CPI report shows prices climbing faster than July but in line with forecasts, keeping a September rate cut firmly on the table despite lingering inflation pressures.

The Data: CPI In Line on Yearly, Hotter on Monthly

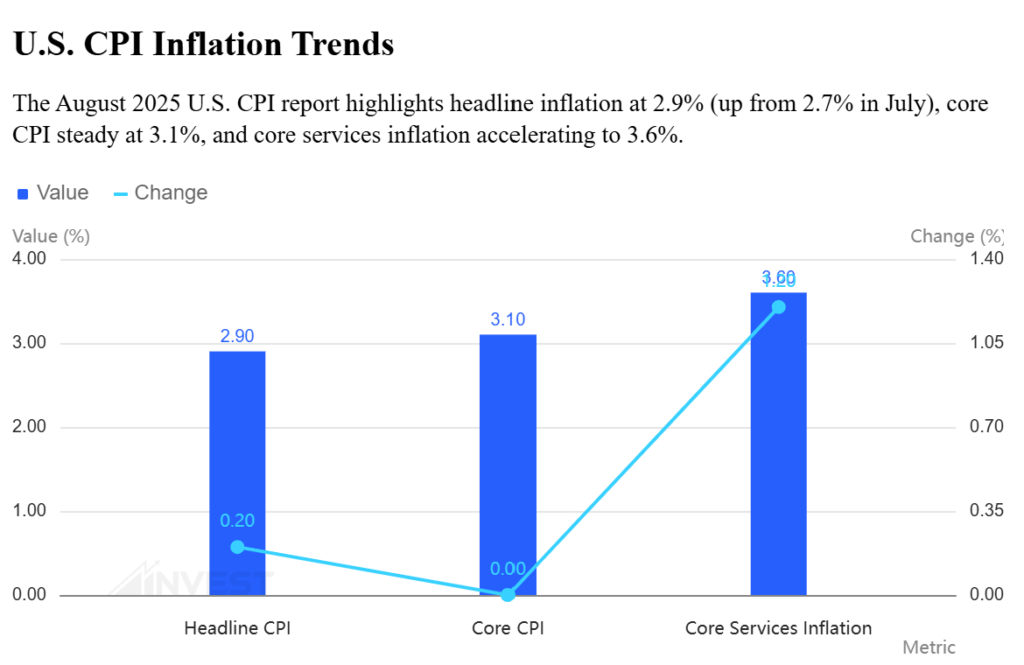

The Consumer Price Index (CPI) released Thursday showed headline inflation rising 2.9% year-over-year in August, up from 2.7% in July and matching economists’ expectations. On a monthly basis, CPI rose 0.4%, slightly hotter than the 0.3% forecast.

Core CPI, which strips out food and energy, climbed 3.1% YoY (in line with estimates) and 0.3% MoM (also in line).

Food prices rose 0.5% in August, with groceries up 0.6% and restaurant meals up 0.3%, underscoring persistent cost pressures for households. Over the past year, the overall food index is up 3.2%.

The data followed Wednesday’s Producer Price Index (PPI) report, which showed an unexpected 0.1% monthly decline, calming some concerns that inflation momentum was accelerating.

Market Reaction: Futures Steady, Yields Ease

Markets took the CPI print largely in stride.

- S&P 500, Nasdaq, and Dow futures ticked slightly higher (+0.1%), holding near record levels after Oracle’s massive AI-fueled rally earlier this week.

- Treasury yields slipped, with the 10-year easing toward 4.0%, as traders interpreted the data as keeping the Fed on track to cut rates.

- The dollar softened modestly, while European stocks edged higher. The ECB left its policy rate unchanged at 2%, as widely expected.

Asian markets had already closed higher, with Japan’s Nikkei 225 hitting another record, driven by SoftBank’s 9% surge after Oracle’s results.

Labor Market Signal: Jobless Claims Spike

Adding to the dovish tilt, initial jobless claims jumped by 27,000 to 263,000, the highest since 2021. Economists had expected a slight drop. The spike highlights growing cracks in the labor market, reinforcing the case for Fed easing.

What It Means for the Fed

The Fed meets next week, and markets are nearly unanimous in expecting at least a 25 basis-point rate cut. Futures are pricing in about 67 bps of total easing for 2025 — two to three cuts.

A tame CPI combined with softer PPI and weakening jobs data gives the Fed cover to move. Some traders are even speculating about a 50 bps cut if policymakers see urgency in supporting growth.

President Trump has kept up pressure on the Fed, repeatedly claiming “no inflation” and demanding faster cuts. But Thursday’s data show inflation still well above the 2% target, complicating the political narrative even as it keeps Wall Street betting on easier policy.

Looking Ahead

The Fed’s September meeting is the next big catalyst. Policymakers must weigh:

- Inflation still above target (2.9% CPI, 3.1% core).

- Weakening labor market (jobless claims at 4-year high).

- Tariff overhang, with potential Supreme Court rulings that could alter costs for companies.

For now, the latest PPI and CPI reports pose no obstacle to a Fed rate cut next week. The bigger debate is whether the Fed delivers a standard quarter-point cut or surprises with a half-point move to get ahead of economic weakness.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility