In a discovery that sounds straight out of alchemy’s wildest dreams, scientists at CERN have successfully transformed lead into gold—at least for a split second.

Using the Large Hadron Collider (LHC), the world’s most powerful particle accelerator, researchers knocked three protons out of lead atoms, briefly creating real gold. Though the gold atoms disintegrated almost instantly, the implications are already making waves—especially in the world of finance and crypto.

How Did They Do It?

Between 2015 and 2018, CERN’s ALICE experiment smashed lead nuclei together at nearly the speed of light. Rather than colliding head-on, the particles passed near each other, generating powerful electromagnetic fields.

This field knocked three protons out of lead (atomic number 82), creating gold (atomic number 79).

The result? Roughly 89,000 gold atoms per second—but totaling just 29 picograms, a fraction of a trillionth of a gram. And none of it lasted more than a moment.

“This Is REALLY Bad for GOLD” — Ran Neuner

While we’re still years (if not decades) away from producing stable, usable lab-grown gold, the symbolic impact has already sparked financial panic.

“This is REALLY bad for GOLD,” warned crypto analyst Ran Neuner.

“Scientists can literally recreate gold in a lab, and this makes gold no longer scarce.”

He compared the event to what happened with lab-grown diamonds, which dramatically devalued the diamond market once mass-produced versions became indistinguishable from natural ones.

“Neither the human eye nor a magnifying glass can tell the difference, and the cost is about 1% of the original,” Neuner added.

“Once people realize this, there will be a huge shift into Bitcoin.”

Bitcoin: The New Digital Gold?

If gold’s appeal has always been its scarcity, this scientific feat—no matter how temporary—throws that scarcity into question. And that could play directly into Bitcoin’s hands.

- JPMorgan forecasts Bitcoin will outpace gold in 2025, fueled by institutional adoption.

- Arthur Hayes, former BitMEX CEO, predicts Bitcoin could hit $1 million by 2028, citing inflation, U.S. capital controls, and devaluation of U.S. treasuries.

“The devaluation of U.S. treasuries and capital flight will be the two catalysts that power Bitcoin to $1 million,” Hayes wrote.

But Bitcoin Isn’t Invincible

Still, Bitcoin’s rise isn’t without threats. The biggest? Quantum computing.

BlackRock and other financial institutions have warned that future quantum computers could potentially break the cryptographic backbone of Bitcoin, unless the protocol adapts.

Why This Matters

This isn’t about collecting gold from the lab tomorrow. It’s about what happens when the idea of “precious” becomes programmable. If gold’s scarcity can be synthesized—or even perceived as no longer sacred—what’s left to hedge against economic chaos?

The answer, increasingly, is Bitcoin.

Quick Stats

| Metric | Value |

|---|---|

| Gold atoms created | 89,000 per second |

| Total amount produced | 29 picograms |

| Bitcoin market cap (May 2025) | ~$1.2 trillion |

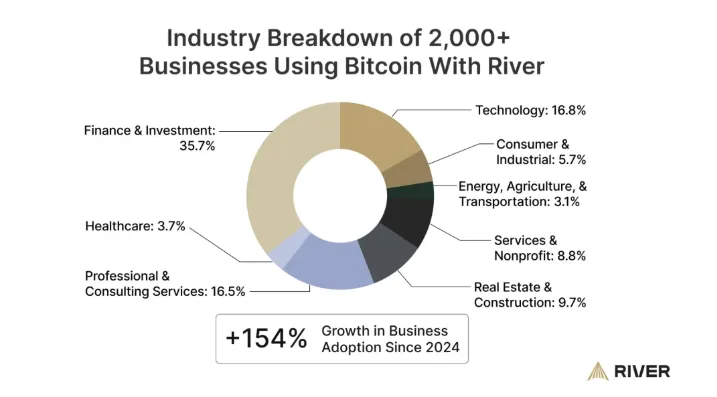

| U.S. companies holding BTC | 2,000+ |

| BTC spot ETF inflows (May 15) | $115 million |

The dream of alchemists is becoming science. Gold’s invincibility is no longer guaranteed—and in a world where digital assets are programmed for scarcity, Bitcoin may now have the final word.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia, Cisco, Oracle and OpenAI are backing the UAE Stargate data center project

Trump vs. Tim Cook: Apple’s Global Strategy Sparks Debate Over Economic Patriotism and AI Security

US and EU break impasse to enable tariff talks

China Tightens Control Over AI Data Centers

Trump: US will set new tariff rates, bypassing trade negotiations

Sundar Pichai Interview on AI, Search, and Future of Google

Billionaire Investors Reveal Q1 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More

Trump & US Executives Lock In Over $1 Trillion in Middle East Deals

Qatar Buys 160 Boeing Jets as Trump Accepts $400M Gift Jet

Elon Musk, Robotaxis, and Starlink: Inside Multi-Billion Dollar US–Saudi Tech Power Play