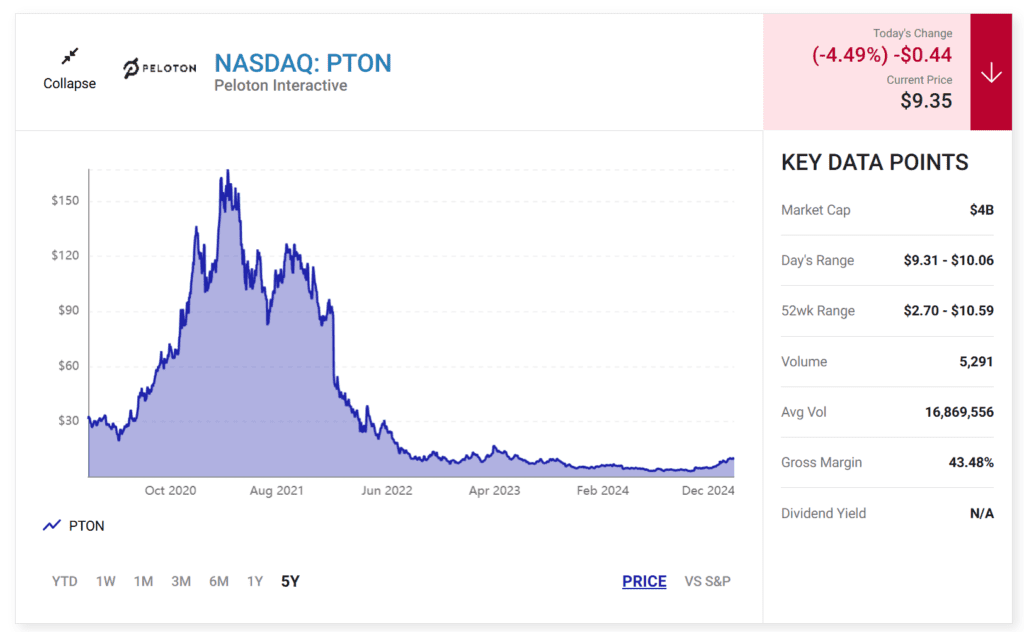

Peloton Interactive, a pandemic darling, has seen its stock plunge 98% since January 2021, driven by mismanagement and fading consumer demand. Once celebrated for its innovative fitness products and soaring revenues, the company is now grappling with plummeting sales and mounting losses.

- Peloton thrived during COVID-19 with triple-digit revenue growth and a $50 billion market cap. Its stock soared 550% to a peak in early 2021.

- Post-pandemic, demand for home workout equipment dwindled, leading to a 43% revenue drop in Q3 2024 compared to three years earlier.

- Efforts to revitalize sales, like partnerships with Amazon, Dick’s Sporting Goods, and Lululemon, have yielded limited results.

- Digital app memberships declined 21% in the last quarter, reflecting challenges in driving high-margin subscription revenue.

- Peloton reported $1.6 billion in operating losses over eight quarters, despite achieving adjusted EBITDA profitability.

- Trading at a P/S ratio of 0.4, the market views Peloton as a value trap, far below its historical average of 4.5.

Peloton’s brand strength and innovative offerings fail to offset its grim financial outlook. With slim chances of a turnaround, the stock remains a risky bet for investors. Avoiding Peloton could save investors from a costly trap.

Related article: 4 Business Services Stocks You’ll Regret Not Buying on Their Dips

This story was originally featured on The Motley Fool.

Disclaimer: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.