US stocks dropped sharply Monday after former President Donald Trump announced a sweeping new round of tariffs, catching markets off guard and sending shockwaves across global trade desks. In a string of official letters posted on his Truth Social account, Trump outlined new import taxes ranging from 25% to 40% on goods from Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar, effective August 1.

“These tariffs may be modified, upward or downward, depending on our relationship with your country. You will never be disappointed with the United States of America,” Trump wrote in one letter, directly warning trade partners of rising penalties should retaliatory tariffs follow.

Tariff Breakdown by Country

| Country | Tariff Rate |

|---|---|

| Japan | 25% |

| South Korea | 25% |

| Malaysia | 25% |

| Kazakhstan | 25% |

| South Africa | 30% |

| Laos | 40% |

| Myanmar | 40% |

Market Reaction

- Dow Jones fell 533 points to 44,298, down 1.18%, hitting fresh session lows.

- S&P 500 shed 1%, while the Nasdaq Composite lost 1.1%, dragged by tech weakness.

- Shares of $TM and $HMC dropped more than 4%.

- $AAPL, $GOOGL, and $AMD all declined over 2%.

- $TSLA plunged 7% after Elon Musk announced plans to form a new “America Party,” adding to investor anxiety over his political distractions.

“The more we’re talking about tariffs, the less happy the market is,” said Jed Ellerbroek of Argent Capital Management.

According to White House press secretary Karoline Leavitt, 14 total letters were sent on Monday, with 12 more countries expected to receive similar notifications this week.

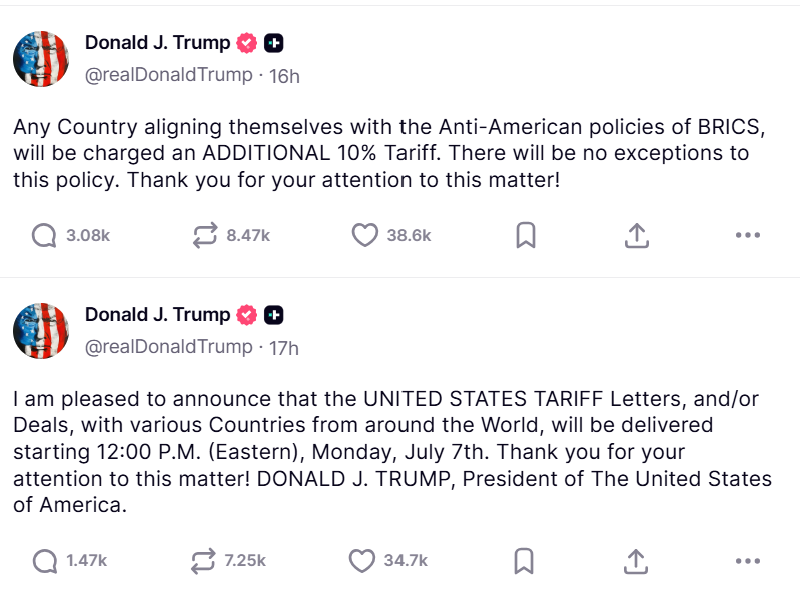

Tariff Delay & BRICS Threat

Trump also signed an executive order delaying the broader July tariff deadline to August 1, giving trade partners more time to negotiate. However, the reprieve comes with new warnings: any country perceived as aligning with the “anti-American policies” of BRICS faces an additional 10% tariff, according to Reuters sources.

“There will be no exceptions to this policy,” Trump said, targeting BRICS nations including Brazil, Russia, India, China, and South Africa.

Notably, EU countries are currently excluded from the new round of tariff letters, with sources confirming no plans for higher tariffs on Europe — a sign of cautious diplomacy ahead of upcoming NATO talks.

Middle East Update: Gaza Truce Talks Resume

Amid tariff chaos, Trump is also leaning into Middle East diplomacy. Israel sent negotiators to Qatar on Sunday, seeking a 60-day ceasefire deal with Hamas, under pressure from the Trump administration.

- Hamas reportedly gave a “positive response” to the US proposal.

- Trump is expected to meet Netanyahu in Washington this week.

- Analysts note it will be harder for Israel to walk away due to renewed US diplomatic involvement following last month’s Iran airstrikes.

Global Trade & Geopolitics: BRICS Shows Cracks

The BRICS summit in Brazil revealed internal tensions:

- Only half the leaders attended, including no-shows from Xi and Putin.

- Delegates avoided direct criticism of the US and instead issued a muted joint statement on tariffs, signaling caution after previous anti-West rhetoric.

- Analysts warn the bloc’s expansion to 11 members may be diluting its cohesion.

US Economy & Markets Snapshot

- US total stock market cap reached a record $63.8 trillion, now bigger than Europe, China, Japan, India, and Hong Kong combined, per Goldman Sachs.

- White House Economic Advisor Kevin Hassett said: “There’s zero chance of a recession.”

- Earnings season kicks off Thursday with $DAL, $CAG, and $LEVI reporting.

What’s Next

- Treasury Secretary Scott Bessent confirmed multiple trade announcements over the next 48 hours.

- Markets brace for further volatility with tariff negotiations, Middle East diplomacy, and earnings dominating the agenda.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump

US Manufacturing Hits 3-Year High, But Tariff Fears Loom

What’s in Tax and Spending Bill That Trump Signed Into Law

F1 The Business: Apple chases Netflix’s Formula 1 playbook

Markets Hit New Highs, Fed Cuts Off Table After Strong Jobs Data; Trade Talks & Tariff Risks Still Loom

Markets Hit Highs After Trump–Vietnam Deal, But All Eyes on US Jobs Report Now

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation