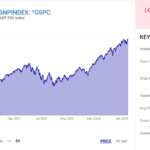

As the stock market concluded January with the Dow Jones Industrial Average posting a healthy gain, and the Nasdaq and S&P 500 achieving modest increases, investors are gearing up for a pivotal first week of February. This period is marked by significant earnings reports from major tech companies, a slew of biotech and pharmaceutical firms, and crucial economic data releases.

Economic Calendar: Anticipating Key Data Releases

The week is laden with critical economic indicators, culminating in the January payrolls report on Friday. Economists anticipate an addition of 170,000 new jobs, with 165,000 stemming from the private sector, maintaining the unemployment rate at 4.1%. Notable releases include the Job Openings and Labor Turnover Survey on Tuesday, the ADP employment report on Wednesday, the Institute for Supply Management’s manufacturing index, and the Treasury Department’s Q1 borrowing expectations on Monday, followed by the ISM services index on Wednesday.

Tech Giants: Earnings on the Horizon

- Amazon.com (AMZN): Set to report earnings late Thursday, Amazon is expected to showcase a 49% earnings growth, despite a fourth consecutive quarter of slowing growth. Revenue is projected to increase by 10%. Discussions may revolve around Amazon’s involvement with China’s DeepSeek AI program, its relationship with UPS, and advertising expenditures via X. The stock appreciated nearly 10% in January.

- Alphabet (GOOGL): Reporting on Tuesday, Alphabet is anticipated to reveal a 29% EPS growth to $2.12 and a 12% revenue increase to $96.7 billion. Google’s internet search advertising is expected to rise by 11% to $53.29 billion, with YouTube ad revenue and cloud computing revenue projected to grow by 11% and 32%, respectively. Investors will be keen to hear from the new CFO, Anat Ashkenazi, regarding future priorities. The stock has climbed approximately 13% since mid-December.

Biotech and Pharmaceutical Earnings: A Packed Schedule

- Pfizer (PFE) and Merck (MRK): Both companies are slated to report fourth-quarter earnings on Tuesday, with analysts forecasting triple-digit earnings growth.

- Eli Lilly (LLY): Scheduled to report on Thursday, the company is expected to announce a 108% earnings increase and a nearly 45% rise in revenue, driven by its weight-loss drug segment.

- Novartis (NOV) and Bristol Myers Squibb (BMY): Both will report on Wednesday, with Novartis anticipated to show growth in profit and sales, while Bristol Myers may report a decline in earnings with flat sales.

Biotech Highlights:

- Regeneron Pharmaceuticals (REGN): Reporting on Tuesday, the company is expected to see a slight decline in profit to $11.24 per share, with a 9% increase in sales to $3.75 billion.

- Amgen (AMGN): Set to report after the close on Tuesday.

- Neurocrine (NBIX): Expected to report on Thursday, with analysts predicting a 25% increase in adjusted earnings per share to $1.93 and a 22% rise in sales to $629.6 million.

Medical Conferences and Earnings:

The MD&M West conference takes place from Monday through Thursday in Anaheim, California, coinciding with earnings reports from Edwards Lifescience (EW), Idexx Labs (IDXX), and Illumina (ILMN). Analysts have high expectations for Illumina, anticipating a 574% earnings gain, with continued growth projected into Q1.

Defense and Technology: Palantir’s Anticipated Report

Palantir Technologies (PLTR) is set to report fourth-quarter earnings after the market closes on Tuesday. Analysts predict a 39% increase in adjusted earnings and a 28% rise in revenue. Discussions are expected to focus on defence and homeland security, given the company’s significant government contracts. The stock has reached new highs, reflecting a 428% gain over the past year. (Palantir Q4 Earnings: Here is $PLTR Stock Prediction)

Additional Earnings to Watch:

- Advanced Micro Devices (AMD): Reporting on Tuesday, with expectations of a 40% increase in earnings per share to $1.08 and a 22% rise in sales to $7.53 billion.

