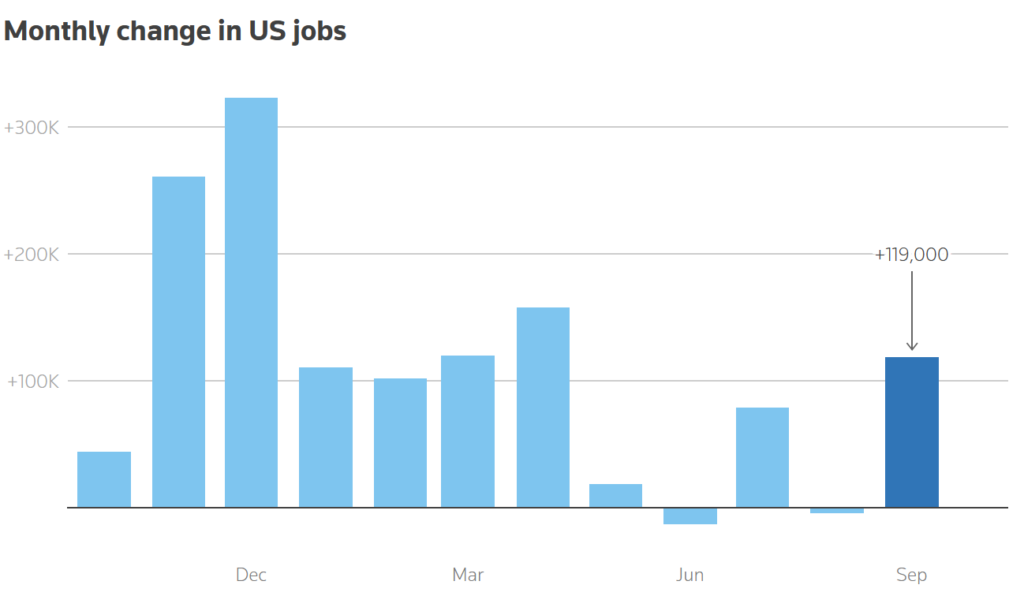

The Federal Reserve’s December meeting is shaping up to be one of the most uncertain in years after a messy batch of delayed labor data, rising unemployment and renewed inflation concerns pushed policymakers further apart on the path of rate cuts.

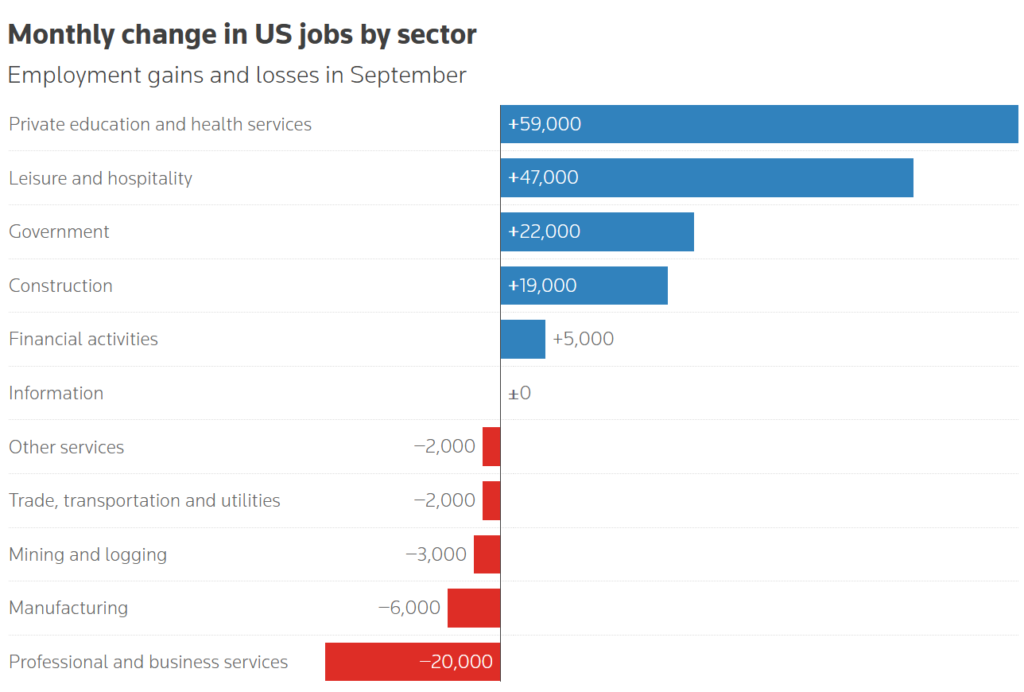

Fresh numbers released Thursday, the first official employment data since the record government shutdown, showed that the US economy added 119,000 jobs in September, nearly double expectations. But the headline strength masked deeper cracks: the unemployment rate climbed to 4.4 percent, the highest since late 2021, driven mostly by an influx of workers rather than layoffs.

