Bitcoin’s slide accelerated on Friday in one of its most volatile stretches since early spring, hammering sentiment across the entire crypto space. The world’s largest digital asset dropped as much as six percent, briefly touching $80,548, its lowest level since April 11, before clawing back to trade near $85,000. Even with the bounce, bitcoin remains down ten percent for the week and twenty-four percent over the month.

This marks a painful thirty six percent decline in just forty six days, putting the token on the edge of a decisive break below the $80,000 support level.

A liquidation wave hits the market

The latest crash was accelerated by a sharp spike in forced selling. More than $1.5 billion in leveraged positions were liquidated in only four hours, intensifying pressure and creating a cycle where every dip triggers more automatic selling.

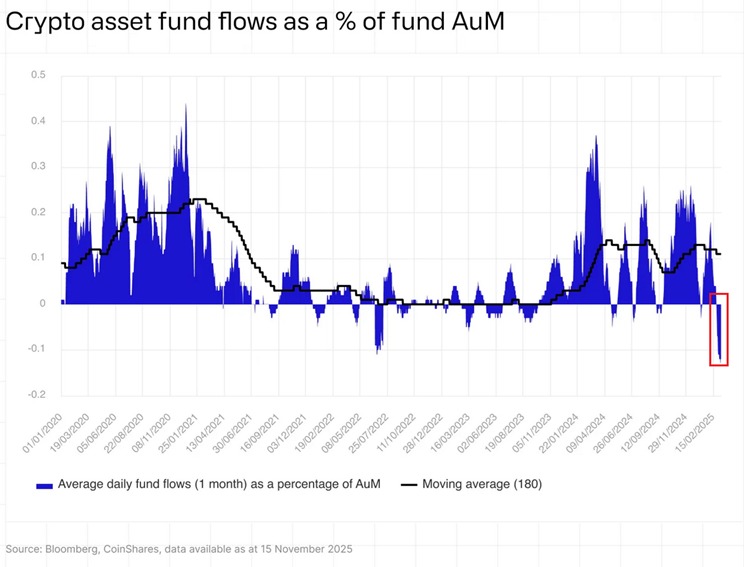

At the same time, institutional crypto funds have quietly been unloading:

- $2 billion in outflows last week — the largest since February

- Three straight weeks of selling, totaling $3.2 billion

- Bitcoin outflows: –$1.4 billion, leading the moves

- Ethereum outflows: –$689 million, among its worst weekly losses this year

- Crypto assets under management are down twenty seven percent since the October peak, dropping to $191 billion

Analysts call this a “structural decline”, not just a correction driven by short term noise.

Why bitcoin is falling: macro fear + AI unwind

Bitcoin has been closely tracking risk assets, especially AI-linked tech stocks. When Nvidia’s post earnings rally faded and the Nasdaq dropped two percent on Thursday, crypto followed instantly. Many AI-focused investors also hold bitcoin, making the two trades deeply interconnected, when one unwinds, the other tends to follow.

Investors are shifting toward safer assets such as gold and Treasurys as concerns rise around:

- Stretched AI valuations

- A divided Federal Reserve

- Delayed jobs data

- Fading conviction about a December rate cut

Risk appetite has taken a clear hit.

Sentiment breaks down as bitcoin turns negative for the year

Bitcoin is now down nine percent year to date, despite making fresh all time highs above $126,000 in early October. That rally was driven by optimism over President Trump’s pro-crypto stance, but tightening financial conditions and rising volatility have now reversed those gains.

The Fear and Greed Index has plunged into Extreme Fear, and traders warn that the mood is fragile enough that any break below $80,000 could trigger another wave of liquidations.

For now the market is trying to stabilize, but with outflows rising and leverage unwinding fast, the weekend could decide whether bitcoin stabilizes or takes its next leg lower.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Markets Bounce As Fed’s Williams Teases December Cut, But Fear Still Runs The Show