- O’Reilly Automotive (ORLY): Set to report on Wednesday, with anticipated earnings growth of approximately 5% to $9.74 per share and a 6% increase in sales.

- McKesson (MCK): Reporting on Wednesday, with expectations of a 4% earnings gain and steady revenue growth near 19%.

- MicroStrategy (MSTR): Set to report on Wednesday, with analysts expecting a loss of 9 cents per share and a slight decline in revenue to $122.4 million.

- Plains All American Pipeline (PAA): Reporting on Friday, with predictions of lower profit and a slight increase in revenue. Discussions may focus on the impact of Canadian tariffs, given the company’s pipeline operations between Edmonton, Alberta, and Cushing, Oklahoma.

Investors should monitor these developments closely, as they will provide insights into the broader economic landscape and sector-specific performance.

| Company | Symbol | Report exp | Comp Rtg | Exp next qtr EPS % chg | Industry | Options strike price | Premium as % to stock price | Days to exp |

|---|---|---|---|---|---|---|---|---|

| Palantir Technologies | PLTR | 02/03/2025 | 99 | 39.0% | Computer Sftwr-Enterprse | 83.0 | 6.6 | 5 |

| Rambus | RMBS | 02/03/2025 | 99 | 23.0% | Elec-Semicondctor Fablss | 62.5 | 5.8 | 19 |

| Advanced Micro Devices | AMD | 02/04/2025 | 62 | 40.0% | Elec-Semicondctor Fablss | 116.0 | 4.6 | 5 |

| Amgen | AMGN | 02/04/2025 | 62 | 8.0% | Medical-Biomed/Biotech | 287.5 | 1.9 | 5 |

| A10 Networks | ATEN | 02/04/2025 | 97 | -11.0% | Computer Sftwr-Enterprse | 20.0 | 2.3 | 19 |

| Enova International | ENVA | 02/04/2025 | 99 | 24.0% | Finance-Consumer Loans | 115.0 | 3.4 | 19 |

| Alphabet | GOOGL | 02/04/2025 | 98 | 30.0% | Internet-Content | 205.0 | 3.0 | 5 |

| Intapp | INTA | 02/04/2025 | 97 | 49.0% | Computer Sftwr-Financial | 75.0 | 3.6 | 19 |

| KKR | KKR | 02/04/2025 | 98 | 28.0% | Finance-Investment Mgmt | 167.5 | 2.5 | 5 |

| Pfizer | PFE | 02/04/2025 | 51 | 369.0% | Medical-Ethical Drugs | 27.0 | 1.4 | 5 |

| PJT Partners | PJT | 02/04/2025 | 97 | 18.0% | Finance-Invest Bnk/Bkrs | 165.0 | 3.8 | 19 |

| Spotify Technology | SPOT | 02/04/2025 | 98 | 654.0% | Computer Sftwr-Edu/Media | 550.0 | 5.4 | 5 |

| American Superconductor | AMSC | 02/05/2025 | 95 | 67.0% | Electrical-Power/Equipmt | 27.0 | 9.0 | 19 |

| Ares Management | ARES | 02/05/2025 | 97 | 7.0% | Finance-Investment Mgmt | 200.0 | 3.1 | 19 |

| Arm Holdings | ARM | 02/05/2025 | 95 | 17.0% | Elec-Semicondctor Fablss | 160.0 | 5.0 | 5 |

| Boston Scientific | BSX | 02/05/2025 | 97 | 20.0% | Medical-Products | 103.0 | 2.0 | 5 |

| Corpay | CPAY | 02/05/2025 | 96 | 21.0% | Financial Svcs-Specialty | 390.0 | 2.4 | 19 |

| Dayforce | DAY | 02/05/2025 | 96 | -9.0% | Computer Sftwr-Enterprse | 75.0 | 2.3 | 19 |

| Disney | DIS | 02/05/2025 | 93 | 19.0% | Media-Diversified | 114.0 | 3.3 | 5 |

| Evercore | EVR | 02/05/2025 | 96 | 40.0% | Finance-Invest Bnk/Bkrs | 300.0 | 2.4 | 19 |

