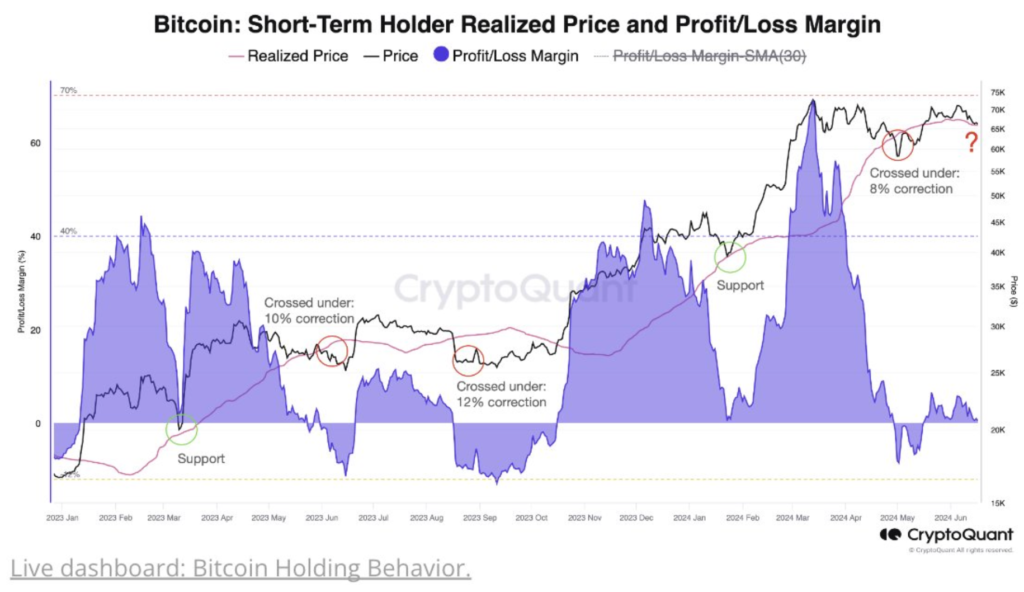

Bitcoin’s price briefly dipped below $64,000, raising concerns among traders of a potential further decline towards $60,000. According to cryptocurrency analysis firm CryptoQuant, falling below the short-term holder realized price (STH-RP) at $64,230 could signal an 8%-12% correction.

On June 22, Bitcoin dropped 2% to $63,442, breaking a critical support level. This breach suggests the possibility of a further decline, a level not seen since May 3 when Bitcoin was trading at $59,122. The STH-RP, an important indicator for speculative traders, has acted as a solid support throughout the bull market since early 2023.

CryptoQuant’s analysis indicated that Bitcoin trading below $65.8K and now under $64K could result in a significant correction. If Bitcoin drops to $60,000, it could lead to $1.64 billion in long positions being liquidated, according to CoinGlass data.

Despite the downturn, some analysts believe the extended consolidation period could set Bitcoin up for a massive upside rally. Ki Young Ju, CEO of CryptoQuant, suggested that Bitcoin’s network fundamentals might support a market cap three times its current size, potentially sustaining a price of $265,000.