwriters) • Bloomberg (auction-like bookbuild; oversubscription; $1.2B raise above range), (https://www.bloomberg.com/news/articles/2025-07-30/figma-said-expected-to-price-ipo-above-range-at-33-per-share) • Axios Pro (Marin Community Foundation planned sale size) • Barron’s (day-of pricing & context) • Fortune (IPO window context) • Kiplinger (investor context; prospectus tidbits incl. blockchain stock authorization).

Sources