If inflation headlines made you think everyday costs were finally easing, grocery bills told a different story.

In December, food prices jumped sharply, offering little relief to consumers who have been dealing with high grocery costs for years. The increase is now emerging as a political and economic pressure point, even as broader inflation shows signs of cooling.

Groceries jumped when people least expected it

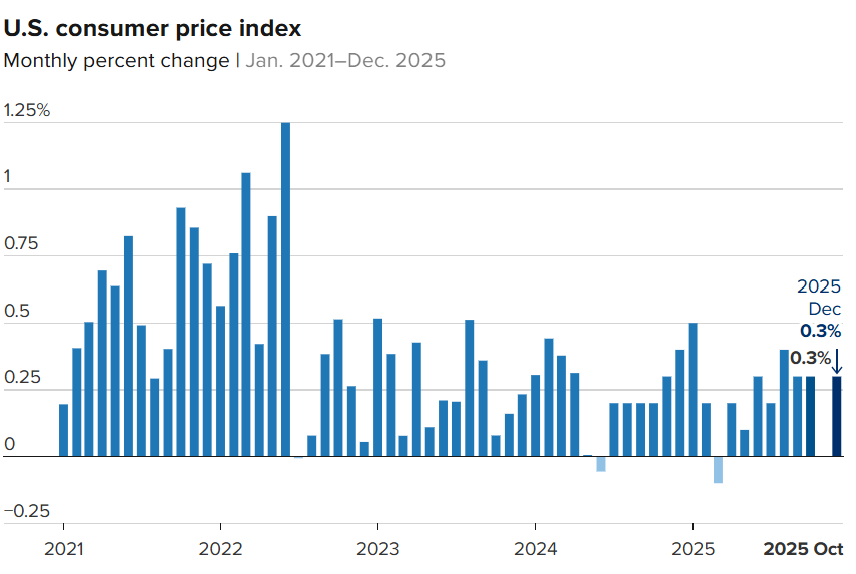

According to the latest inflation data, food prices rose 0.7% in December, the biggest monthly increase since October 2022. That was a notable acceleration from September, the last month with full inflation data before the government shutdown disrupted reporting.

On an annual basis:

- Overall food prices were up 3.1%

- Grocery prices rose 2.4%

For households, food remains one of the most visible and emotionally felt costs. Even when inflation slows elsewhere, rising grocery bills tend to shape how people feel about the economy.

Meat, coffee, and produce drove the increase

Several everyday food categories became more expensive last month.

Fruit and vegetable prices climbed 0.5%. Coffee prices jumped 1.9%, while cereal and bakery products rose 0.6%.

Beef and veal prices increased 1% in December and are now up 16.4% from a year earlier. Economists point to a smaller US cattle herd as the main reason beef prices remain elevated.

Egg prices were the one clear exception. Retail egg prices fell 8.2% in December and are down nearly 21% from a year ago, after surging previously during a bird flu outbreak that forced producers to cull millions of hens.

Inflation overall is cooling, but food stands out

The food price surge contrasts with the broader inflation picture.

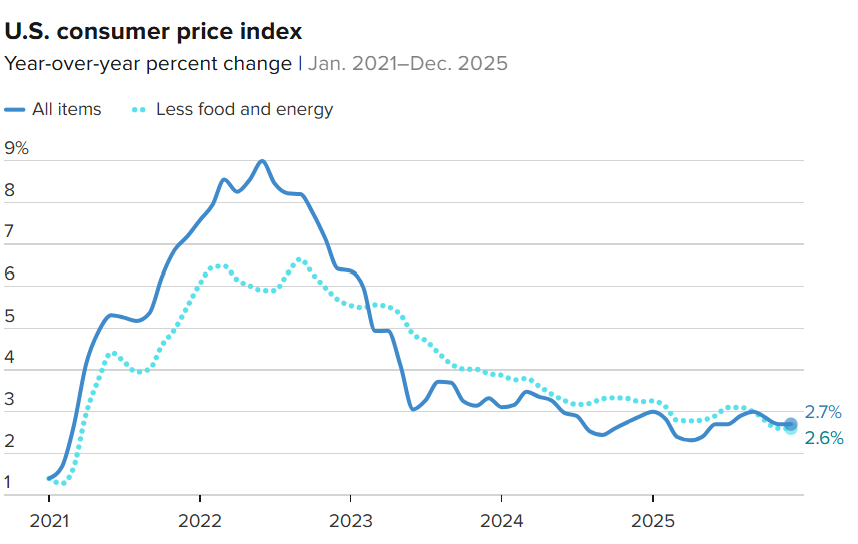

Core consumer prices rose at a 2.6% annual rate in December, slightly below expectations. On a monthly basis, core inflation increased 0.2%, while headline inflation rose 0.3%, putting the overall annual rate at 2.7%.

The Bureau of Labor Statistics data suggests inflation is gradually moving closer to the Federal Reserve’s 2% target, but not fast enough to declare victory.

Shelter costs remained a major source of pressure, rising 0.4% for the month and 3.2% over the year, accounting for more than one-third of the CPI weighting.

Markets react, Fed stays patient

Financial markets responded calmly to the report. Stock futures briefly moved higher, while Treasury yields dipped.

Traders continue to expect the Federal Reserve to hold interest rates steady at its upcoming meeting, with the next potential rate cut not expected until June, according to CME Group FedWatch data.

Policymakers cut rates three times in late 2025 and are now waiting to see how those moves filter through the economy.

Trump turns food inflation into a political issue

President Donald Trump quickly seized on the inflation report to renew pressure on Fed Chair Jerome Powell to cut rates.

Trump argued that cooling inflation should lead to faster and deeper rate cuts, while the White House has also highlighted efforts to tackle food prices directly.

In December, the administration said it would direct the attorney general and the Federal Trade Commission to investigate potential price-fixing and anti-competitive practices across the food sector.

Food costs were a major political liability during the 2024 election cycle, and rising grocery prices risk reopening that debate in 2026.

Why this matters for consumers

Even though inflation overall is easing, food remains a stubborn pocket of pressure. Some of the forces behind higher prices, like supply constraints and agricultural cycles, take time to reverse.

Economists say food inflation today is far more moderate than the sharp spikes of 2022. Still, for consumers standing in grocery aisles, the distinction matters less than the final bill at checkout.

As one strategist put it, inflation is not reheating, but it is not fully beaten either. And for many households, food prices remain the clearest reminder that the cost-of-living fight is not over yet.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Why Latin American markets are leading global returns in 2026