Markets, economists, and media consensus point to a Fed September cut as labour market weakness outweighs tariff-driven inflation risks. The debate now shifts to how deep the easing cycle will run.

The Federal Reserve heads into its September 16–17 policy meeting with near-universal expectations of a 25 basis point rate cut, its first of 2025. The latest inflation and labor data have done little to derail that outlook — even if consumer prices remain well above the Fed’s 2% target.

What the Data Shows

- CPI (August): Headline inflation rose 2.9% YoY (up from 2.7% in July) and 0.4% MoM, slightly hotter than forecast. Core CPI held steady at 3.1% YoY, with 0.3% MoM in line with expectations.

- PPI (August): Wholesale prices fell 0.1% MoM, showing firms absorbed tariff costs rather than fully passing them to consumers.

- Labor market: Initial jobless claims jumped to 263,000, the highest in four years. August payrolls added just 22,000 jobs, well short of expectations, with unemployment rising to 4.3%. June’s jobs report was revised down to negative 13,000, signaling sustained weakness.

Analysts’ Consensus: A Quarter-Point Cut

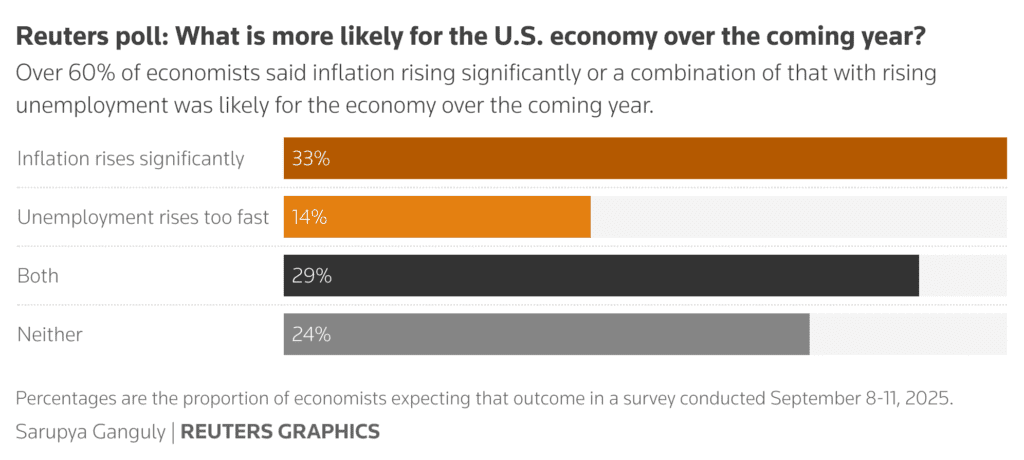

A Reuters poll of 107 economists found that 105 expect a 25bps cut, lowering the Fed funds rate to 4.00–4.25%. A handful see a chance of a larger 50bps move, but the majority view sticky inflation as a ceiling on how aggressive the Fed can go.

Morgan Stanley, which previously forecast two cuts this year, now expects three consecutive 25bps cuts (September, October, and December), citing “persistent labour softness.” Bank of America’s Stephen Juneau warned of potential policy error if the Fed leans too heavily on jobs while ignoring inflation risk.

Capital Economics’ Stephen Brown noted that the CPI data “cements the case for a 25bps cut rather than supporting a larger 50bps move.”

Market Pricing and Media Tone

The CME FedWatch Tool shows a 92% probability of a quarter-point cut and only 7–8% odds of a half-point cut. Futures markets now imply up to three cuts by year-end, with another 75bps of easing expected in 2026.

- Bloomberg: emphasizes the Fed’s “difficult balancing act,” noting sticky inflation but growing signs of labor weakness.

- Yahoo Finance: argues a cut is “fully priced in” and points to Trump’s mounting pressure on Powell as another driver.

- MarketWatch: highlights winners (borrowers, firms with floating debt, overseas USD borrowers) and losers (savers, money market funds) if cuts unfold. Analysts warn Main Street may not see grocery bills or gas prices fall, even if borrowing costs ease.

- Reuters: stresses that economists now expect “at least one more cut” in Q4, with some projecting three total this year.

Political Pressure and Fed Independence

President Trump has sharply criticized Jerome Powell for being “too slow” to cut rates, tying monetary policy to his tariff-driven economic strategy. His nominee, Stephen Miran, is expected to join the board soon, tilting the Fed more dovish. Meanwhile, a court ruling blocked Trump’s attempt to oust Governor Lisa Cook, setting up potential board dissents in September’s vote.

Former Kansas City Fed President Esther George warned that inflation’s underlying momentum remains concerning: “It has stalled out around 3%.” But she acknowledged the weakening jobs market leaves policymakers little choice.

The Outlook

Most economists see:

- September: 25bps cut all but certain.

- Year-end: At least one more cut, possibly two, bringing the Fed funds rate to 3.50–3.75%.

- 2026: Poll medians suggest another 75bps of cuts, taking the rate closer to 3.00–3.25%.

The Fed faces its toughest test yet, easing policy to support jobs without letting tariffs and inflation expectations spiral. The balance Powell strikes next week could set the tone not only for markets but for Trump’s economic credibility heading into the election year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Gold Surpasses Inflation-Adjusted Record High Set in 1980

CPI report shows prices climbing faster than July, What it means for Fed

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility