The poster child of the AI boom may finally be hitting a wall. Deutsche Bank says ChatGPT subscriptions in Europe have “flatlined” since May — a worrying sign for OpenAI as it pursues trillion-dollar infrastructure ambitions.

Growth Hits a Wall in Europe

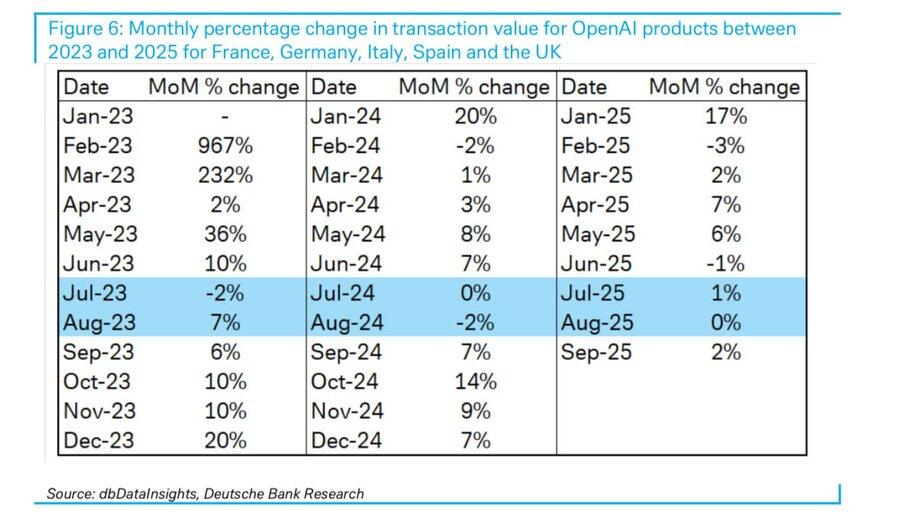

After a year of explosive adoption, ChatGPT’s paid subscriber growth has stalled, according to new data from Deutsche Bank Research Institute. The bank’s report, highlighted by Fortune, found that European spending on ChatGPT “has stalled since May”, signaling a slowdown in OpenAI’s most mature market.

Despite CEO Sam Altman’s recent boast that 800 million people use ChatGPT weekly, only about 5% are paying subscribers, according to the Financial Times. Deutsche Bank’s analysis suggests that subscription revenue — OpenAI’s primary income source — has flatlined for the past four months after surging through early 2023.

“European spending on ChatGPT has stalled since May, suggesting the poster child for the AI boom may be struggling to recruit new subscribers to pay for it,” Deutsche Bank wrote.

A Warning Sign for the AI Industry

The stagnation comes as OpenAI races to fund massive AI infrastructure projects. The company reportedly plans to spend more than $1 trillion on computing buildouts — a staggering sum for a business still dependent on consumer subscriptions.

While Europeans currently spend more on ChatGPT than on Disney+, the report warns that growth momentum is fading. If subscription expansion resumes, ChatGPT could theoretically overtake Spotify by mid-2027 and Netflix by early 2028 — but that scenario is looking increasingly unlikely.

The plateau, analysts say, could mark a critical inflection point for the broader AI economy. Investor optimism has hinged on the idea that rising compute investment would naturally translate into revenue growth — a narrative now being tested.

Revenue Pressures Mount

OpenAI’s infrastructure commitments are massive. The firm has promised partners like Nvidia and AMD that it will deliver 26 gigawatts of computing capacity — nearly enough to power the entire state of New York at peak demand.

But as subscription revenue slows, OpenAI may need new ways to fund its ambitions. The company has already started exploring:

- Online advertising integrated into ChatGPT.

- Monetization of its new text-to-video app “Sora.”

- A hardware device project with former Apple designer Jony Ive.

Still, none of these initiatives are expected to generate near-term profits at the scale needed to support trillion-dollar investments.

Profitability? “Not the Goal,” Says Altman

Altman has repeatedly said that profitability is not OpenAI’s priority. Instead, he envisions building an “AI utility” — a foundational layer of intelligence that powers economies and governments alike.

However, that vision depends on sustained revenue — and for now, the ChatGPT Plus subscription remains the engine driving OpenAI’s finances. A slowdown in that core business could pressure both its investors and partners to rethink the pace of its expansion.

A Shift in Strategy — or a Red Flag?

OpenAI recently announced it would allow “mature” ChatGPT apps, a reversal from Altman’s August claim that the platform didn’t host any “sexbots.” The move appears aimed at broadening engagement and monetization — a sign the company is searching for new user segments as growth cools.

Whether this pivot marks a temporary plateau or an early warning of market saturation remains unclear. What’s certain is that the AI boom’s most famous product is no longer growing like one.

ChatGPT’s meteoric rise defined the start of the AI era — but sustaining that momentum may be its toughest challenge yet. With subscriber growth stalling and trillion-dollar expenses mounting, OpenAI faces the same test that once humbled Silicon Valley’s biggest disruptors: proving that innovation can eventually pay for itself.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.