| Fiserv | FI | 02/05/2025 | 95 | 13.0% | Financial Svcs-Specialty | 217.5 | 1.9 | 5 |

| MicroStrategy | MSTR | 02/05/2025 | 59 | -118.0% | Financial Svcs-Specialty | 340.0 | 4.5 | 5 |

| Nomura Holdings | NMR | 02/05/2025 | 98 | 24.0% | Finance-Invest Bnk/Bkrs | 7.5 | 0.8 | 19 |

| Paycor | PYCR | 02/05/2025 | 99 | 6.0% | Computer Sftwr-Enterprse | 22.5 | 0.1 | 19 |

| LiveRamp Holdings | RAMP | 02/05/2025 | 95 | -1.0% | Computer-Tech Services | 35.0 | 7.6 | 19 |

| SiTime | SITM | 02/05/2025 | 97 | 77.0% | Elec-Semicondctor Fablss | 210.0 | 8.3 | 19 |

| Universal Tech Institute | UTI | 02/05/2025 | 98 | 7.0% | Consumer Svcs-Education | 27.5 | 5.5 | 19 |

| Amazon.com | AMZN | 02/06/2025 | 99 | 49.0% | Retail-Internet | 240.0 | 2.9 | 5 |

| AstraZeneca | AZN | 02/06/2025 | 68 | 44.0% | Medical-Diversified | 71.0 | 2.2 | 5 |

| Bristol Myers Squibb | BMY | 02/06/2025 | 76 | -14.0% | Medical-Ethical Drugs | 59.0 | 2.3 | 5 |

| Doximity | DOCS | 02/06/2025 | 99 | 16.0% | Computer Sftwr-Medical | 60.0 | 8.4 | 19 |

| Fortinet | FTNT | 02/06/2025 | 99 | 19.0% | Computer Sftwr-Security | 101.0 | 5.2 | 5 |

| Intercontinental Exchange | ICE | 02/06/2025 | 95 | 12.0% | Financial Svcs-Specialty | 160.0 | 2.5 | 19 |

| Eli Lilly | LLY | 02/06/2025 | 85 | 107.0% | Medical-Diversified | 812.5 | 2.7 | 5 |

| Liquidity Services | LQDT | 02/06/2025 | 98 | 57.0% | Retail-Internet | 35.0 | 5.2 | 19 |

| Neurocrine Biosciences | NBIX | 02/06/2025 | 95 | 10.0% | Medical-Biomed/Biotech | 155.0 | 3.2 | 19 |

| Cloudflare | NET | 02/06/2025 | 99 | 20.0% | Computer Sftwr-Enterprse | 139.0 | 5.7 | 5 |

| Blue Owl Capital | OWL | 02/06/2025 | 99 | 19.0% | Finance-Investment Mgmt | 27.0 | 2.7 | 19 |

| Paylocity | PCTY | 02/06/2025 | 97 | -4.0% | Computer Sftwr-Enterprse | 210.0 | 3.8 | 19 |

| Ralph Lauren | RL | 02/06/2025 | 95 | 8.0% | Apparel-Clothing Mfg | 250.0 | 4.7 | 19 |

| Skechers USA | SKX | 02/06/2025 | 97 | 56.0% | Apparel-Shoes & Rel Mfg | 77.5 | 3.7 | 19 |

| StepStone | STEP | 02/06/2025 | 96 | 23.0% | Finance-Investment Mgmt | 65.0 | 3.3 | 19 |

| Tradeweb Markets | TW | 02/06/2025 | 99 | 16.0% | Financial Svcs-Specialty | 130.0 | 2.1 | 19 |

| Byrna Technologies | BYRN | 02/07/2025 | 96 | 387.0% | Security/Sfty | 30.0 | 4.4 | 19 |

| Perella Weinberg Partners | PWP | 02/07/2025 | 98 | 163.0% | Finance-Invest Bnk/Bkrs | 30.0 | 1.5 | 19 |

Related: Has a new era begun? Investors have never been so optimistic…