The US dollar has been the world’s reserve currency for over 70 years, acting as the cornerstone of global trade and financial stability. However, growing geopolitical tensions, rising debt levels, and the rise of alternative currencies have sparked debate over the dollar’s future.

Could we be approaching a turning point?

Let’s explore the role of the dollar today, the potential challengers, and what its evolving status could mean for global markets.

Why the Dollar Matters

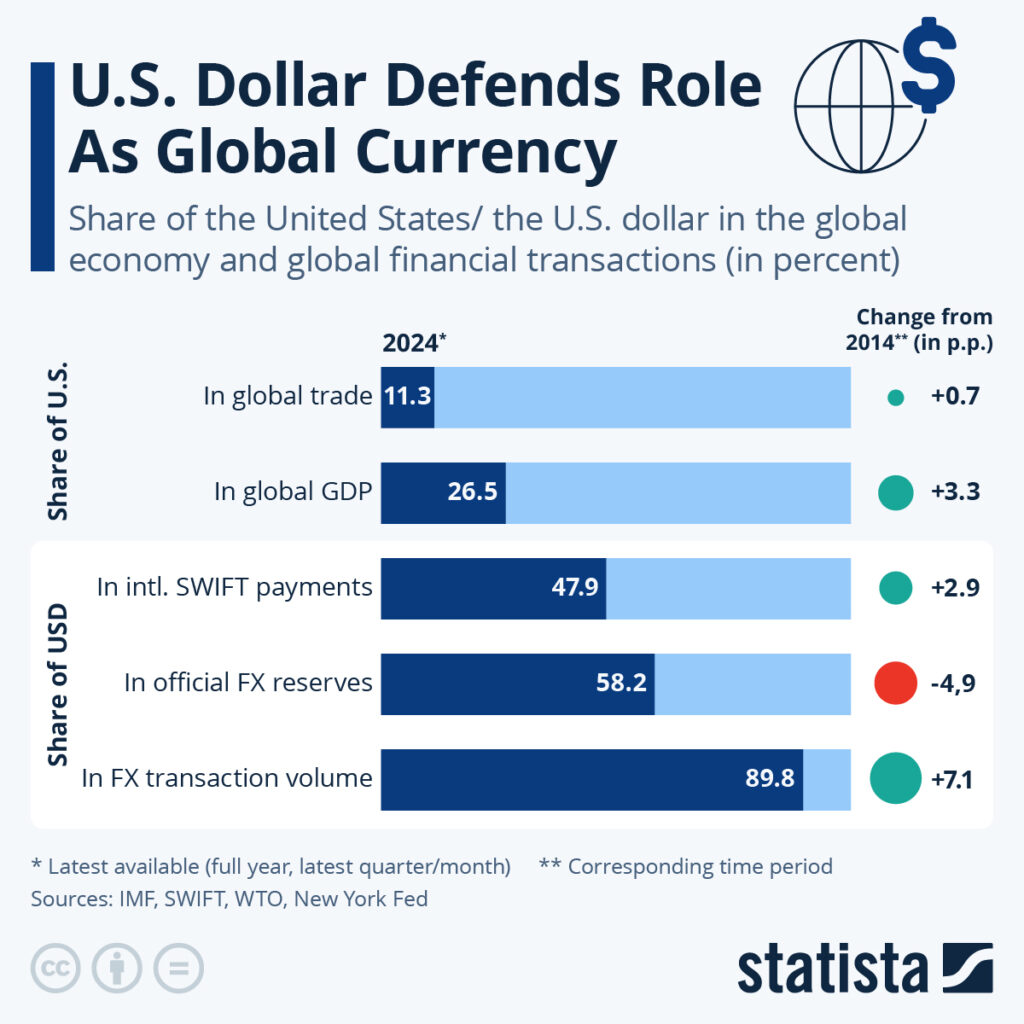

The U.S. dollar dominates global finance. Over 60% of foreign exchange reserves are held in dollars, and nearly 90% of international trade transactions are settled in USD.

It is the global safe haven during crises, driving investor demand for U.S. Treasuries and assets. The dollar’s dominance gives the United States immense advantages, including lower borrowing costs and the ability to influence global markets through monetary policy.

However, its central role is not without challenges.

The Challenges to the Dollar’s Dominance

The dollar’s reserve status faces growing competition. China’s yuan, is gaining traction as a global trade currency. Through its Digital Yuan, China is pioneering the use of central bank digital currencies (CBDCs) in cross-border transactions, providing an alternative to traditional financial systems.

Meanwhile, geopolitical fragmentation- such as U.S.-led sanctions- has pushed countries like Russia and China to settle trade in local currencies. The rise of other digital currencies, such as the Digital Euro, further adds to the diversification trend.

While these challengers lack the dollar’s unmatched liquidity and trust, their influence is gradually growing.

Implications for Global Trade and Financial Stability

If the dollar’s dominance declines, global trade and markets could face significant shifts. Reduced demand for U.S. Treasuries might lead to higher borrowing costs for the United States, while a multi-currency system could introduce greater currency volatility.

For businesses and investors, navigating exchange rate fluctuations may become more complex. In emerging markets, the impact could be twofold. A weaker dollar would ease the burden of dollar-denominated debts, but rising volatility could disrupt capital flows, creating new risks.

I believe the dollar will retain its global status for now, but its strength may slowly erode as alternatives, like the yuan and CBDCs, continue to grow. 🇳🇱

What Digital Currencies Could Mean for the Dollar

Central Bank Digital Currencies (CBDCs) are poised to reshape global finance. China’s Digital Yuan, already in pilot programs, is showing how digital currencies can bypass traditional financial systems and settle international trade more efficiently.

Europe’s Digital Euro could enhance its position as a competitor to the dollar in global payments. However, the dollar’s long-established role as a trusted, liquid asset makes it hard to replace overnight. In times of economic uncertainty, I expect investors will continue to flock to the dollar as a safe haven. Rather than immediately replacing the dollar, digital currencies will likely complement it over time.

Winners and Losers in a Changing Currency Landscape

The gradual shift away from the dollar’s dominance will bring opportunities and challenges.

Countries with strong local currencies and robust financial systems stand to benefit, as will economies that can diversify trade away from dollar reliance. Commodity exporters may gain as trade begins to settle in alternative currencies.

On the other hand, the United States may face rising borrowing costs as demand for its debt weakens. Meanwhile, countries heavily reliant on dollar-based trade might experience short-term volatility during this transition.

Visions of Tomorrow

The dollar’s role will continue to evolve. I see three key trends emerging:

- The yuan and digital currencies, like the Digital Euro, will gain influence in global trade settlements.

- Rising U.S. debt and reduced demand for Treasuries may gradually push up borrowing costs.

- A more fragmented global currency system will bring both volatility and opportunities for investors.

Bonus Lesson to Remember

The dollar’s role as the world’s reserve currency has shaped the global economy for decades, but change may be on the horizon.

While challengers like the yuan and digital currencies are rising, change will be gradual. For investors, a more fragmented global currency system means greater risks but also opportunities. By understanding these shifts and staying diversified across assets and currencies, we can position ourselves to thrive in the new financial landscape.

The dollar remains king, but every kingdom eventually changes. Time will show this.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source: Macro Mornings

Related:

The Dot-com bubble burst: How irrational exuberance led to tech stock collapse

Energy Transition and Its Macro Impact

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance