On September 17, 2025, the U.S. Federal Reserve cut its key interest rate by 25 basis points (¼ of a percent). The new target range for the fed funds rate is 4.00% to 4.25%, down from the previous level. This is the Fed’s first rate cut since December 2024.

Fed Chair Jerome Powell and the FOMC signalled there will likely be two more cuts this year. However, they emphasised caution: inflation remains above target, and job growth is slowing.

In its statement, the Fed said economic activity has “moderated” and “job gains have slowed,” while warning that inflation is “still somewhat elevated.” The message was clear: while inflation remains a problem, the balance of risks has shifted toward the employment side of the Fed’s dual mandate.

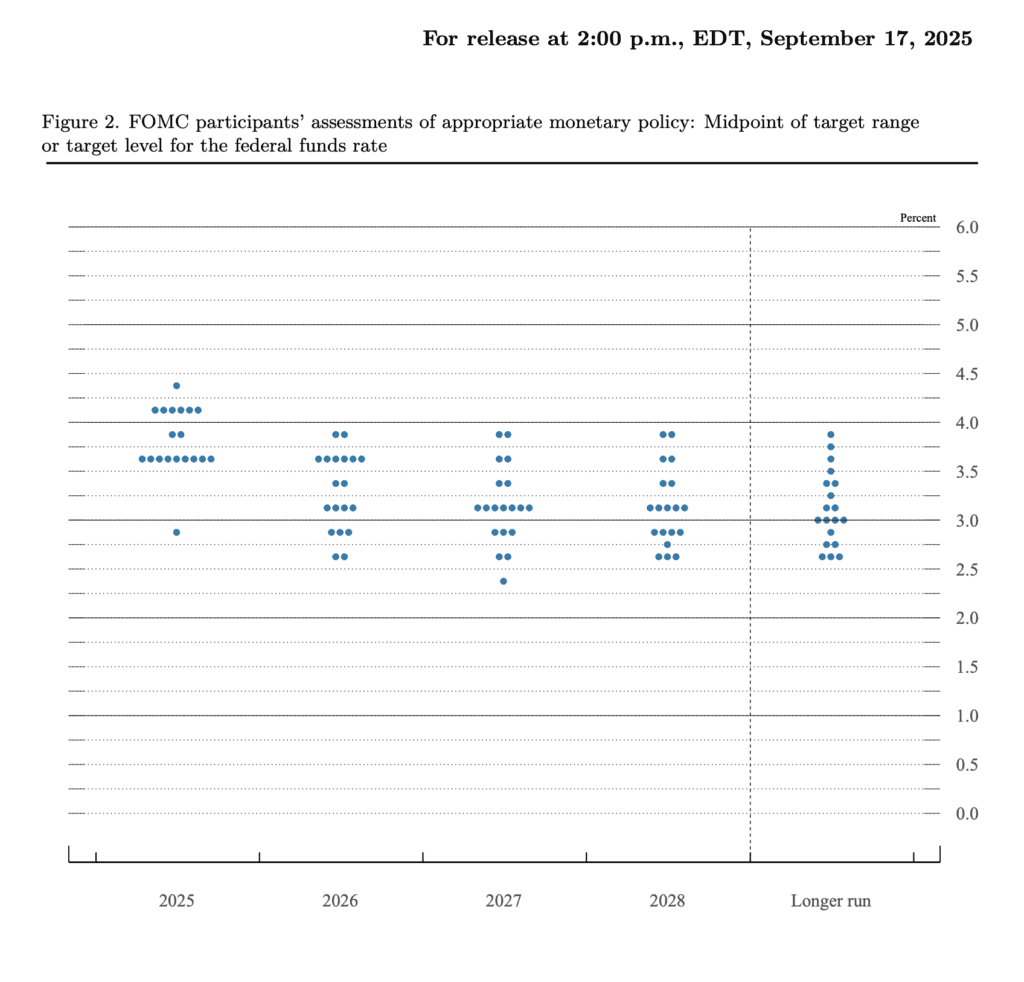

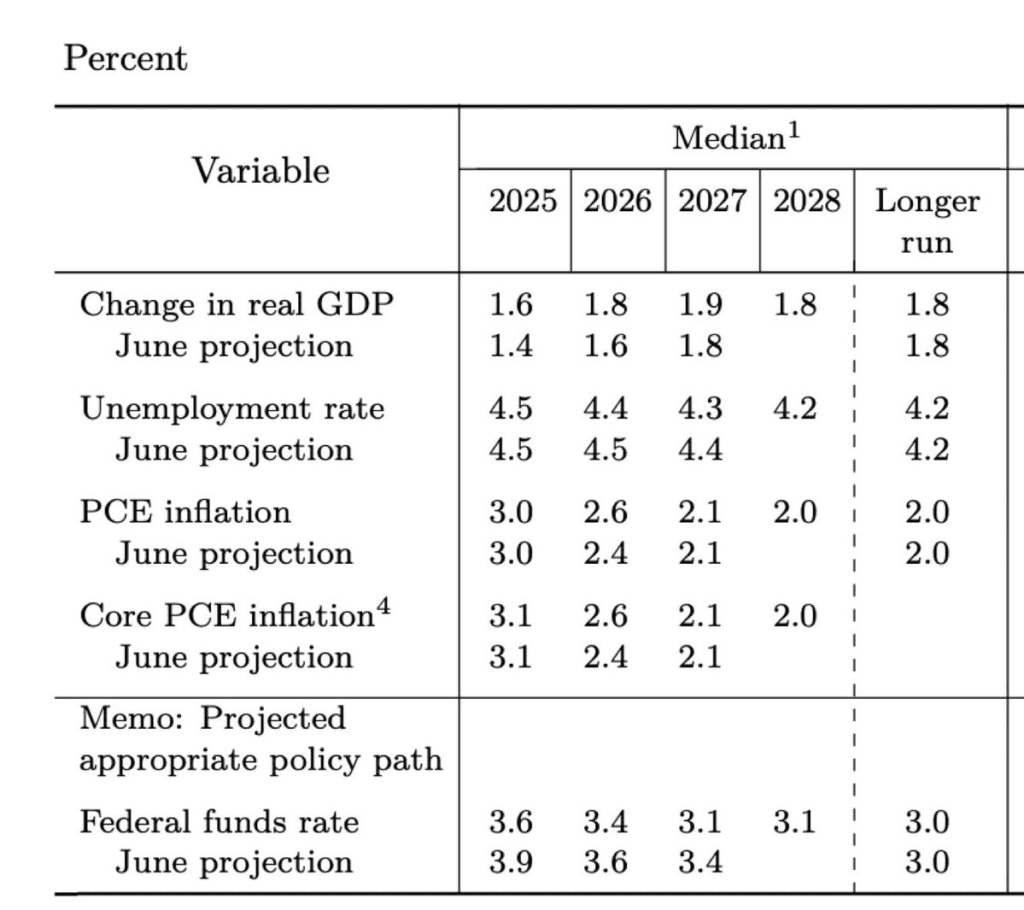

New Fed Projections (September SEP)

The Fed’s Summary of Economic Projections (SEP) and dot plot show a clear path lower for rates:

- 2025: Fed funds projected at 3.6% (vs 3.9% in June).

- 2026: 3.4% (vs 3.6% prior).

- 2027: 3.1% (unchanged).

- 2028: 3.1% (first projection).

- Longer run: 3.0% (unchanged).

At the same time:

- GDP: Expected to grow just 1.6% in 2025, then ~1.8% per year through 2028.

- Unemployment: Projected at 4.5% in 2025, easing only slowly to 4.2% by 2028.

- Inflation: PCE inflation at 3.0% this year, 2.6% in 2026, 2.1% in 2027, and back to target 2.0% in 2028.

Why the Cut Happened

Several key reasons pushed the Fed to make this move:

Labor Market Weakness

- Job gains have cooled significantly.

- Some earlier months had negative revisions (i.e. previously reported job gains were lowered).

Inflation Above Target but Cooling

- Inflation (headline) in August was ~2.9% year-over-year; core inflation (excluding volatile items) is around 3.1%.