The report immediately reshaped Wall Street expectations. Morgan Stanley scrapped its call for a December cut, saying the rebound in payrolls and a participation-driven rise in unemployment means the Fed will likely wait until January to resume easing, followed by April and June. Their terminal rate forecast remains 3.0–3.25 percent.

And the central bank itself appears increasingly unsure.

Fed Minutes Reveal a Split: “Strongly Differing Views”

Minutes from the Fed’s late-October meeting show deep internal disagreement, with policymakers openly divided on whether to cut rates for a third straight meeting on December 10.

The FOMC wrote that members expressed “strongly differing views” on whether another cut was appropriate. While many agreed rates should fall over time, several officials signaled that December may be too soon, especially with inflation still hovering near 3 percent.

Fed Governor Michael Barr reinforced that caution Thursday, saying inflation is still a full point above target and that policymakers must “proceed carefully” before easing further.

Meanwhile, the CME FedWatch tool now shows only a 35 percent probability of a December cut — far from the near-certainty priced in just one month ago.

October Jobs Report Canceled, leaving the Fed flying blind

The 43-day government shutdown forced the Bureau of Labor Statistics to cancel the entire October jobs report, confirming it will not be published at all.

Instead, October payrolls will be merged with the November report, due December 16, a full week after the Fed meeting.

This means policymakers will head into the December vote without:

- October unemployment data

- October household survey

- October wage data

- Any updated CPI figures (also delayed)

Economists say the lack of data raises the risk of a policy error at a moment when the labor market is sending mixed signals.

What the September Report Really Shows

Beyond the top-level numbers, the September data revealed a labor market cooling in slow motion:

- Nonfarm payrolls: +119,000

- Two-month revision: –33,000

- Unemployment: 4.4 percent

- Avg hourly earnings: up 0.2 percent MoM, 3.8 percent YoY

- Healthcare added 43,000 jobs

- Restaurants and bars added 37,000

- Transportation and warehousing lost 25,000

- Federal employment has fallen by 97,000 since January

Economists highlight the broader trend: job creation has been heavily revised downward all year, immigration crackdowns have reduced labor supply, and AI adoption is quietly reshaping low-level hiring.

Some say the US now needs only 30–50k jobs per month to keep pace with labor force growth, far below the 150k baseline of earlier years.

Political Pressure Mounts

The data also landed in a heated political environment.

Fox News polling shows 76 percent of Americans rate the economy negatively, with many blaming President Trump for the recent slowdown. Job growth revisions wiped out sizeable chunks of the administration’s earlier reported gains, triggering renewed criticism of economic management.

Trump’s decision to fire BLS Commissioner Erika McEntarfer in August, hours after a major downward revision, continues to draw scrutiny.

Market Reaction: Volatile but Resilient

Markets took the September report as neither a clear positive nor a negative:

- Stocks opened higher, with traders focusing on Nvidia’s upcoming earnings.

- Treasury yields fell as investors leaned toward a slower Fed easing path.

- Dollar steady, with traders cautious ahead of Fed minutes.

Former Fed Vice Chair Roger Ferguson summed up the mood: “Not a dramatic move one way or the other.”

But the real tension lies ahead. With inflation still sticky, labor data incomplete, and policymakers openly divided, the December decision is no longer the sure thing it looked like in early autumn.

The September jobs report didn’t settle the debate, it deepened it.

- Unemployment is rising

- Hiring is slowing but not collapsing

- Inflation is stuck near 3 percent

- October data is missing

- The Fed is sharply split

And now, with Morgan Stanley abandoning its December cut call and Fed officials openly clashing over how to interpret the economy, the central bank enters its most data-starved and divided meeting in years.

The December rate decision is now a coin toss, and markets know it.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Stocks Steady as Nvidia Earnings Become Market’s Make-or-Break Moment