- These rates are down from earlier highs, but are still above the Fed’s 2% goal, which means the Fed must balance easing with the risk inflation could bounce back.

Market Expectations

- The market was strongly expecting a cut. Futures, analysts, and crypto markets had largely priced in this 25 bp move. Not cutting would have risked negative surprises.

Risk of Economic Slowdown

- Growth has “moderated,” meaning it’s slowing but not yet collapsing.

- Rising unemployment or weak hiring signals threaten to turn that moderation into a sharper contraction.

Political Pressure & Credibility Concerns

- While legal protections (like “for cause” removal) limit how much the President can force the Fed, political friction does add pressure to show action.

- Observers are watching how Powell frames the decision: emphasizing data, not politics, to preserve credibility.

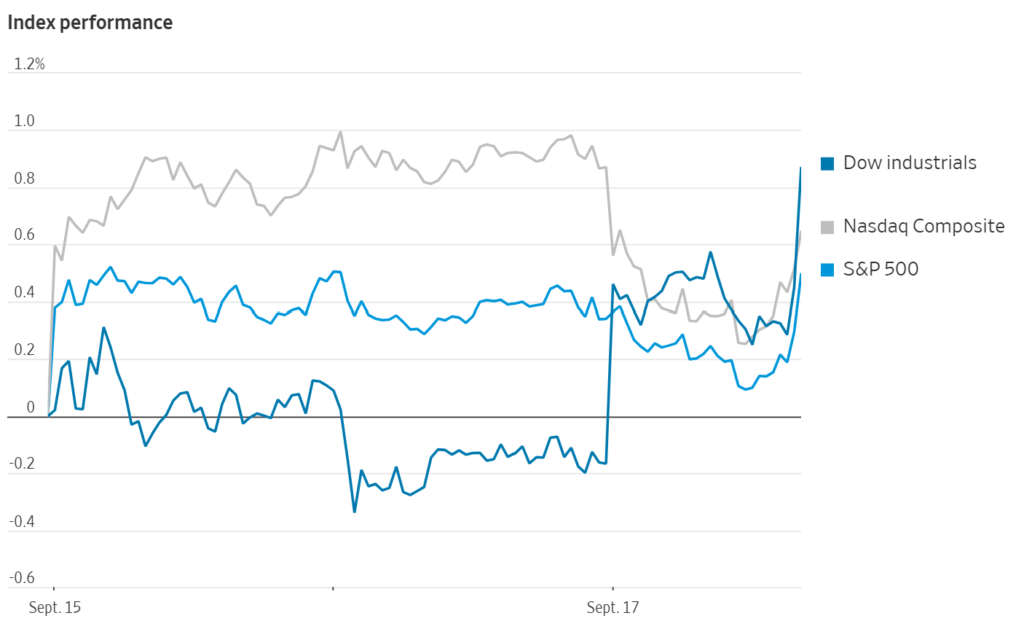

How Markets Reacted: Equities, Bonds, Crypto

Here’s how different markets responded:

| Asset | Reaction |

|---|---|

| Stocks | Broadly positive. Lower rates reduce borrowing costs, help corporate earnings visibility, and encourage risk-taking. Major indices rose after the cut. |

| Treasury Yields / Bonds | Yields fell, especially short-term ones. The yield curve looks more favorable to risk assets when short rates drop and longer rates stay stable. |

| Crypto (Bitcoin, Ethereum etc.) | Bitcoin rose (~1%) after the cut. The overall crypto market is up on expectations: lower rates mean lower opportunity cost of holding non-yielding assets. Some altcoins are mixed. |

| Dollar / Commodities | A weaker dollar is likely, which tends to help gold and other commodities. Though specific reactions depend on tariff risk, inflation outlook, and how dovish Fed signals are. |

Simple Summary: What It Means

- The Fed is slowly shifting gears from fighting inflation to making sure the economy doesn’t weaken too much.

- This cut doesn’t mean rates will drop fast; it’s more like tapping the brakes.

- Markets like stocks and crypto tend to do well in this regime — but only if Powell signals that there will be more easing down the road.

- If Powell is cautious or signals few further cuts, there could be short-term volatility (“sell the news”) even after today’s cut.

Powel speech here